Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i know chegg policy and according to the policy you have to answer all four questions. if you answer all then i will.give you a

i know chegg policy and according to the policy you have to answer all four questions. if you answer all then i will.give you a like.

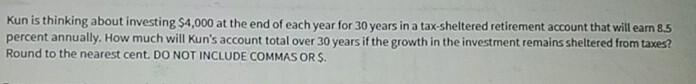

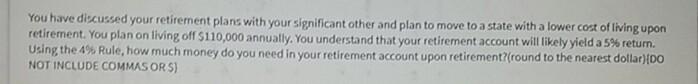

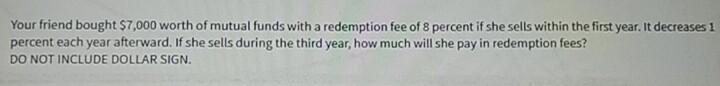

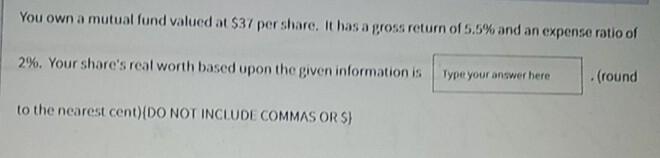

Kun is thinking about investing $4,000 at the end of each year for 30 years in a tax-sheltered retirement account that will earn 8.5 percent annually. How much will Kun's account total over 30 years if the growth in the investment remains sheltered from taxes? Round to the nearest cent. DO NOT INCLUDE COMMAS OR $. You have discussed your retirement plans with your significant other and plan to move to a state with a lower cost of living upon retirement. You plan on living off $110,000 annually. You understand that your retirement account will likely yield a 5% return. Using the 4% Rule, how much money do you need in your retirement account upon retirement?(round to the nearest dollar) (DO NOT INCLUDE COMMAS ORS) Your friend bought $7,000 worth of mutual funds with a redemption fee of 8 percent if she sells within the first year. It decreases 1 percent each year afterward. If she sells during the third year, how much will she pay in redemption fees? DO NOT INCLUDE DOLLAR SIGN. You own a mutual fund valued at $37 per share. It has a gross return of 5.5% and an expense ratio of 2%. Your share's real worth based upon the given information is Type your answer here. . (round to the nearest cent) (DO NOT INCLUDE COMMAS OR SStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started