Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know the answer is $273,700, but what are the steps to get this answer? Question 16 0.2 out of 0.2 points Rustic Living Furniture

I know the answer is $273,700, but what are the steps to get this answer?

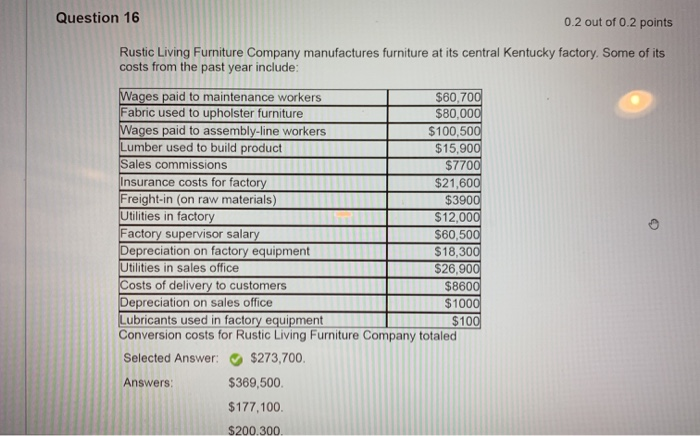

Question 16 0.2 out of 0.2 points Rustic Living Furniture Company manufactures furniture at its central Kentucky factory. Some of its costs from the past year include: Wages paid to maintenance workers $60,700 Fabric used to upholster furniture $80,000 Wages paid to assembly-line workers $100,500 Lumber used to build product $15,900 Sales commissions $7700 Insurance costs for factory $21,600 Freight-in (on raw materials) $3900 Utilities in factory $12,000 Factory supervisor salary $60,500 Depreciation on factory equipment | $18,300 Utilities in sales office $26,900 Costs of delivery to customers $8600 Depreciation on sales office $1000 Lubricants used in factory equipment R $100 Conversion costs for Rustic Living Furniture Company totaled Selected Answer: $273,700. Answers $369,500 $177,100 $200.300 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started