Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know the answer is in the $5,000's. Just looking for clarification. An economist has federal taxable income of $90,000 and falls into the 5.0%

I know the answer is in the $5,000's. Just looking for clarification.

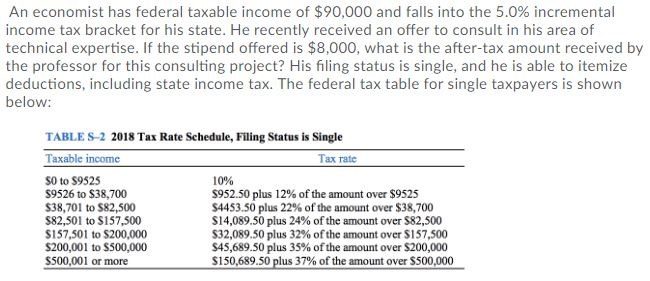

An economist has federal taxable income of $90,000 and falls into the 5.0% incremental income tax bracket for his state. He recently received an offer to consult in his area of technical expertise. If the stipend offered is $8,000, what is the after-tax amount received by the professor for this consulting project? His filing status is single, and he is able to itemize deductions, including state income tax. The federal tax table for single taxpayers is shown below: TABLE S 2 2018 Tax Rate Schedule, Filing Status is Single Taxable income Tax rate SO to $9525 $9526 to $38,700 $38,701 to S82,500 S82,501 to S157,500 S157,501 to $200,000 S200,001 to S500,000 S500,001 or more 10% $952.50 plus 12% of the amount over $9525 $4453.50 plus 22% of the amount over $38,700 $14,089.50 plus 24% of the amount over $82,500 $32,089.50 plus 32% ofthe amount over $157,500 $45,689.50 plus 35% ofthe amount over S200,000 $150,689.50 plus 37% of the amount over $500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started