Answered step by step

Verified Expert Solution

Question

1 Approved Answer

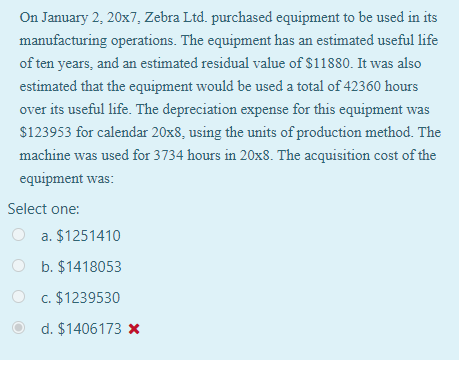

I know the answer is b), could someone please show me how you get to that answer? On January 2, 20x7, Zebra Ltd. purchased equipment

I know the answer is b), could someone please show me how you get to that answer?

On January 2, 20x7, Zebra Ltd. purchased equipment to be used in its manufacturing operations. The equipment has an estimated useful life of ten years, and an estimated residual value of $11880. It was also estimated that the equipment would be used a total of 42360 hours over its useful life. The depreciation expense for this equipment was $123953 for calendar 20x8, using the units of production method. The machine was used for 3734 hours in 20x8. The acquisition cost of the equipment was: Select one: a. $1251410 b. $1418053 C. $1239530 d. $1406173 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started