I just need the schedule 1 done please

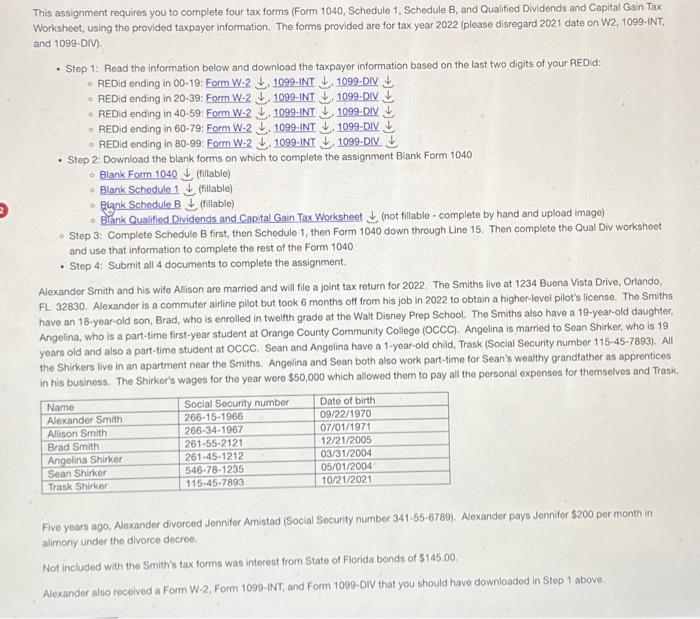

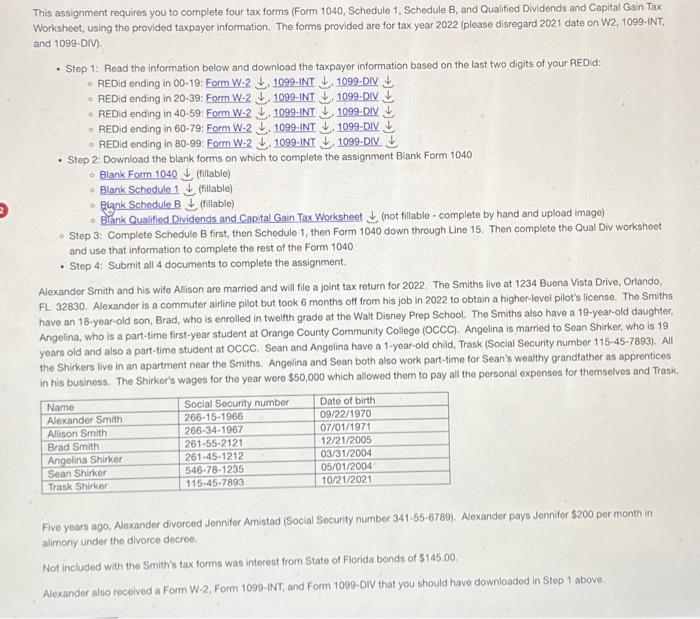

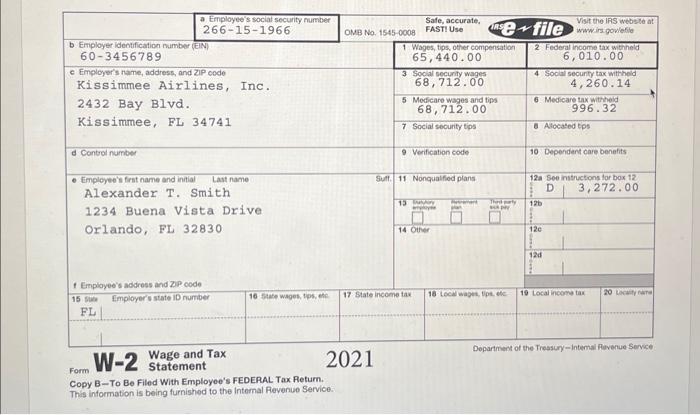

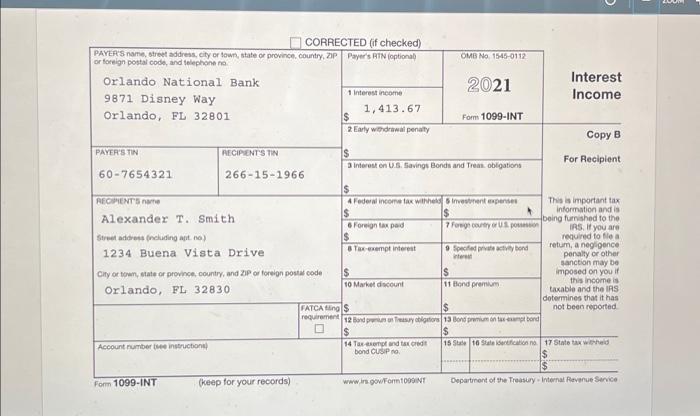

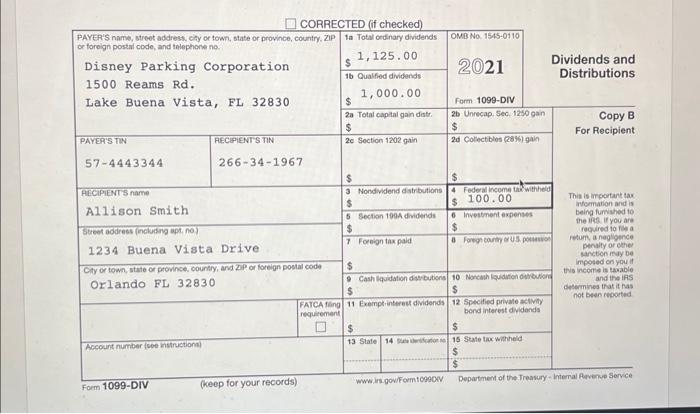

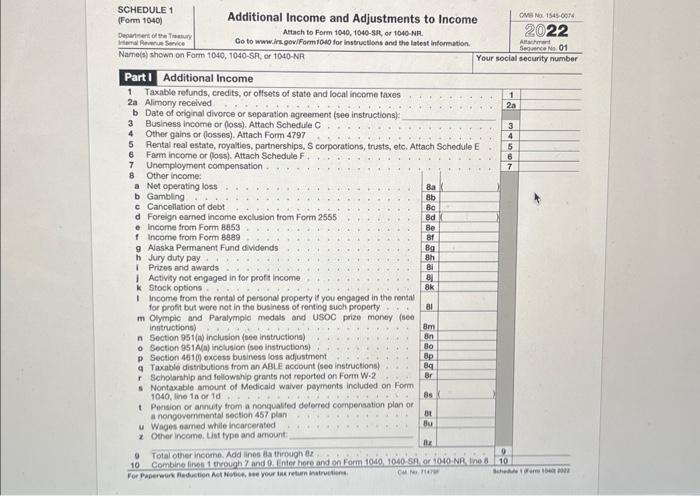

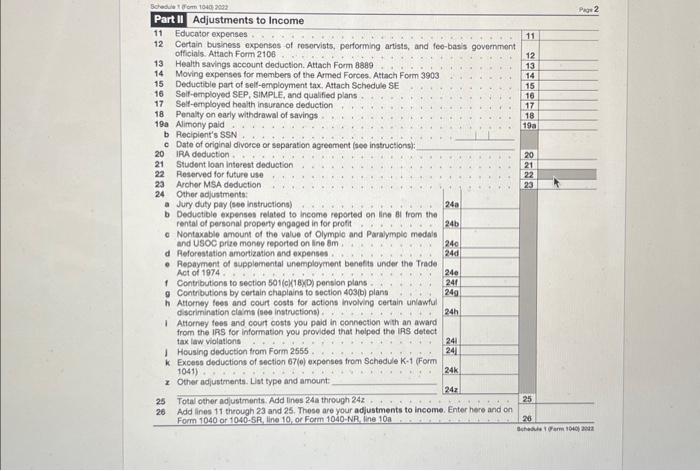

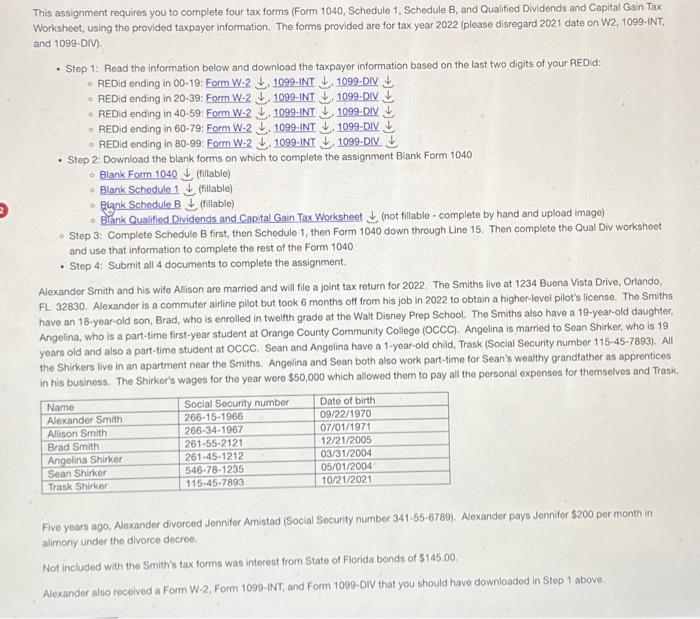

This assignment requires you to complete four tax forms (Form 1040, Schedule 1, Schedule B, and Qualified Dividends and Capital Gain Tax Worksheet, using the provided taxpayor information. The forms provided are for tax year 2022 (please disregard 2021 date on W2, 1099-INT, and 1099 -DI). - Step 1: Read the information below and download the taxpayer information based on the last two digits of your REDid: - REDid ending in 00-19: Form W-2 ,10991NT,1099 DIV - AEDid ending in 20-39: Form W-2 ,1099-INT ,1099-DN - REDid ending in 40-59: Form W-2 ,10991NT, , 1099-DIV - REDid ending in 60-79: Form W-2 ,10991NT,,1099 DIV REDid ending in 80-99: Eorm W2, 1099-INT , 1099-OIV - Step 2: Download the blank forms on which to complete the assignment Blank Form 1040 Blank Form 1040 (fillable) Blank Schedule 1 (fillable) - Pgank Schedule B (fillable) - Blank Qualified Dividends and Capital Gain Tax Worksheet (not fillable - complete by hand and upload image) Step 3: Complete Schedule B first, then Schedule 1, then Form 1040 down through Line 15. Then complete the Qual Div workshoet and use that information to complete the rest of the Form 1040 - Step 4: Submit all 4 documents to complete the assignment. Alexander Smith and his wife Allison are married and will fle a joint tax return for 2022 . The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level pilot's license. The Smiths have an 18-year-old son, Brad, who is enroiled in twelfth grade at the Walt Disney Prep School. The Smiths also have a 19 -year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandtather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask. Fivo years ago, Aloxander divorced Jennifor Amistad (Soelal Secunty number 341-65-6789). Alexander pays Jennifer $200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DiV that you should have downioaded in Step 1 above. Copy B-To Be Filed With Employee's reuerum a ravourn. This information is being furnishod to the Intemal Pevenue Service: CORAECTED (if checked) CORRECTED (if checked) Form 1099-DIV (keep for your records) wwi. in gowformt 9900 Depatmen of the Treasury - hlemal Aemenve Sorvce Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony recelved b Date of original divorce or separation agreement (see instructions): 3 Business income or (oss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F. 7 Unemployment compensation . 