Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i just need the balance sheet because i cant read this. im not really undersanding the question 1. This question uses the financial statements for

i just need the balance sheet because i cant read this. im not really undersanding the question

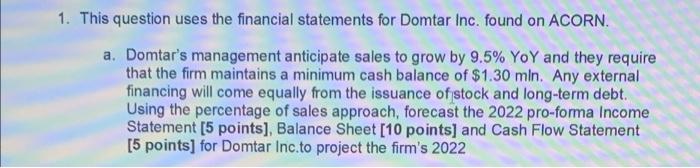

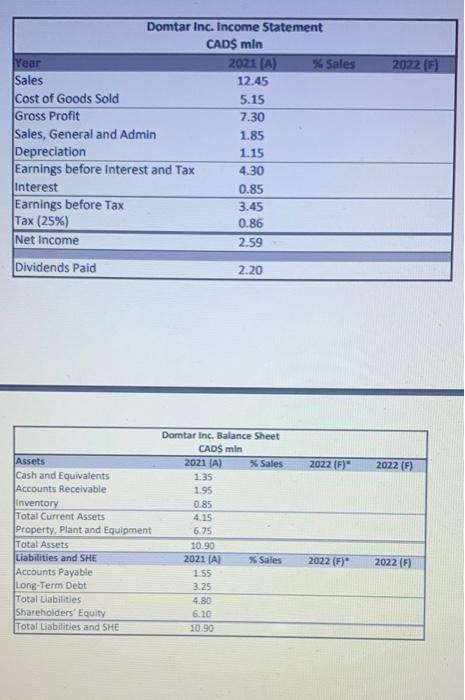

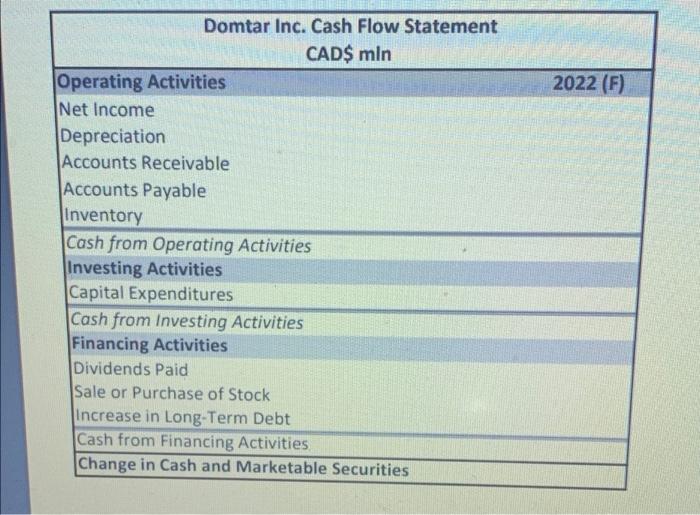

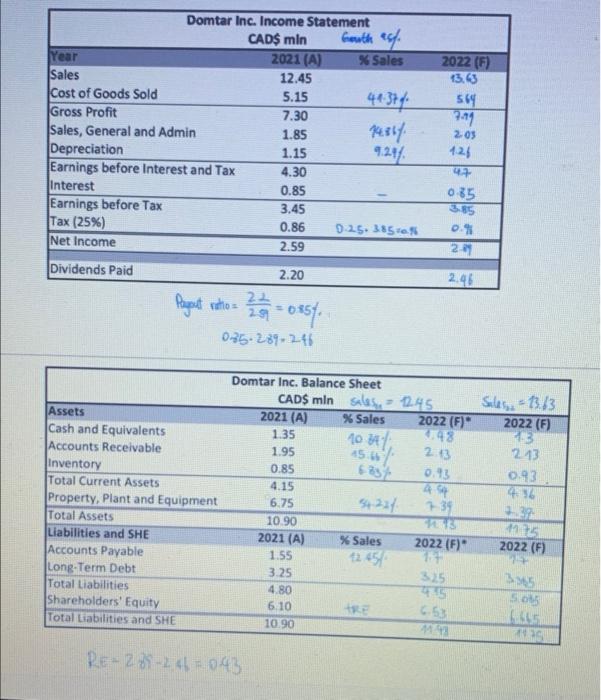

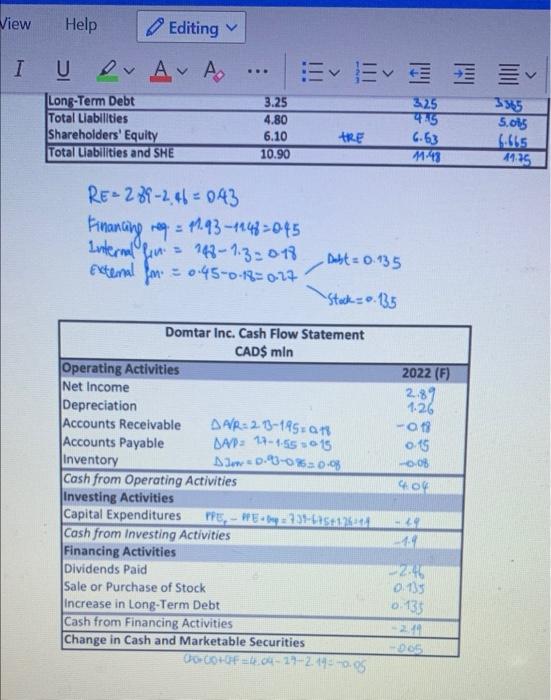

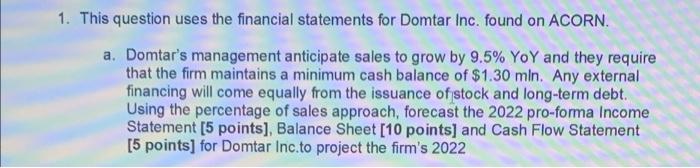

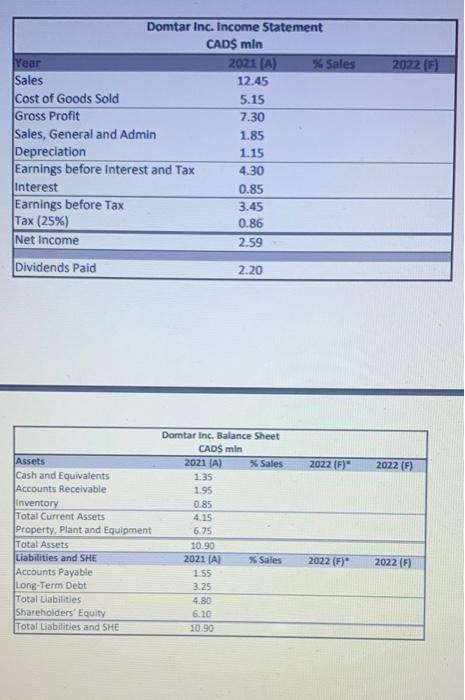

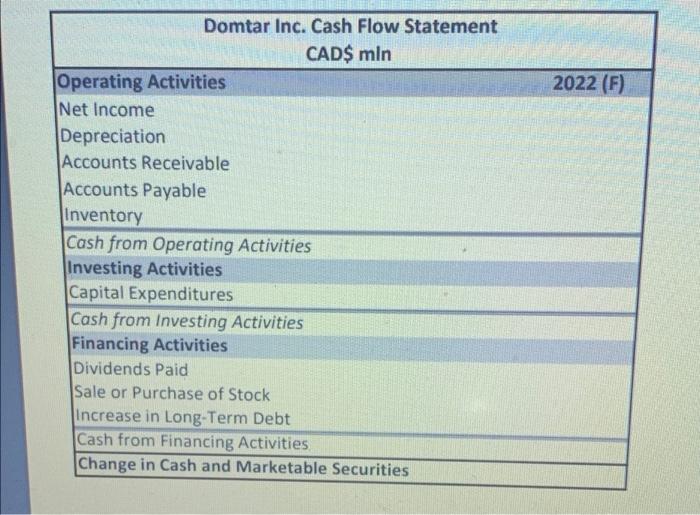

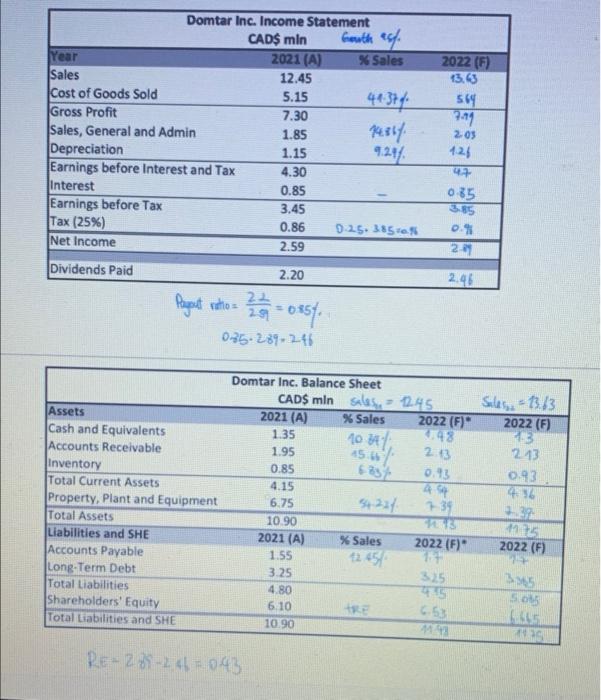

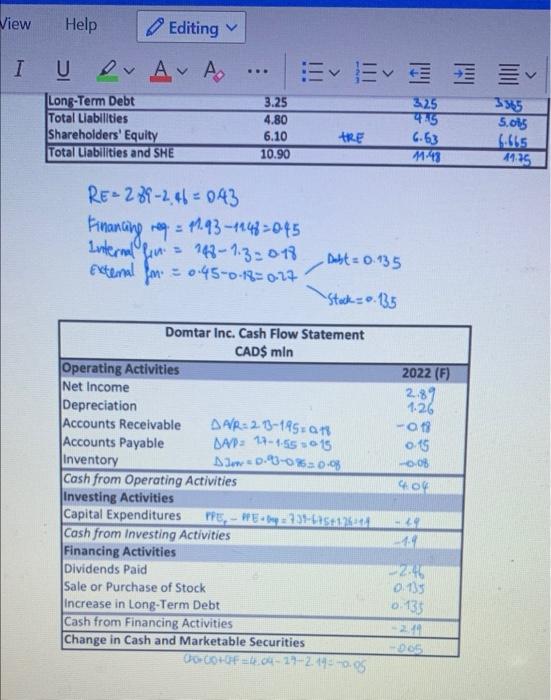

1. This question uses the financial statements for Domtar Inc. found on ACORN. a. Domtar's management anticipate sales to grow by 9.5% YoY and they require that the firm maintains a minimum cash balance of $1.30 min. Any external financing will come equally from the issuance of stock and long-term debt. Using the percentage of sales approach, forecast the 2022 pro-forma Income Statement [5 points), Balance Sheet (10 points) and Cash Flow Statement [5 points] for Domtar Inc.to project the firm's 2022 2022 (F) Domtar Inc. Income Statement CAD$ mln Year 2021 (A) % Sales Sales 12.45 Cost of Goods Sold 5.15 Gross Profit 7.30 Sales, General and Admin 1.85 