Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know part 1 is decrease, no change, decrease, but I need part 2 Use the following information to answer the next two questions: Harris

I know part 1 is decrease, no change, decrease, but I need part 2

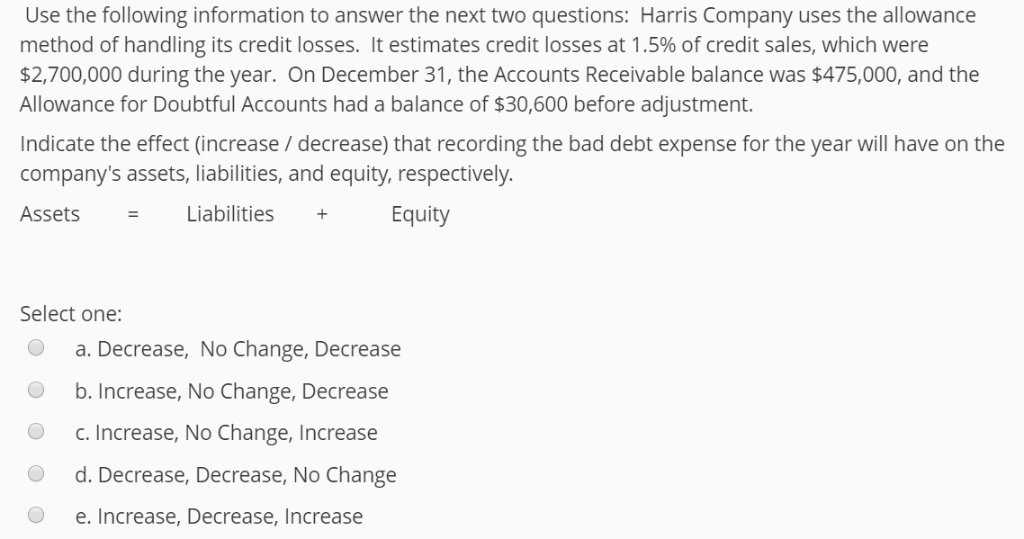

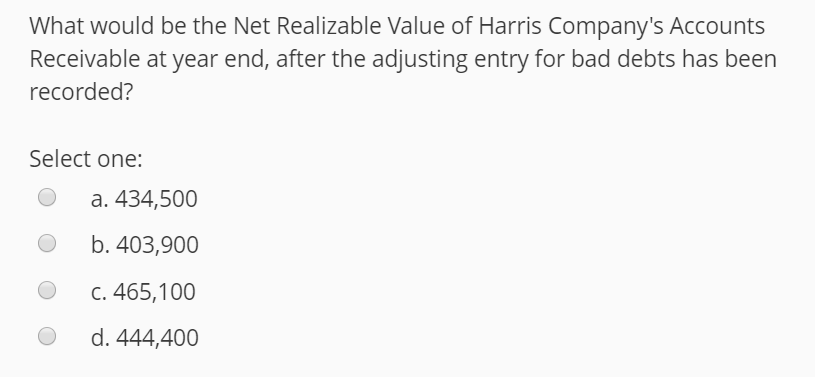

Use the following information to answer the next two questions: Harris Company uses the allowance method of handling its credit losses. It estimates credit losses at 1.5% of credit sales, which were $2,700,000 during the year. On December 31, the Accounts Receivable balance was $475,000, and the Allowance for Doubtful Accounts had a balance of $30,600 before adjustment. Indicate the effect (increase / decrease) that recording the bad debt expense for the year will have on the company's assets, liabilities, and equity, respectively. Assets Liabilities+ Equity Select one: a. Decrease, No Change, Decrease b. Increase, No Change, Decrease C. Increase, No Change, Increase O d. Decrease, Decrease, No Change O e. Increase, Decrease, Increase What would be the Net Realizable Value of Harris Company's Accounts Receivable at year end, after the adjusting entry for bad debts has been recorded? Select one: O a. 434,500 O b. 403,900 O c. 465,100 O d. 444,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started