I just need to know how to calculate the balance inventory pls and thanks !

I just need to know how to calculate the balance inventory pls and thanks !

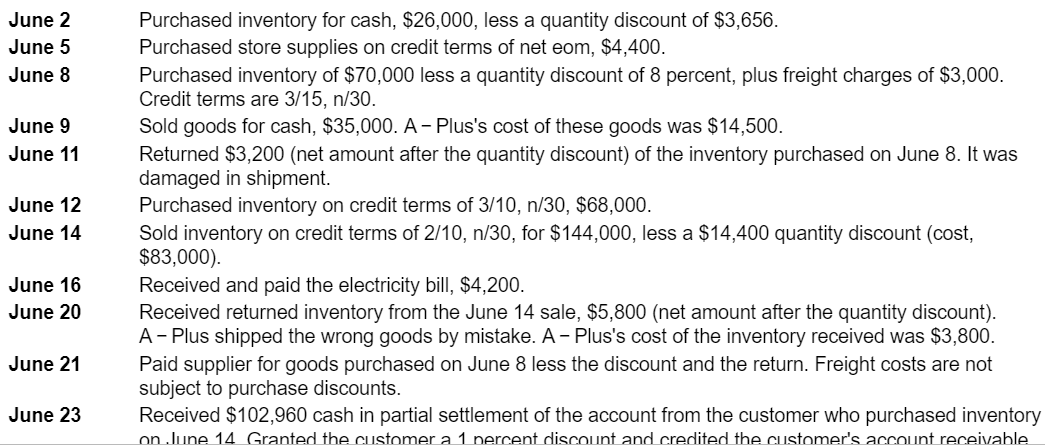

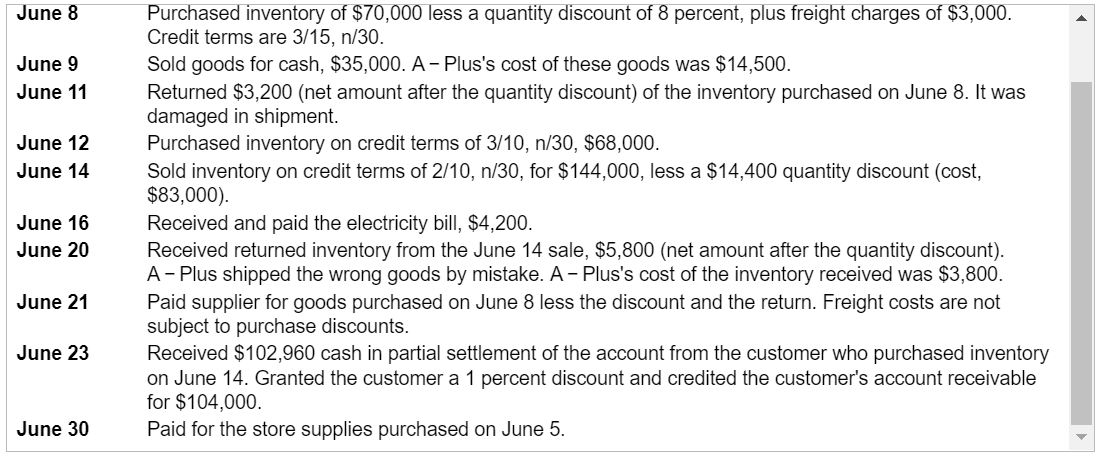

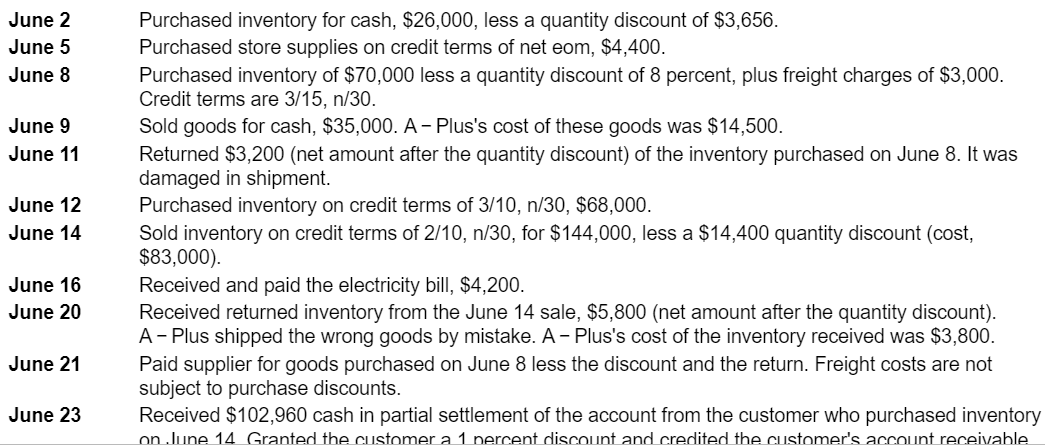

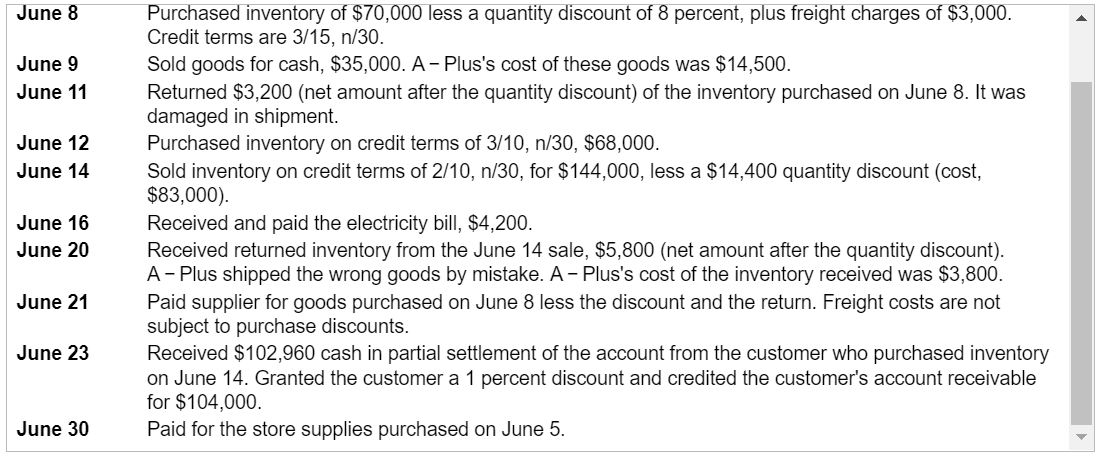

Purchased inventory for cash, $26,000, less a quantity discount of $3,656. Purchased store supplies on credit terms of net eom, $4,400. Purchased inventory of $70,000 less a quantity discount of 8 percent, plus freight charges of $3,000. Credit terms are 3/15,n/30. Sold goods for cash, $35,000. A - Plus's cost of these goods was $14,500. Returned $3,200 (net amount after the quantity discount) of the inventory purchased on June 8 . It was damaged in shipment. Purchased inventory on credit terms of 3/10,n/30,$68,000. Sold inventory on credit terms of 2/10,n/30, for $144,000, less a $14,400 quantity discount (cost, $83,000 ). Received and paid the electricity bill, $4,200. Received returned inventory from the June 14 sale, $5,800 (net amount after the quantity discount). A - Plus shipped the wrong goods by mistake. A - Plus's cost of the inventory received was $3,800. Paid supplier for goods purchased on June 8 less the discount and the return. Freight costs are not subject to purchase discounts. Received $102,960 cash in partial settlement of the account from the customer who purchased inventory Requirement 2. Suppose the balance