Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know how to work A.B but got C and D wrong. if you could show me how to compute those please. 20. Mr. and

I know how to work A.B but got C and D wrong. if you could show me how to compute those please.

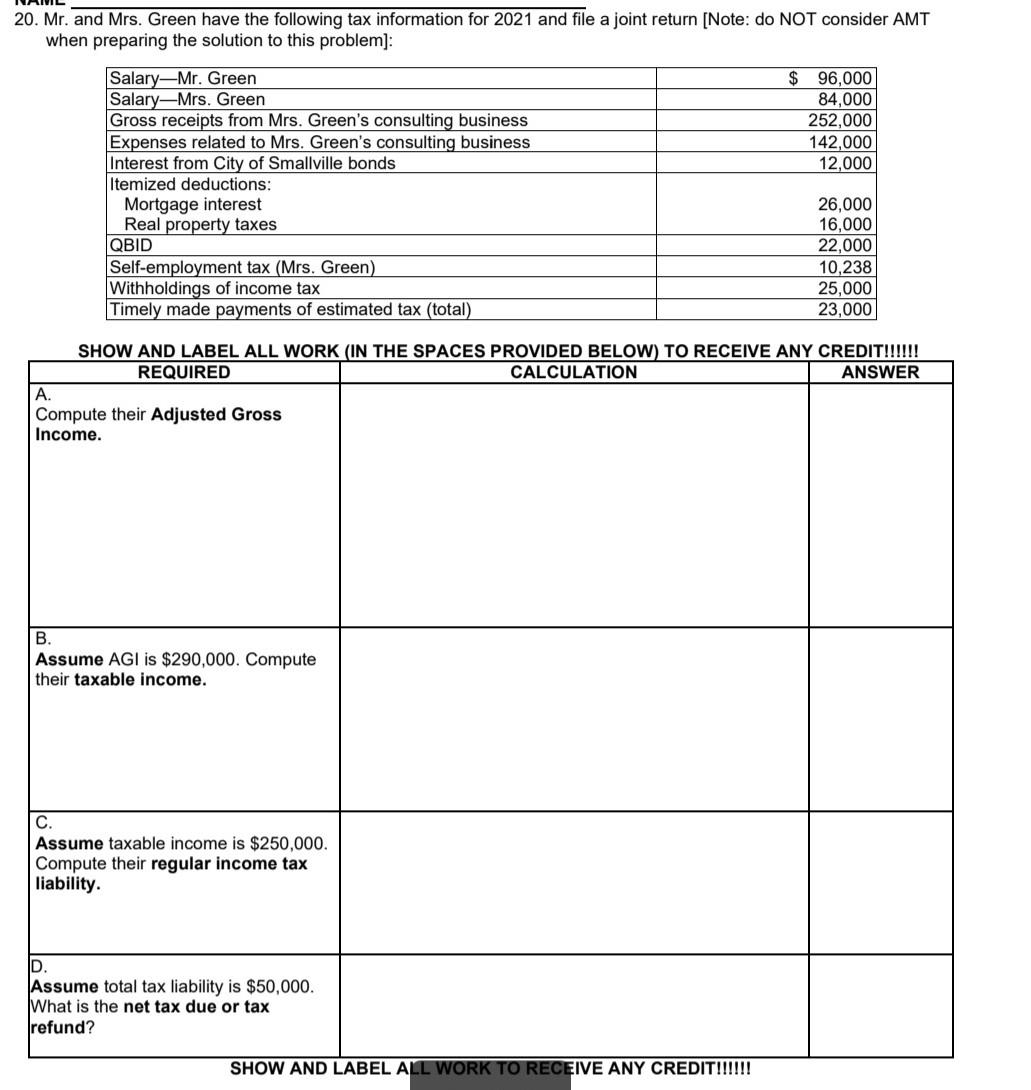

20. Mr. and Mrs. Green have the following tax information for 2021 and file a joint return [Note: do NOT consider AMT when preparing the solution to this problem]: $ 96,000 84,000 252,000 142,000 12,000 Salary-Mr. Green SalaryMrs. Green Gross receipts from Mrs. Green's consulting business Expenses related to Mrs. Green's consulting business Interest from City of Smallville bonds Itemized deductions: Mortgage interest Real property taxes QBID Self-employment tax (Mrs. Green) Withholdings of income tax Timely made payments of estimated tax (total) 26,000 16,000 22,000 10,238 25,000 23,000 SHOW AND LABEL ALL WORK (IN THE SPACES PROVIDED BELOW) TO RECEIVE ANY CREDIT!!!!!! REQUIRED CALCULATION ANSWER A. Compute their Adjusted Gross Income. B. Assume AGI is $290,000. Compute their taxable income. . Assume taxable income is $250,000. Compute their regular income tax liability. D. Assume total tax liability is $50,000. What is the net tax due or tax refund? SHOW AND LABEL ALL WORK TO RECEIVE ANY CREDITStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started