Depreciation 1.15 Earnings before Interest and Tax 4.30 Interest 0.85 Earnings before Tax 3.45 Tax (25%) 0.86 Net Income 2.59 Dividends Paid 2.20 2022 (F)" 2022 (F) Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Property, plant and Equipment Total Assets Liabilities and SHE Accounts Payable Long-Term Debt Total Liabilities Shareholders' Equity Total Liabilities and SHE Domtar Inc. Balance Sheet CADS min 2021 (A) * Sales 1:35 1.95 0.85 4.15 6.75 10.90 2021 (A) X Sales 1.55 3.25 4.80 6.10 10.90 2022 (F)" 2022 (F) 2022 (F) Domtar Inc. Cash Flow Statement CAD$ mln Operating Activities Net Income Depreciation Accounts Receivable Accounts Payable Inventory Cash from Operating Activities Investing Activities Capital Expenditures Cash from Investing Activities Financing Activities Dividends Paid Sale or Purchase of Stock Increase in Long-Term Debt Cash from Financing Activities, Change in Cash and Marketable Securities 2022 (F) 13.63 564 Domtar Inc. Income Statement CAD$ min Gouthead Year 2021 (A) % Sales Sales 12.45 Cost of Goods Sold 5.15 41.37 Gross Profit 7.30 Sales, General and Admin 1.85 Kest/ Depreciation 1.15 9,247 Earnings before Interest and Tax 4.30 interest 0.85 Earnings before Tax 3.45 Tax (25%) 0.86 0.25.385 Net Income 2.59 2.03 126 47 0.35 0.1 27 Dividends Paid 2.20 2.46 Payout ratio= 0-35.289-241 - 05] Sales - 13:43 2022 (F) 1913 2.13 0.93 