I just need the red X ones so part of B and C and D

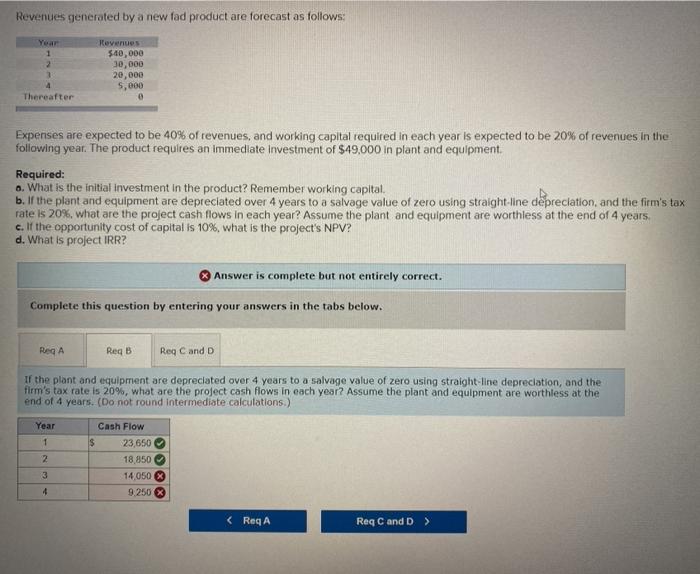

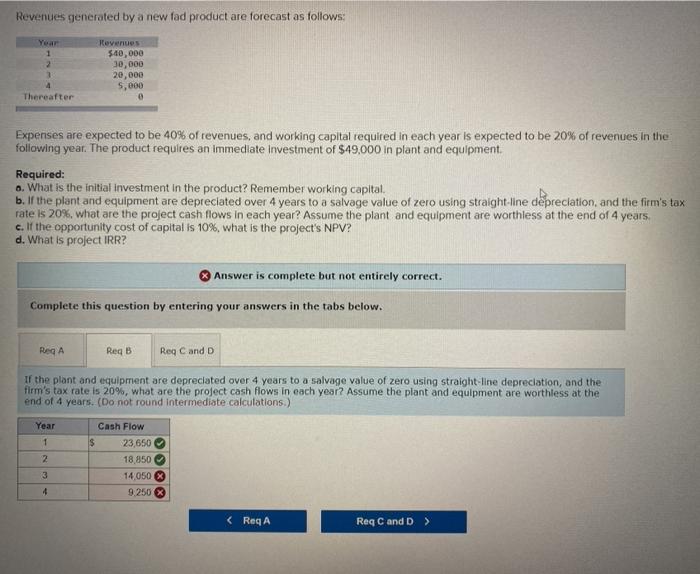

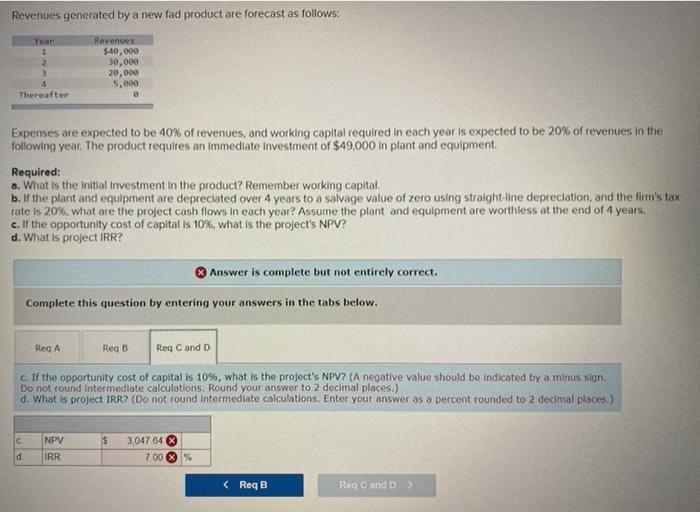

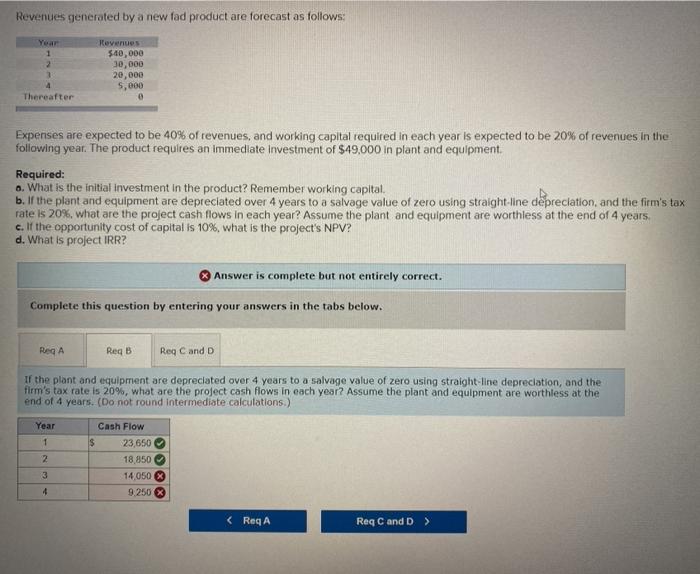

Revenues generated by a new fed product are forecast as follows: Year 1 2 2 Revenues $40,000 30,000 20,000 5,000 Thereafter Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate Investment of $49,000 in plant and equipment. Required: a. What is the initial investment in the product? Remember working capital b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is project IRR? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg A ReqB ReqC and D If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. (Do not round Intermediate calculations.) Year 1 2 Cash Flow $ 23,650 18 850 14.050 9.250 3 4 Revenues generated by a new fad product are forecast as follows: Year 1 2 Revenues $40,000 30,000 20,000 5,000 Thereafter Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $49,000 in plant and equipment Required: o. What is the initial investment in the product? Remember working capital b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is project IRR? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg A Red B Reg C and D c. If the opportunity cost of capital is 10%, what is the project's NPV? (A negative value should be indicated by a minus sian. Do not round Intermediate calculations. Round your answer to 2 decimal places.) d. What is project IRR? (Do not found intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) $ NPV IRR 3,047 64 X 700 X % d