Answered step by step

Verified Expert Solution

Question

1 Approved Answer

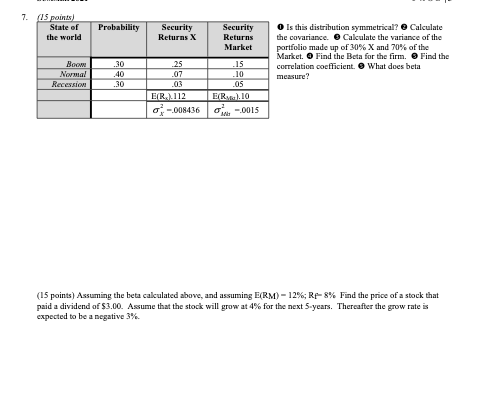

I just need the second part of the question answered, the beta in the first part was 0.54 7. (15 points) State of the world

I just need the second part of the question answered, the beta in the first part was 0.54

7. (15 points) State of the world Probability Is this distribution symmetrical? Calculate the covariance. Calculate the variance of the portfolio made up of 30% X and 70% of the Market. Find the Beta for the firm. Find the correlation coefficient. What does beta measure? Boom Normal Recession Security Security Returns X Returns Market .25 .15 07 10 .03 .OS ER: 112 E/ R.10 o-008436 .-0015 .30 .40 .30 (15 points) Assuming the beta cakulated above, and assuming E(RM) - 12%; Re-8% Find the price of a stock that paid a dividend of $3.00. Assume that the stock will grow at 4% for the next 5 years. Thereafter the grow rate is expected to be a negative 3%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started