Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know the A, B, C, D. So, I want to know how to do E, F, G. Please show the detailed steps for E,

I know the A, B, C, D. So, I want to know how to do E, F, G. Please show the detailed steps for E, F, G. Thank you so much!!!

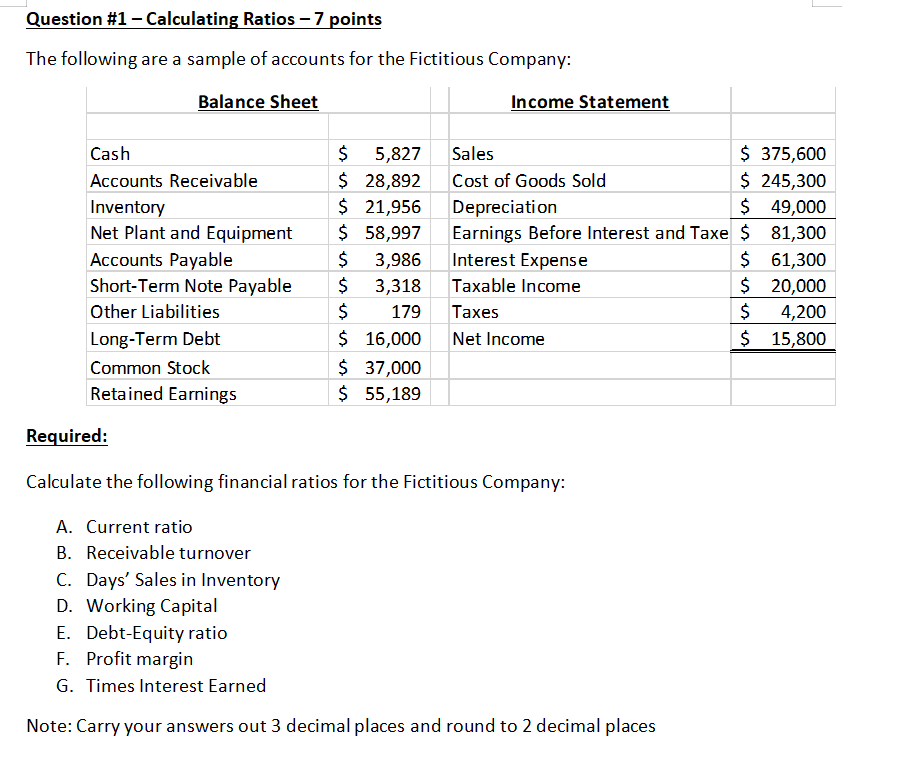

Question #1 - Calculating Ratios 7 points The following are a sample of accounts for the Fictitious Company: Balance Sheet Income Statement Cash Accounts Receivable Inventory Net Plant and Equipment Accounts Payable Short-Term Note Payable Other Liabilities Long-Term Debt Common Stock Retained Earnings $ 5,827 $ 28,892 $ 21,956 $ 58,997 $ 3,986 $ 3,318 $ 179 $ 16,000 $ 37,000 $ 55,189 Sales $ 375,600 Cost of Goods Sold $ 245,300 Depreciation $ 49,000 Earnings Before Interest and Taxe $ 81,300 Interest Expense $ 61,300 Taxable income $ 20,000 Taxes $ 4,200 Net Income $ 15,800 Required: Calculate the following financial ratios for the Fictitious Company: A. Current ratio B. Receivable turnover C. Days' Sales in Inventory D. Working Capital E. Debt-Equity ratio F. Profit margin G. Times Interest Earned Note: Carry your answers out 3 decimal places and round to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started