I just need the yellow ones done please. Will rate thumbs up!!

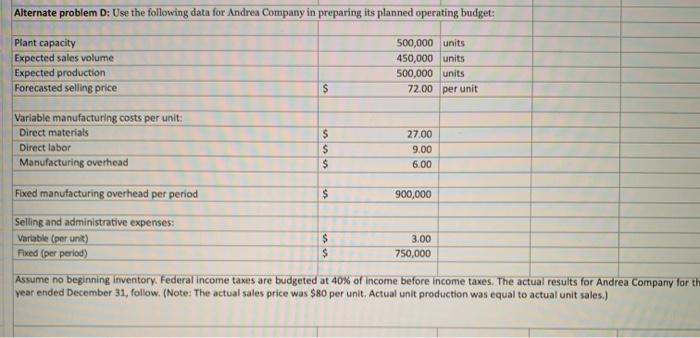

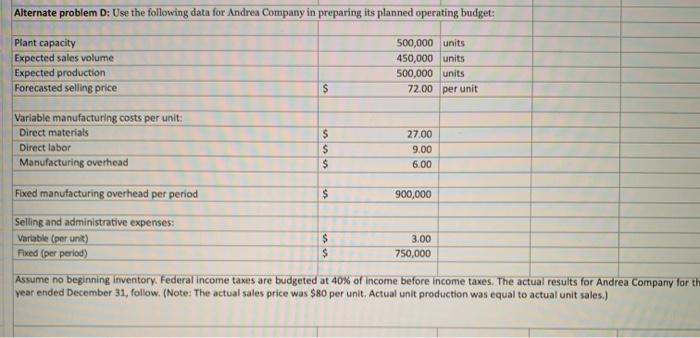

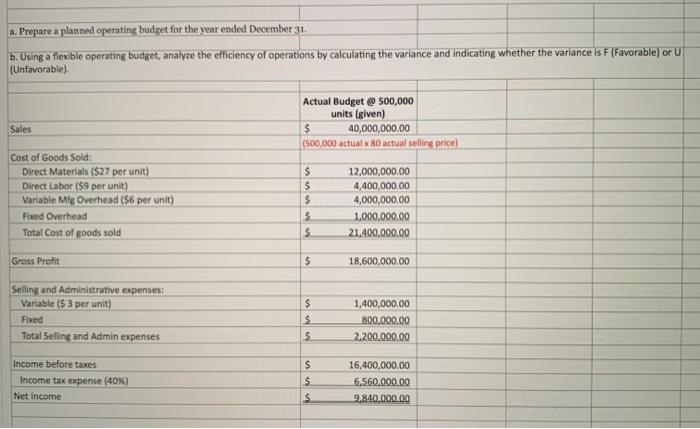

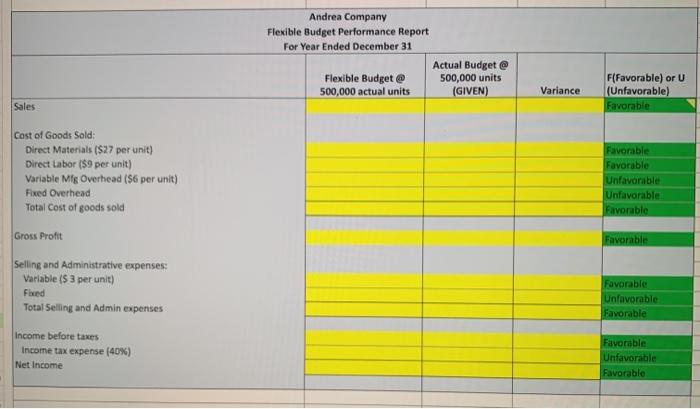

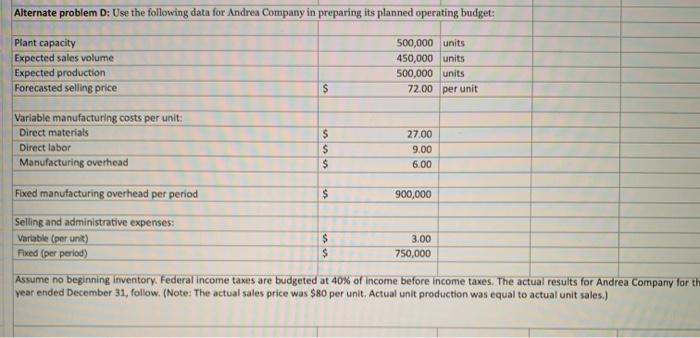

Alternate problem D: Use the following data for Andrea Company in preparing its planned operating budget: Plant capacity Expected sales volume Expected production Forecasted selling price 500,000 units 450,000 units 500,000 units 72.00 per unit $ Variable manufacturing costs per unit: Direct materials Direct labor Manufacturing overhead $ $ $ 27.00 9.00 6.00 Fixed manufacturing overhead per period $ 900,000 Selling and administrative expenses: Variable (per unit) Fixed (per period) $ $ 3.00 750,000 Assume no beginning inventory. Federal income taxes are budgeted at 40% of income before income taxes. The actual results for Andrea Company for the year ended December 31, follow. (Note: The actual sales price was $80 per unit. Actual unit production was equal to actual unit sales.) a. Prepare a planned operating budget for the year ended December 31 b. Using a flexible operating budget, analyze the efficiency of operations by calculating the variance and indicating whether the variance is F (Favorable) or U (Unfavorable) Sales Cost of Goods Sold: Direct Materials (527 per unit) Direct Labor ($9 per unit) Variable Mtg Overhead ($6 per unit) Fixed Overhead Total Cost of goods sold Actual Budget @ 500,000 units (given) $ 40,000,000.00 (500,000 actual x 80 actual selling price) $ 12,000,000.00 $ 4,400,000.00 $ 4,000,000.00 S 1.000.000.00 $ 21.400.000.00 Gross Profit $ 18,600,000.00 Seiling and Administrative expenses Variable (53 per unit) Fixed Total Selling and Admin expenses $ $ $ 1,400,000.00 800,000.00 2,200,000.00 Income before taxes Income tax expense (40%) Net Income $ $ 16,400,000.00 6,560,000.00 9.840,000.00 S Andrea Company Flexible Budget Performance Report For Year Ended December 31 Actual Budget @ Flexible Budget @ 500,000 units 500,000 actual units (GIVEN) Variance F(Favorable) or U (Unfavorable) Favorable Sales Cost of Goods Sold: Direct Materials (527 per unit) Direct Labor ($9 per unit) Variable Mig Overhead ($6 per unit) Fixed Overhead Total cost of goods sold Favorable Favorable Unfavorable Unfavorable Favorable Gross Profit Favorable Selling and Administrative expenses: Variable (53 per unit) Fired Total Selling and Admin expenses Favorable Unfavorable Favorable Income before taxes Income tax expense (40%) Net Income Favorable Unfavorable Favorable