Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need to choose the correct answers not need to explain. Thanks Which of the following are true? Consider each one carefully. Assume all

I just need to choose the correct answers not need to explain. Thanks

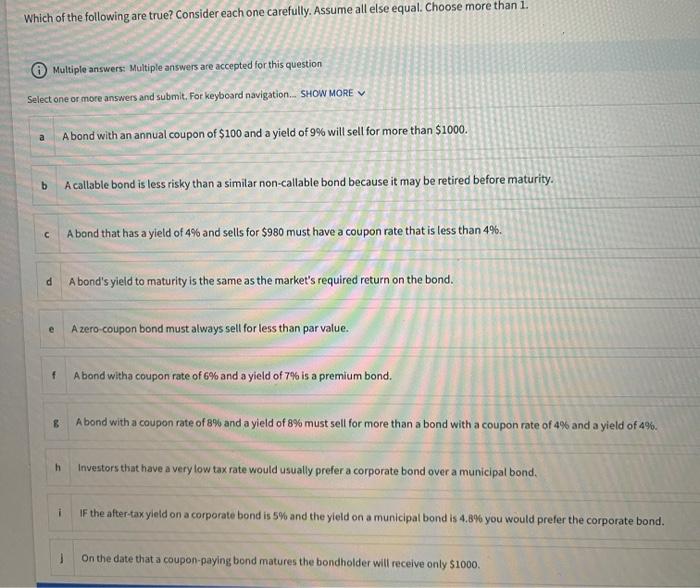

Which of the following are true? Consider each one carefully. Assume all else equal. Choose more than 1. Multiple answers: Multiple answers are accepted for this question Select one or more answers and submit. For keyboard navigation. SHOW MORE a A bond with an annual coupon of $100 and a yield of 9% will sell for more than $1000. b A callable bond is less risky than a similar non-callable bond because it may be retired before maturity. c A bond that has a yield of 4% and sells for $980 must have a coupon rate that is less than 4%. d A bond's yield to maturity is the same as the market's required return on the bond. e A zero-coupon bond must always sell for less than par value. f Abond with coupon rate of 6% and a yield of 7% is a premium bond. 8 A bond with a coupon rate of 8% and a yield of 8% must sell for more than a bond with a coupon rate of 4% and a yield of 4%. h Investors that have a very low tax rate would usually prefer a corporate bond over a municipal bond. IF the after-tax yield on a corporate bond is 5% and the yield on a municipal bond is 4,8% you would prefer the corporate bond. On the date that a coupon-paying bond matures the bondholder will receive only $1000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started