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Forelgn earned income exclusion from Form 2555 e Income from Form BAS3 1 income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards 1. Activity not engaged in for proft income k Stock options . I Income from the rental of personal property if you engaged in the rental for prosit but wore not in the business of renting such property m Olympic and Paralympic modals and USOC prize money (see instructions) n Section 951(a) inchution (seo instructions) o Section 951A.a) inclusion (soo instructions) p Section 4610 expess business loss adjustment a Tacable distrbutions from an ABLE account (seo instructions) r Scholarship and fellowenip grants not reported on Form W-2 s Nontaxable amount of Medicaid waiver poyments included on Form t. Pension of annuty from a nonqualifed deferred compensation plan or a nongovernenental section 457 plan u Wages eamed while incarcerated x Other income. List type and amount: Sobedule 1 gom 104a zogr P10+2 Part II Adjustments to Income 11 Educator expenses . 12 Certain bushess expenses of reservists, performing artists, and foe-basis government officials. Attach Form 2100 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forcos. Attach Form 3903 15 Deductible part of self-employment tax, Attach Schedule SE 16 Self-employod SEP, SIMPLE, and qualified plans 17 Selt-employed bealth insurence deduction 18 Penalty on early withdrawal of savings 19a Alimony paid b Aocipient's SSN c Date of original divorce or separation agreoment (see instructions): 20 IRA doduction. 21 Studont loan interest deduction 22 Reserved for future use 23 Aroher MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 8 from the rental of personal property engaged in for profit.... . . 24b a Nontaxable amount of the value of Olymple and Paralymplo medils and USOC prize money reported on line 8m d Peforestation amortization and expenses. - Repayment of supplemental unemployment benefis under the Trade 1 Contributions to section So1(c)(18yD) pension plans. 9 Contributions by certain chaplains to section 403(b) plans h Attorney foes and court costs for actions involving certain uniawful dscrimination claime (see instructions). 1 Athorney fees and court costs you paid in connection with an award from the IRS for information you provided that hoiped the IAS detect tax law violations I Housing deduction from Form 2555 . k Excess deductions of section 67(0) expenses from Schedule K-1 (Form 1041). Other adustenents. List type and amount: 25 Total other adjustments. Add lines 24a through 242. 