Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I keep getting $72,700 as my answer, but I've seen someone else say the answer is D. 78,700. Can you please explain the answer, maybe

I keep getting $72,700 as my answer, but I've seen someone else say the answer is D. 78,700. Can you please explain the answer, maybe something in the wording of the problem is confusing me. Thank you.

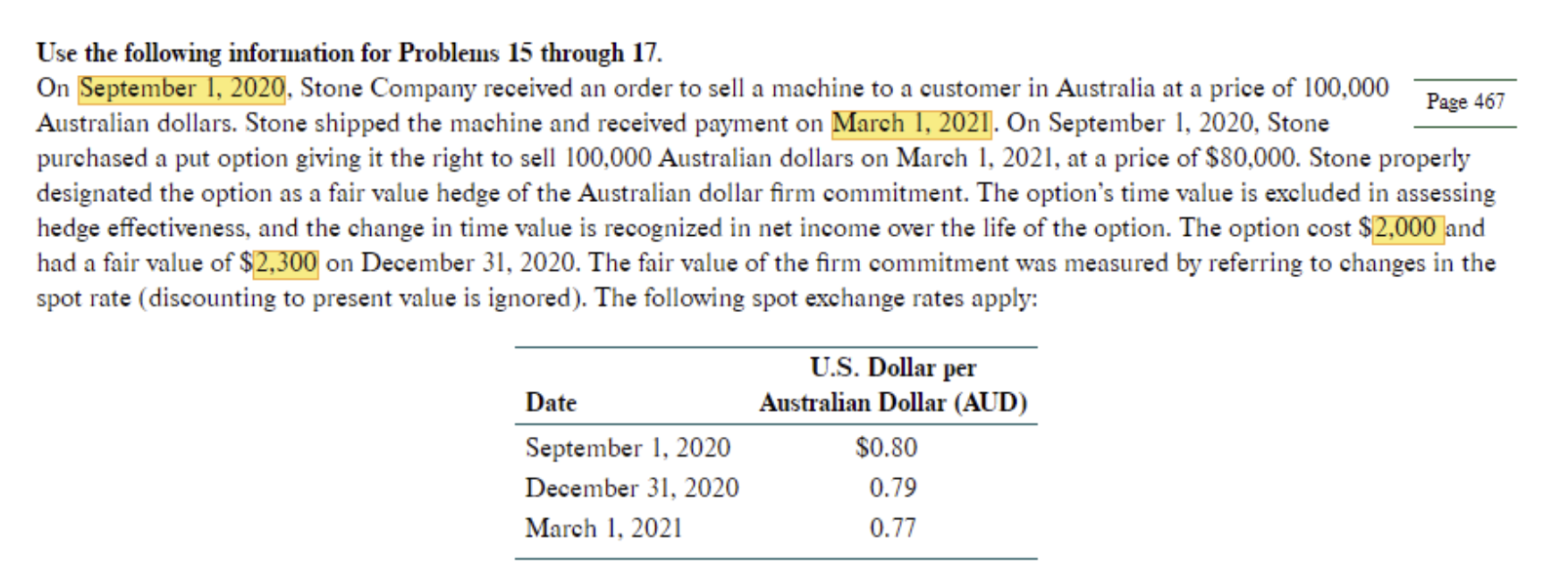

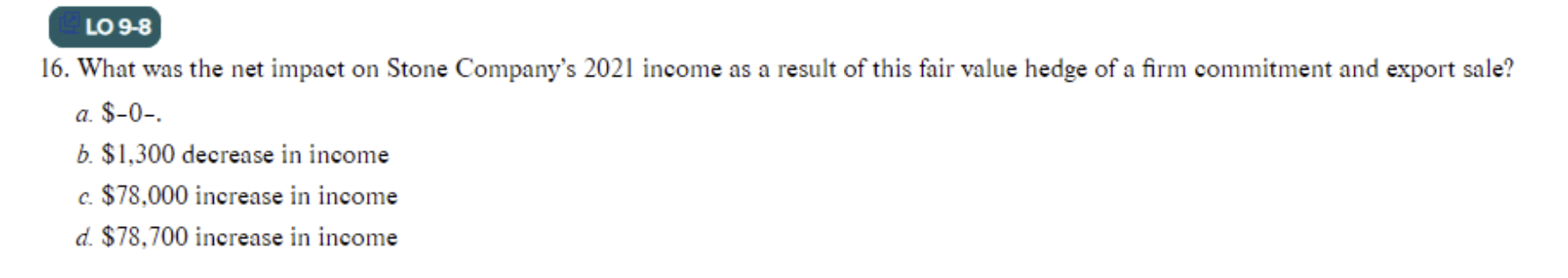

Use the following information for Problems 15 through 17. On September 1, 2020, Stone Company received an order to sell a machine to a customer in Australia at a price of 100,000 Australian dollars. Stone shipped the machine and received payment on March 1, 2021. On September 1, 2020, Stone Page 467 purchased a put option giving it the right to sell 100,000 Australian dollars on March 1, 2021, at a price of $80,000. Stone properly designated the option as a fair value hedge of the Australian dollar firm commitment. The option's time value is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income over the life of the option. The option cost $2,000 and had a fair value of $2,300 on December 31, 2020. The fair value of the firm commitment was measured by referring to changes in the spot rate (discounting to present value is ignored). The following spot exchange rates apply: 16. What was the net impact on Stone Company's 2021 income as a result of this fair value hedge of a firm commitment and export sale? a. $0. b. $1,300 decrease in income c. $78,000 increase in income d. $78,700 increase in incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started