Answered step by step

Verified Expert Solution

Question

1 Approved Answer

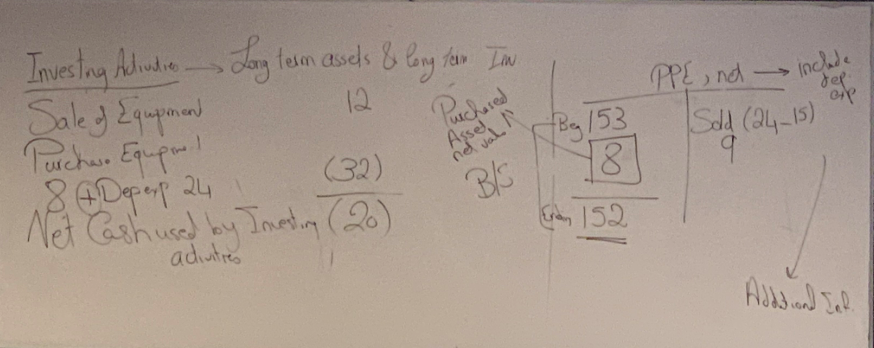

i just wonder where is the 24 in T account sold coming from? and where is the depr expense 24 under purchase equipment coming from?

i just wonder where is the 24 in T account sold coming from? and where is the depr expense 24 under purchase equipment coming from?

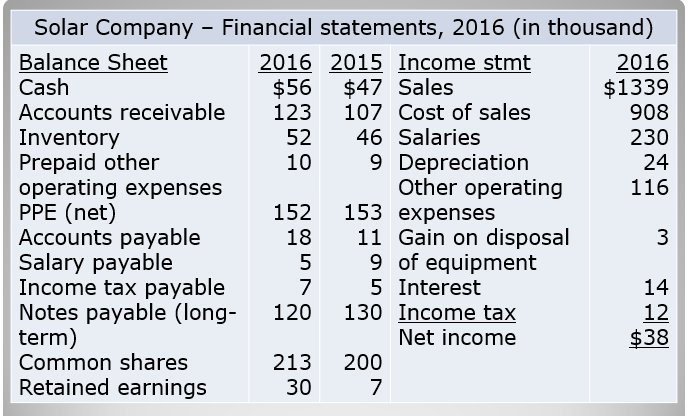

$56 116 Solar Company - Financial statements, 2016 (in thousand) Balance Sheet 2016 2015 Income stmt 2016 Cash $47 Sales $1339 Accounts receivable 123 107 Cost of sales 908 Inventory 52 46 Salaries 230 Prepaid other 10 9 Depreciation 24 operating expenses Other operating PPE (net) 153 expenses Accounts payable 18 11 Gain on disposal Salary payable 9 of equipment Income tax payable 5 Interest Notes payable (long 120 130 Income tax term) Net income $38 Common shares 213 200 Retained earnings 30 152 5 12 Additional Information during 2016: 1. Equipment with a historic cost of 24,000 and accumulated depreciation of $15,000 was sold for $12,000 cash. 2. Cash dividends were paid. 3. Notes payable were repaid as scheduled. 4. Common shares were issued for cash. Required: Prepare the statement of cash flows for Solar for the 2016 fiscal year, using both direct and indirect methods. PPE, nu include Purchased Sold (24-15) 115) - Investing Actiudies Long term assels & long term IN Sale & Equpment uch Ba 153 Purchase Equipment 18 4 Depepp 24 ( Net Cash used by Investing (20) En 152 adivities Ble se 1 Addriond SolStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started