14592 44 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Property, Plant and Equipment Total Assets Liabilities and SHE Accounts Payable Long Term Debt Total Liabilities Shareholders' Equity Total Liabilities and SHE Domtar Inc. Balance Sheet CAD$ mlnsiles- 245 2021 (A) % Sales 2022 (F) 1.35 10341 3743 1.95 15.6% 2.13 0.85 5287 0.93 4.15 6.75 739 10.90 2021 (A) % Sales 2022 (F) 1.55 3.25 325 4.80 495 6.10 10.90 2022 (1) S05 RE-228-246 043 View Help Editing . Ev EvE v I U ON A AO Long-Term Debt Total Liabilities Shareholders' Equity Total Liabilities and SHE 3.25 4.80 6.10 10.90 3:25 4715 6.63 1.43 te 3365 5015 1.665 41.35 RE=289-2.46 = 0.431 Financing req = 41.93-4149-045 Internal fin 188-1.3-018 External m : 0.45-0-13= 027 Duht = 0.135 "Stock = 0.135 2022 (F) 2.89 1.26 -ot o.15 -0.08 404 Domtar Inc. Cash Flow Statement CAD$ min Operating Activities Net Income Depreciation Accounts Receivable AR: 2 13-1855073 Accounts Payable DAD - 1.2-4-551015 Inventory 30.0-0%20:08 Cash from Operating Activities Investing Activities Capital Expenditures E - Ey 23-25 12:41 Cash from Investing Activities Financing Activities Dividends Paid Sale or Purchase of Stock increase in Long-Term Debt Cash from Financing Activities Change in Cash and Marketable Securities JUE+OF+4.04-17-214--005 24 0.135 0:13 2011 DOG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started