Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just want an optional solution Question 1 Not yet answered Marked out of 1 Flag question X leased a machine from Yon 1 1/

I just want an optional solution

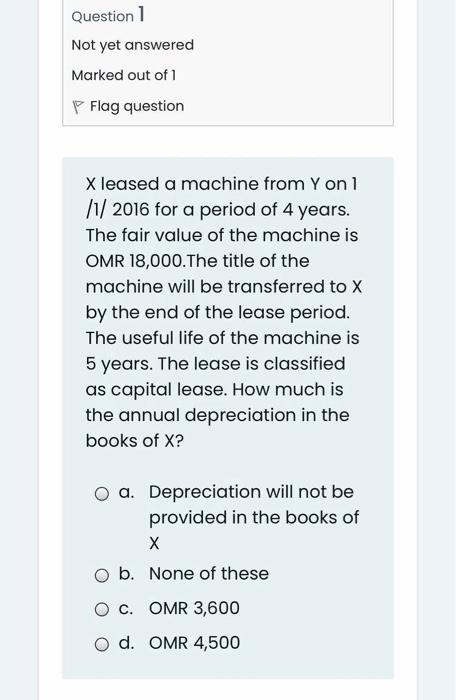

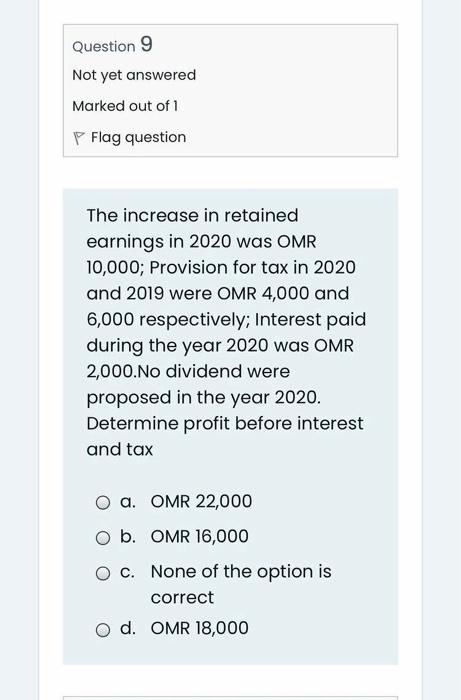

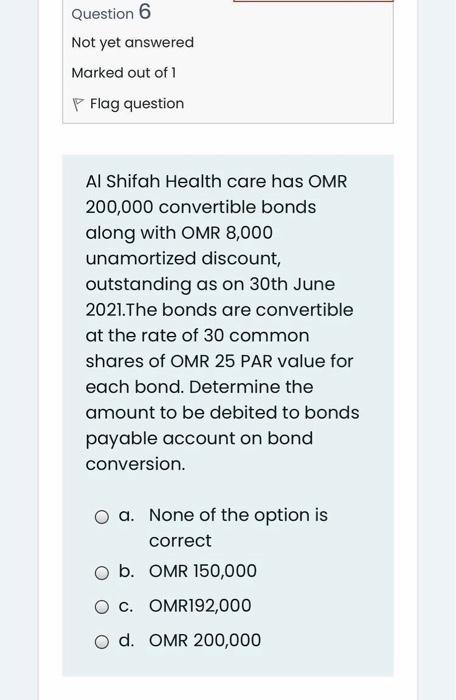

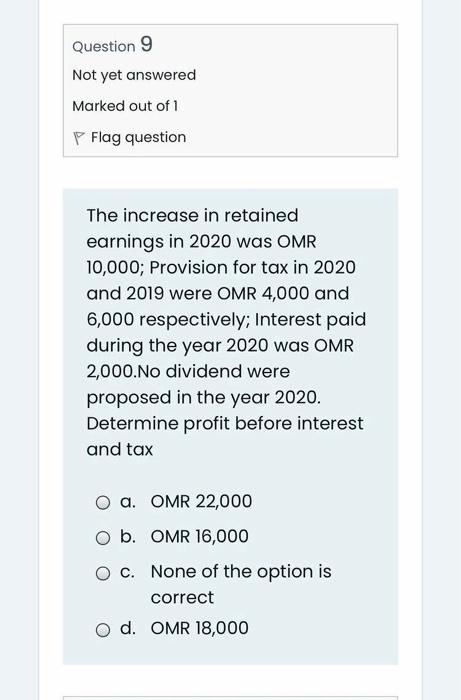

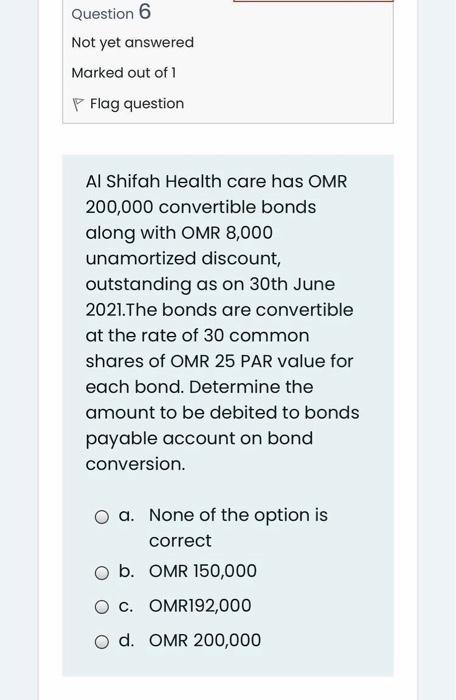

Question 1 Not yet answered Marked out of 1 Flag question X leased a machine from Yon 1 1/ 2016 for a period of 4 years. The fair value of the machine is OMR 18,000.The title of the machine will be transferred to X by the end of the lease period. The useful life of the machine is 5 years. The lease is classified as capital lease. How much is the annual depreciation in the books of X? O a. Depreciation will not be provided in the books of ob. None of these O c. OMR 3,600 d. OMR 4,500 Question 9 Not yet answered Marked out of 1 P Flag question The increase in retained earnings in 2020 was OMR 10,000; Provision for tax in 2020 and 2019 were OMR 4,000 and 6,000 respectively; Interest paid during the year 2020 was OMR 2,000.No dividend were proposed in the year 2020. Determine profit before interest and tax a. OMR 22,000 O b. OMR 16,000 O c. None of the option is correct O d. OMR 18,000 Question 6 Not yet answered Marked out of 1 P Flag question Al Shifah Health care has OMR 200,000 convertible bonds along with OMR 8,000 unamortized discount, outstanding as on 30th June 2021.The bonds are convertible at the rate of 30 common shares of OMR 25 PAR value for each bond. Determine the amount to be debited to bonds payable account on bond conversion. a. None of the option is correct b. OMR 150,000 O c. OMR192,000 od. OMR 200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started