Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just want to know how to calculate the free cash flow for this question, thanks. The comparative statement of financial position of Marigold Corporation

I just want to know how to calculate the free cash flow for this question, thanks.

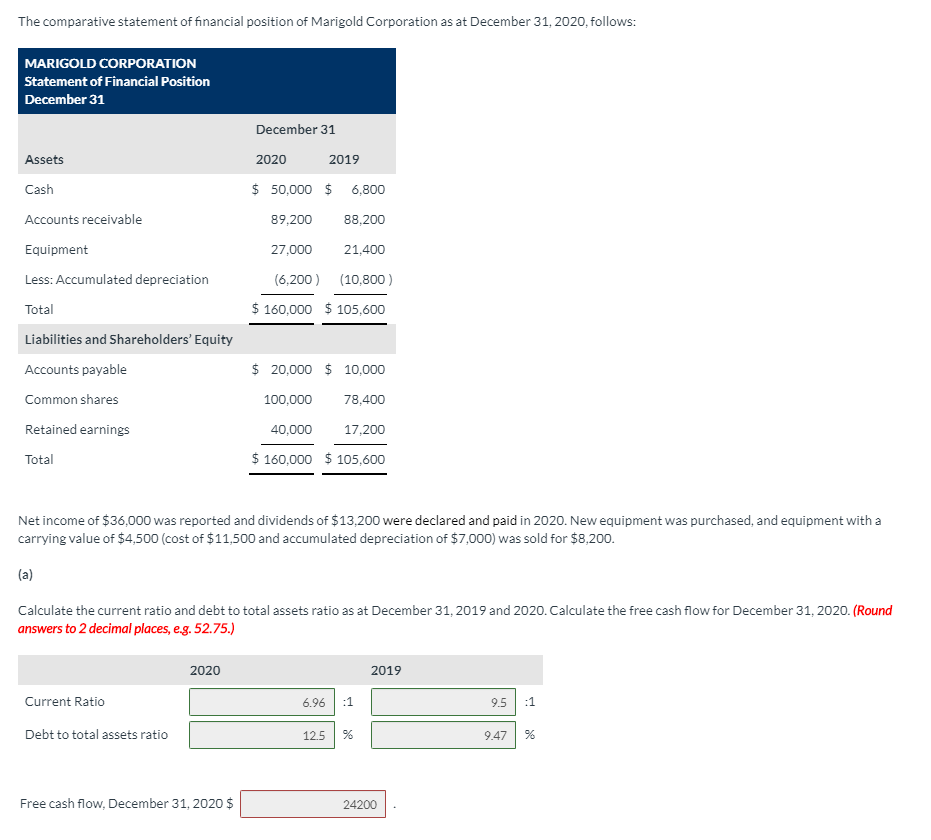

The comparative statement of financial position of Marigold Corporation as at December 31, 2020, follows: MARIGOLD CORPORATION Statement of Financial Position December 31 December 31 Assets 2020 2019 Cash $ 50,000 $ 6,800 Accounts receivable 89,200 88,200 27,000 21,400 Equipment Less: Accumulated depreciation (6,200) (10.800) $ 160,000 $ 105,600 Total Liabilities and Shareholders' Equity Accounts payable $ 20,000 $ 10,000 Common shares 100,000 78,400 Retained earnings 40,000 17,200 Total $ 160,000 $ 105,600 Net income of $36,000 was reported and dividends of $13,200 were declared and paid in 2020. New equipment was purchased, and equipment with a carrying value of $4,500 (cost of $11,500 and accumulated depreciation of $7,000) was sold for $8,200. (a) Calculate the current ratio and debt to total assets ratio as at December 31, 2019 and 2020. Calculate the free cash flow for December 31, 2020. (Round answers to 2 decimal places, e.g. 52.75.) 2020 2019 Current Ratio 6.96 :1 9.5 :1 Debt to total assets ratio 12.5 % 9.47 % Free cash flow, December 31, 2020 $ 24200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started