26 . Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-5R, line 10, or Form 1040-NR. line 10a This assignment requires you to complete four tax forms (Form 1040, Schedule 1, Schedule B, and Qualified Dividends and Capital Gain Tax Worksheet, using the provided taxpayor information. The forms provided are for tax year 2022 (please disregard 2021 date on W2, 1099-INT, and 1099 -DI). - Step 1: Read the information below and download the taxpayer information based on the last two digits of your REDid: - REDid ending in 00-19: Form W-2 ,10991NT,1099 DIV - AEDid ending in 20-39: Form W-2 ,1099-INT ,1099-DN - REDid ending in 40-59: Form W-2 ,10991NT, , 1099-DIV - REDid ending in 60-79: Form W-2 ,10991NT,,1099 DIV REDid ending in 80-99: Eorm W2, 1099-INT , 1099-OIV - Step 2: Download the blank forms on which to complete the assignment Blank Form 1040 Blank Form 1040 (fillable) Blank Schedule 1 (fillable) - Pgank Schedule B (fillable) - Blank Qualified Dividends and Capital Gain Tax Worksheet (not fillable - complete by hand and upload image) Step 3: Complete Schedule B first, then Schedule 1, then Form 1040 down through Line 15. Then complete the Qual Div workshoet and use that information to complete the rest of the Form 1040 - Step 4: Submit all 4 documents to complete the assignment. Alexander Smith and his wife Allison are married and will fle a joint tax return for 2022 . The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level pilot's license. The Smiths have an 18-year-old son, Brad, who is enroiled in twelfth grade at the Walt Disney Prep School. The Smiths also have a 19 -year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandtather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask. Fivo years ago, Aloxander divorced Jennifor Amistad (Soelal Secunty number 341-65-6789). Alexander pays Jennifer $200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DiV that you should have downioaded in Step 1 above. Copy B-To Be Filed With Employee's reuerum a ravourn. This information is being furnishod to the Intemal Pevenue Service: CORAECTED (if checked) CORRECTED (if checked) Form 1099-DIV (keep for your records) wwi. in gowformt 9900 Depatmen of the Treasury - hlemal Aemenve Sorvce Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony recelved b Date of original divorce or separation agreement (see instructions): 3 Business income or (oss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F. 7 Unemployment compensation . 