Answered step by step

Verified Expert Solution

Question

1 Approved Answer

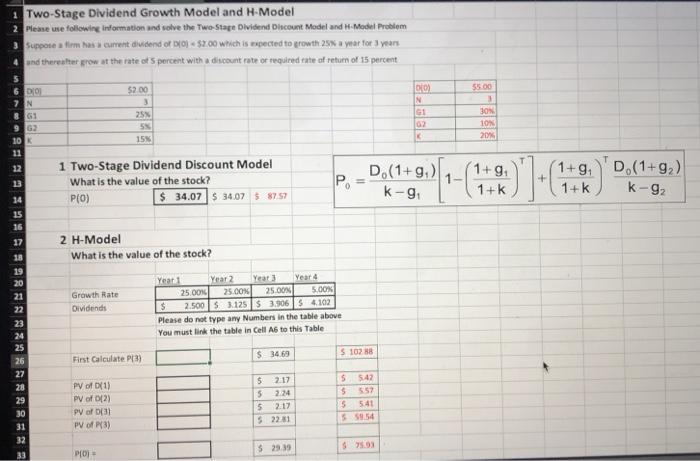

I just need the formulas. The correct answers are given. 1 Two-Stage Dividend Growth Model and H-Model 2 Please use following information and solve the

I just need the formulas. The correct answers are given.

1 Two-Stage Dividend Growth Model and H-Model 2 Please use following information and solve the Two-Stage Dividend Discount Model and H-Model Problem 3. Suppose firm has current dividend of DO $7.00 which is expected to growth 25% a year for years and thereafter prow at the rate of 5 percent with a discount rate or required rate of retum of 15 percent DIO N $2.00 3 25 0 N 55.00 3 30N 10 20% G 02 15 10 K 11 D. (1+9) 1 1+9 1+9 D (1+2) - 1 Two-Stage Dividend Discount Model What is the value of the stock? P(O) $ 34.07 $ 34.07 5 8757 12 13 14 15 16 1+k K-9 1+k K-92 2 H-Model What is the value of the stock? Growth Rate Dividendi 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Year Year 2 Year 3 Year 4 25.OON 25.00 25.00% 5.00% $ 2.500S 3.125 $ 3.906 $4.102 Please do not type any Numbers in the table above You must link the table in Cell Ab to this Table $ 3469 51028 First Calculate 13) PV of (1) PV of 12) PV of 3 PV of P3) S 2.17 5 224 5 2.17 52281 $ 542 $ 557 5 541 59.54 $29.39 33 PO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started