i know its alot but the answers would truly be very helpful . thank you

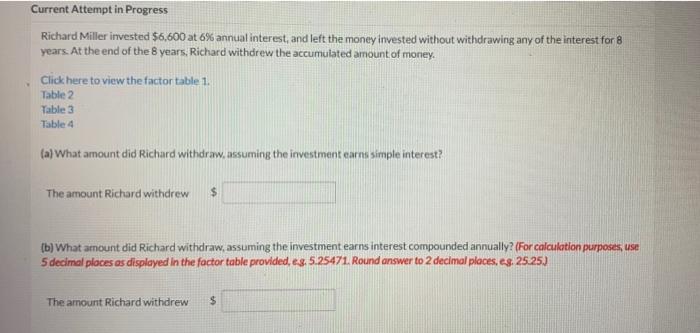

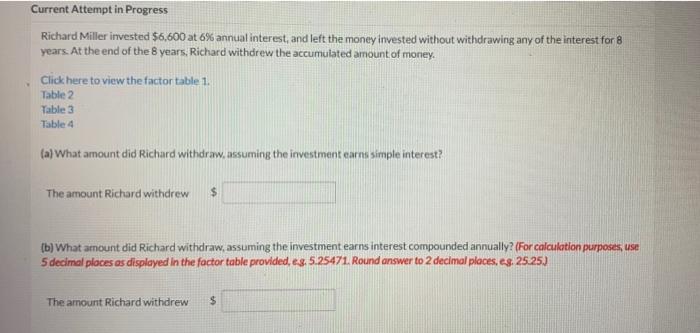

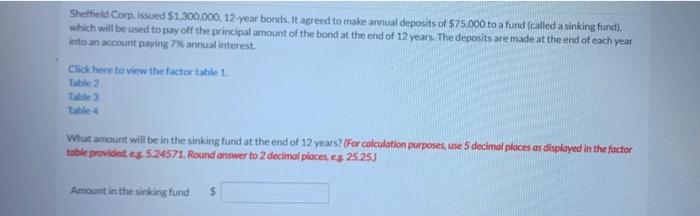

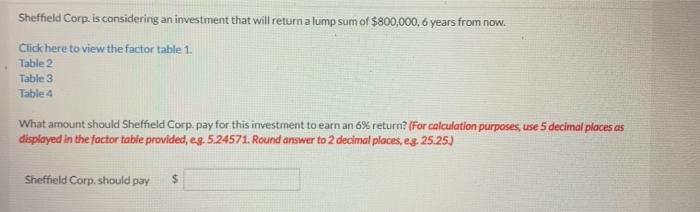

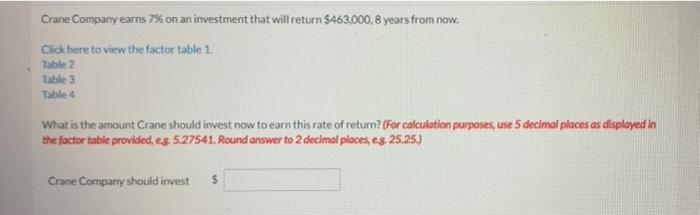

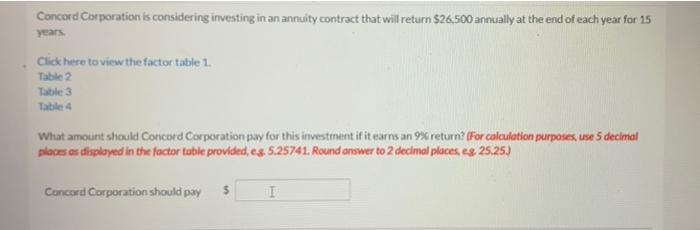

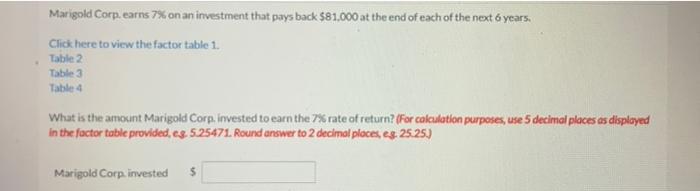

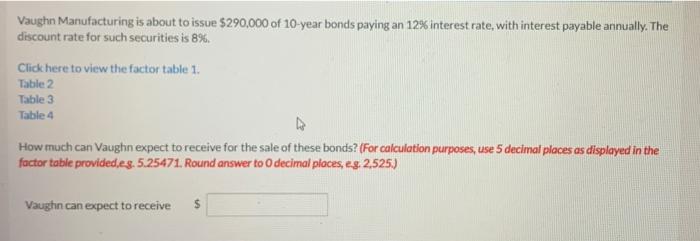

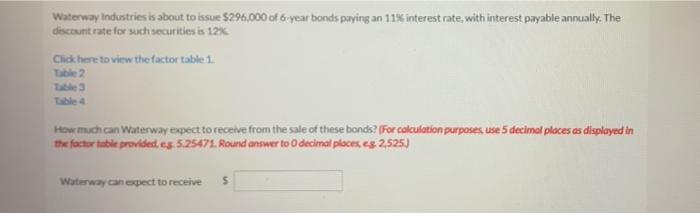

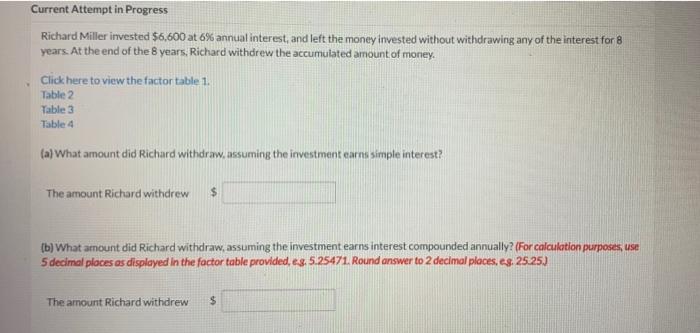

Current Attempt in Progress Richard Miller invested $6,600 at 6% annual interest, and left the money invested without withdrawing any of the interest for 8 years. At the end of the 8 years, Richard withdrew the accumulated amount of money, Click here to view the factor table 1. Table 2 Table 3 Table 4 (a) What amount did Richard withdraw, assuming the investment earns simple interest? The amount Richard withdrew $ (b) What amount did Richard withdraw, assuming the investment earns interest compounded annually? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, es, 5.25471. Round answer to 2 decimal places, es 25.25) The amount Richard withdrew $ Sheffield Corp. issued $1,300,000, 12-year bords. It agreed to make annual deposits of $75,000 to a fund (called a sinking fund). which will be used to pay off the principal amount of the bond at the end of 12 years. The deposits are made at the end of each year into an account paying 7% annual interest. Click here to view the factor table 1. Table 2 Table 3 What amount will be in the sinking fund at the end of 12 years? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, es 5.24571. Round answer to 2 decimal places, eg 25.25) Amount in the sinking fund $ Sheffield Corp. is considering an investment that will return a lump sum of $800,000, 6 years from now. Click here to view the factor table 1. Table 2 Table 3 Table 4 What amount should Sheffield Corp. pay for this investment to earn an 6% return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, eg. 5.24571. Round answer to 2 decimal places, eg. 25.25) Sheffield Corp. should pay $ Crane