in inventory was $59,000 on June 1 . What is the balance in inventory on June 30 ? Purchased inventory for cash, $26,000, less a quantity discount of $3,656. Purchased store supplies on credit terms of net eom, $4,400. Purchased inventory of $70,000 less a quantity discount of 8 percent, plus freight charges of $3,000. Credit terms are 3/15,n/30. Sold goods for cash, $35,000. A - Plus's cost of these goods was $14,500. Returned $3,200 (net amount after the quantity discount) of the inventory purchased on June 8 . It was damaged in shipment. Purchased inventory on credit terms of 3/10,n/30,$68,000. Sold inventory on credit terms of 2/10,n/30, for $144,000, less a $14,400 quantity discount (cost, $83,000 ). Received and paid the electricity bill, $4,200. Received returned inventory from the June 14 sale, $5,800 (net amount after the quantity discount). A - Plus shipped the wrong goods by mistake. A - Plus's cost of the inventory received was $3,800. Paid supplier for goods purchased on June 8 less the discount and the return. Freight costs are not subject to purchase discounts. Received $102,960 cash in partial settlement of the account from the customer who purchased inventory Requirement 2. Suppose the balance in inventory was $59,000 on June 1 . What is the balance in inventory on June 30

I just need to know how to calculate the balance inventory pls and thanks !

I just need to know how to calculate the balance inventory pls and thanks !