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Forelgn earned income exclusion from Form 2555 e Income from Form BAS3 1 income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards 1. Activity not engaged in for proft income k Stock options . I Income from the rental of personal property if you engaged in the rental for prosit but wore not in the business of renting such property m Olympic and Paralympic modals and USOC prize money (see instructions) n Section 951(a) inchution (seo instructions) o Section 951A.a) inclusion (soo instructions) p Section 4610 expess business loss adjustment a Tacable distrbutions from an ABLE account (seo instructions) r Scholarship and fellowenip grants not reported on Form W-2 s Nontaxable amount of Medicaid waiver poyments included on Form t. Pension of annuty from a nonqualifed deferred compensation plan or a nongovernenental section 457 plan u Wages eamed while incarcerated x Other income. List type and amount: Sobedule 1 gom 104a zogr P10+2 Part II Adjustments to Income 11 Educator expenses . 12 Certain bushess expenses of reservists, performing artists, and foe-basis government officials. Attach Form 2100 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forcos. Attach Form 3903 15 Deductible part of self-employment tax, Attach Schedule SE 16 Self-employod SEP, SIMPLE, and qualified plans 17 Selt-employed bealth insurence deduction 18 Penalty on early withdrawal of savings 19a Alimony paid b Aocipient's SSN c Date of original divorce or separation agreoment (see instructions): 20 IRA doduction. 21 Studont loan interest deduction 22 Reserved for future use 23 Aroher MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 8 from the rental of personal property engaged in for profit.... . . 24b a Nontaxable amount of the value of Olymple and Paralymplo medils and USOC prize money reported on line 8m d Peforestation amortization and expenses. - Repayment of supplemental unemployment benefis under the Trade 1 Contributions to section So1(c)(18yD) pension plans. 9 Contributions by certain chaplains to section 403(b) plans h Attorney foes and court costs for actions involving certain uniawful dscrimination claime (see instructions). 1 Athorney fees and court costs you paid in connection with an award from the IRS for information you provided that hoiped the IAS detect tax law violations I Housing deduction from Form 2555 . k Excess deductions of section 67(0) expenses from Schedule K-1 (Form 1041). Other adustenents. List type and amount: 25 Total other adjustments. Add lines 24a through 242. 26 . Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-5R, line 10, or Form 1040-NR. line 10a