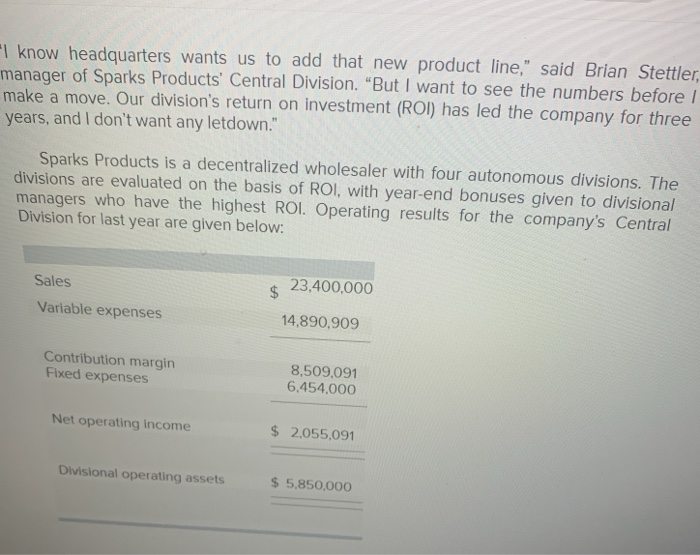

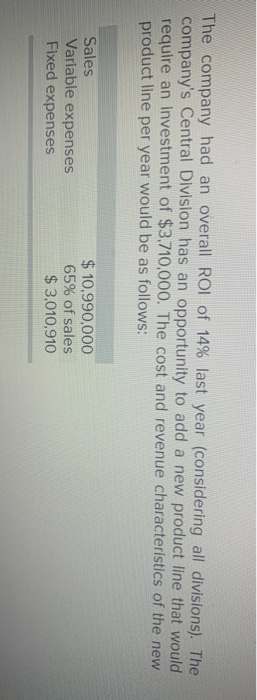

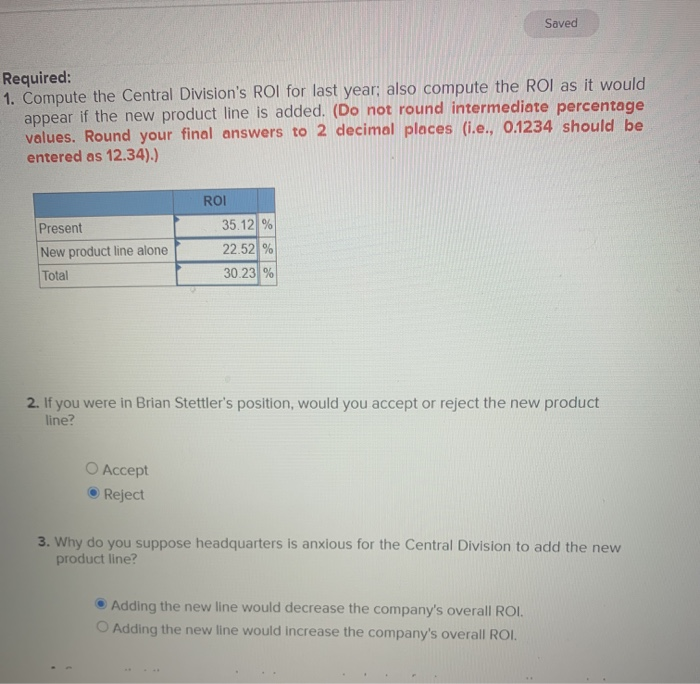

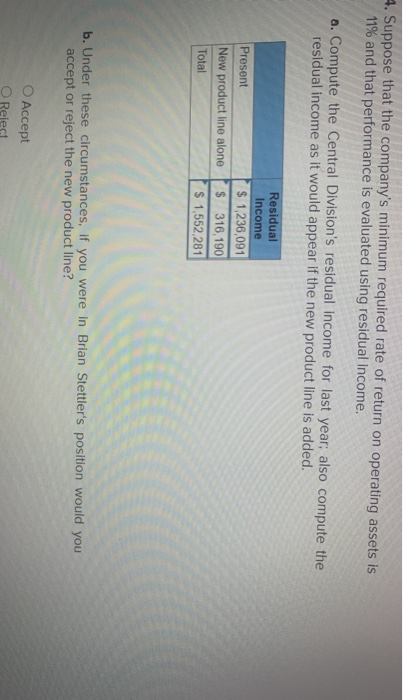

I know headquarters wants us to add that new product line," said Brian Stettler, manager of Sparks Products' Central Division. "But I want to see the numbers before ! make a move. Our division's return on investment (ROI) has led the company for three years, and I don't want any letdown." Sparks Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROI. Operating results for the company's Central Division for last year are given below: Sales $ 23,400,000 Variable expenses 14,890,909 Contribution margin Fixed expenses 8,509,091 6,454.000 Net operating income $ 2,055,091 Divisional operating assets $ 5,850,000 The company had an overall ROI of 14% last year (considering all divisions). The company's Central Division has an opportunity to add a new product line that would require an investment of $3,710,000. The cost and revenue characteristics of the new product line per year would be as follows: Sales Variable expenses Fixed expenses $ 10,990,000 65% of sales $ 3,010,910 Saved Required: 1. Compute the Central Division's ROI for last year: also compute the ROI as it would appear if the new product line is added. (Do not round intermediate percentage values. Round your final answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34).) Present New product line alone Total ROI 35.12 % 22.52 % 30.23% 2. If you were in Brian Stettler's position, would you accept or reject the new product line? O Accept Reject 3. Why do you suppose headquarters is anxious for the Central Division to add the new product line? Adding the new line would decrease the company's overall ROI. O Adding the new line would increase the company's overall ROI. 4. Suppose that the company's minimum required rate of return on operating assets is 11% and that performance is evaluated using residual income. a. Compute the Central Division's residual income for last year; also compute the residual income as it would appear if the new product line is added. Present New product line alone Total Residual Income $ 1,236,091 $ 316,190 $ 1,552,281 b. Under these circumstances, if you were in Brian Stettler's position would you accept or reject the new product line? O Accept O Reiect