I just want to double check my answers before submitting.

I just want to double check my answers before submitting.

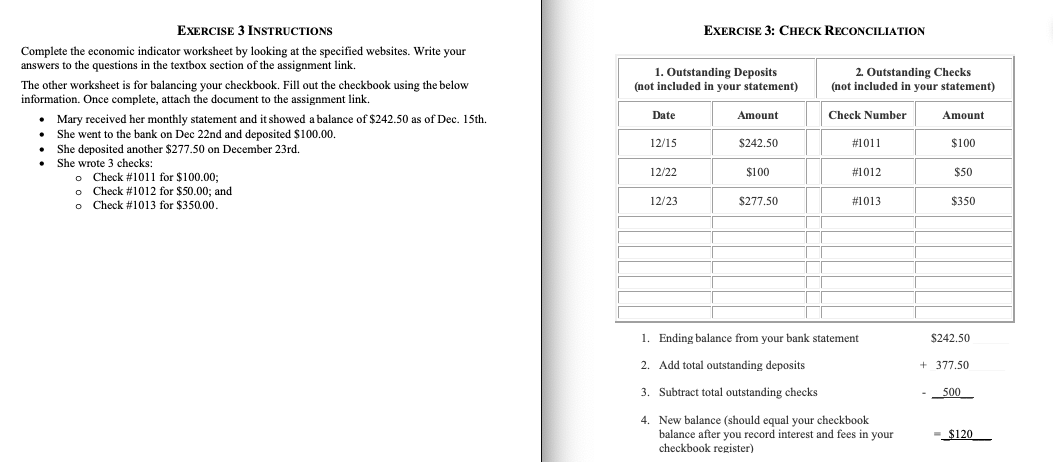

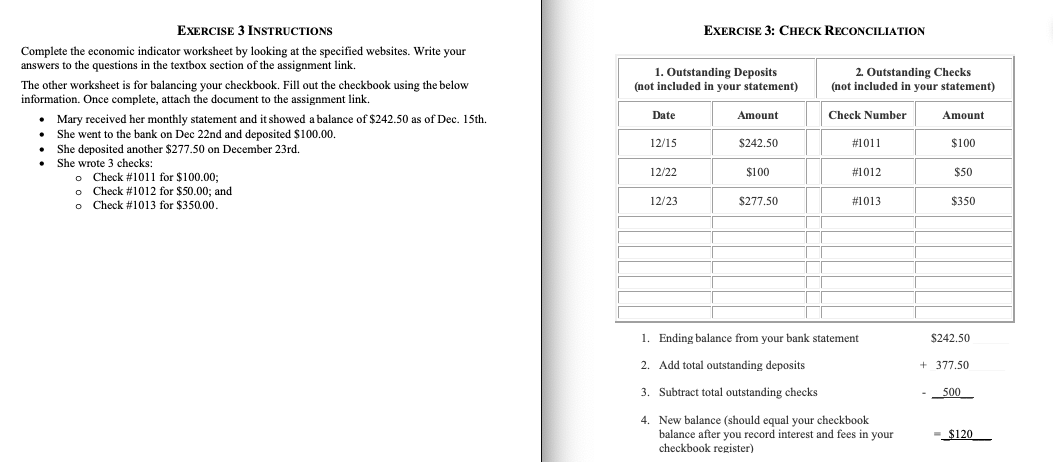

EXERCISE 3: CHECK RECONCILIATION 1. Outstanding Deposits (not included in your statement) 2. Outstanding Checks (not included in your statement) EXERCISE 3 INSTRUCTIONS Complete the economic indicator worksheet by looking at the specified websites. Write your answers to the questions in the textbox section of the assignment link. The other worksheet is for balancing your checkbook. Fill out the checkbook using the below information. Once complete, attach the document to the assignment link. Mary received her monthly statement and it showed a balance of $242.50 as of Dec. 15th. She went to the bank on Dec 22nd and deposited $100.00. She deposited another $277.50 on December 23rd. She wrote 3 checks: o Check #1011 for $100.00; o Check #1012 for $50.00; and o Check #1013 for $350.00. Date Amount Check Number Amount 12/15 $242.50 #1011 $100 12/22 $100 #1012 $50 12/23 $277.50 #1013 $350 1. Ending balance from your bank statement $242.50 2. Add total outstanding deposits + 377.50 3. Subtract total outstanding checks - 500 4. New balance should equal your checkbook balance after you record interest and fees in your checkbook register) - $120 EXERCISE 3: CHECK RECONCILIATION 1. Outstanding Deposits (not included in your statement) 2. Outstanding Checks (not included in your statement) EXERCISE 3 INSTRUCTIONS Complete the economic indicator worksheet by looking at the specified websites. Write your answers to the questions in the textbox section of the assignment link. The other worksheet is for balancing your checkbook. Fill out the checkbook using the below information. Once complete, attach the document to the assignment link. Mary received her monthly statement and it showed a balance of $242.50 as of Dec. 15th. She went to the bank on Dec 22nd and deposited $100.00. She deposited another $277.50 on December 23rd. She wrote 3 checks: o Check #1011 for $100.00; o Check #1012 for $50.00; and o Check #1013 for $350.00. Date Amount Check Number Amount 12/15 $242.50 #1011 $100 12/22 $100 #1012 $50 12/23 $277.50 #1013 $350 1. Ending balance from your bank statement $242.50 2. Add total outstanding deposits + 377.50 3. Subtract total outstanding checks - 500 4. New balance should equal your checkbook balance after you record interest and fees in your checkbook register) - $120

I just want to double check my answers before submitting.

I just want to double check my answers before submitting.