Answered step by step

Verified Expert Solution

Question

1 Approved Answer

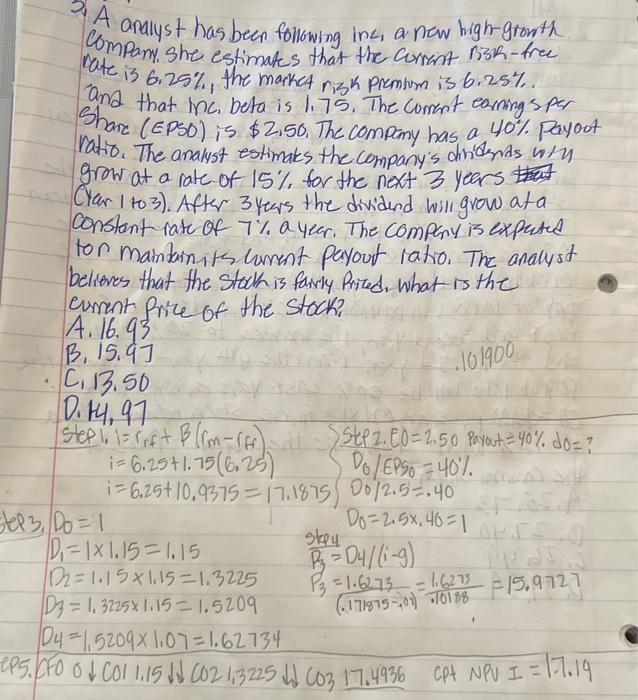

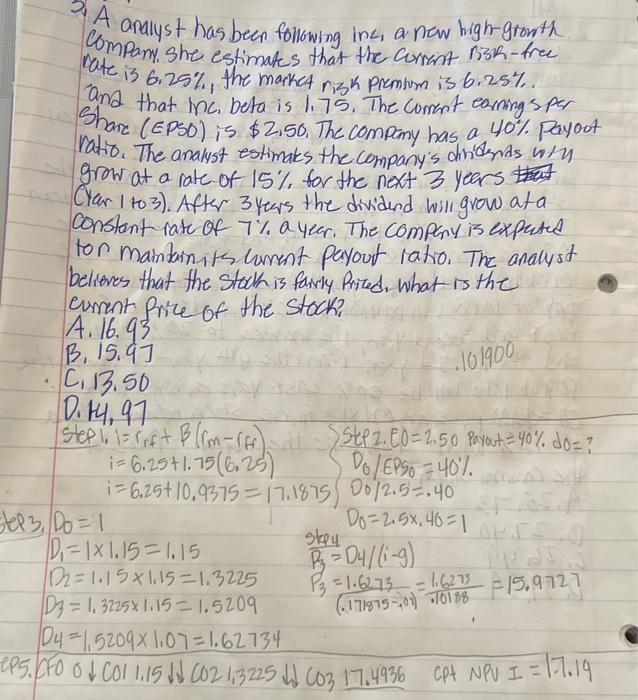

I keep trying to rework it and im not getting the right answer please help! A analyst has been forlowing inc, a new high-growth Company.

I keep trying to rework it and im not getting the right answer please help!

A analyst has been forlowing inc, a new high-growth Company. She estimates that the corrent Ni3k-free ate is 6.25%, the market ri3 k premum is 6.25\%. and that inc. beta is 1.75. The coment eaning sper Share (EPSO) is $2,50. The company has a 40\% payout ratio. The analyst estimaks the company's dridends wit grow at a rate of 15% for the next 3 yeers (yan 1 to 3). After 3 years the dividend will grow at a constant rate of 7% a yeer. The compeny is exputed tor maintain its coment payout ratio. The analyst belieres that the Stack is farly Priced. What is the eurent price of the stock? A. 16.93 B,15.97 C113.50 D1+4.97 D4=1.52091.07=1.62734 FO 0CO11,15C021,3225CO317,4936 cpt NPVI=17.19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started