Company earns 7% on an investment that will return $463,000, 8 years from now. Click here to view the factor table 1 Table 2 Table 3 Table 4 What is the amount Crane should invest now to earn this rate of return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. es. 5.27541. Round answer to 2 decimal places, s. 25.25.) Crane Company should invest $ Concord Corporation is considering investing in an annuity contract that will return $26.500 annually at the end of each year for 15 years Click here to view the factor table 1. Table 2 Table 3 Table 4 What amount should Concord Corporation pay for this investment if it earns an 9% return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, es 5.25741. Round answer to 2 decimal places, eg 25.25) Concord Corporation should pays 1 Marigold Corp. earns 7% on an investment that pays back $81.000 at the end of each of the next 6 years. Click here to view the factor table 1. Table 2 Table 3 Table 4 What is the amount Marigold Corp, invested to earn the 7% rate of return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, cs. 5.25471. Round answer to 2 decimal places, es 25.25.) Marigold Corp. invested $ Vaughn Manufacturing is about to issue $290,000 of 10-year bonds paying an 12% interest rate, with interest payable annually. The discount rate for such securities is 8%. Click here to view the factor table 1. Table 2 Table 3 Table 4 How much can Vaughn expect to receive for the sale of these bonds? (For calculation purposes, use 5 decimal places as displayed in the factor table provided.-8. 5.25471. Round answer to decimal places, eg 2,525) Vaughn can expect to receive $ Waterway Industries is about to issue $296,000 of 6 year bonds paying an 11% interest rate, with interest payable annually. The discount rate for such securities is 12% Click here to view the factor table 1. Tube 2 How much can Waterway expect to receive from the sale of these bonds? (For calculation purposes use 5 decimal places as displayed in the factor table provided, es 5.25473. Round answer to decimal places, es 2.525) Waterwaycan expect to receive $