Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know the answers for the questions, but I would like explanations as to why they are correct. Thanks. which assets they should leave to

I know the answers for the questions, but I would like explanations as to why they are correct. Thanks.

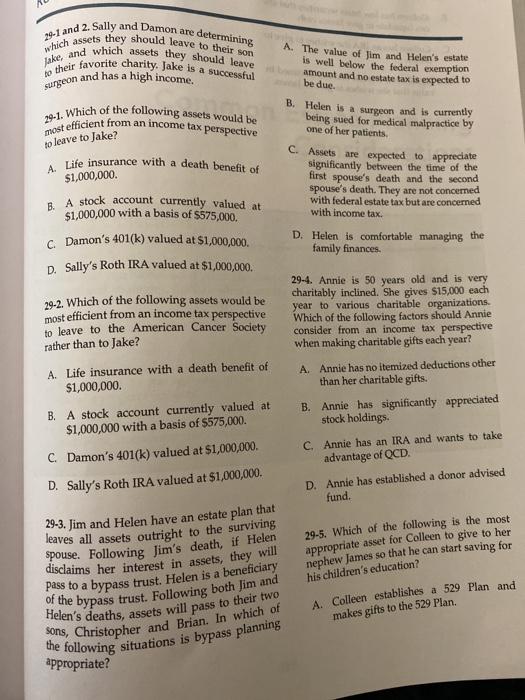

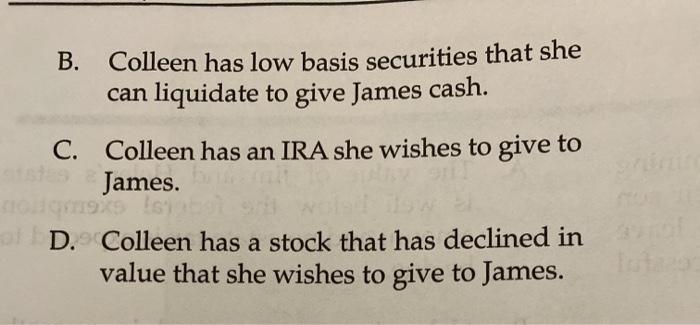

which assets they should leave to their son 29-1 and 2. Sally and Damon are determining Lake, and which assets they should leave to their favorite charity. Jake is a successful surgeon and has a high income. most efficient from an income tax perspective A. The value of Jim and Helen's estate is well below the federal exemption amount and no estate tax is expected to be due. B. Helen is a surgeon and is currently being sued for medical malpractice by one of her patients C. Assets are expected to appreciate significantly between the time of the first spouse's death and the second spouse's death. They are not concerned with federal estate tax but are concerned with income tax. to leave to Jake? A Life insurance with a death benefit of $1,000,000 B. A stock account currently valued at $1,000,000 with a basis of $575,000. c Damon's 401(k) valued at $1,000,000. D. Sally's Roth IRA valued at $1,000,000. D. Helen is comfortable managing the family finances 29-2. Which of the following assets would be most efficient from an income tax perspective to leave to the American Cancer Society rather than to Jake? 29-4. Annie is 50 years old and is very charitably inclined. She gives $15,000 each year to various charitable organizations. Which of the following factors should Annie consider from an income tax perspective when making charitable gifts each year? A. Life insurance with a death benefit of $1,000,000 A Annie has no itemized deductions other than her charitable gifts. B. Annie has significantly appreciated stock holdings. B. A stock account currently valued at $1,000,000 with a basis of $575,000. C Damon's 401(k) valued at $1,000,000 D. Sally's Roth IRA valued at $1,000,000 C. Annie has an IRA and wants to take advantage of OCD D. Annie has established a donor advised fund. 29-3. Jim and Helen have an estate plan that leaves all assets outright to the surviving spouse. Following Jim's death, if Helen disclaims her interest in assets, they will pass to a bypass trust. Helen is a beneficiary of the bypass trust. Following both Jim and Helen's deaths, assets will pass to their two the following situations is bypass planning sons, Christopher and Brian. In which of appropriate? 29-5. Which of the following is the most appropriate asset for Colleen to give to her nephew James so that he can start saving for his children's education? A. Colleen establishes a 529 Plan and makes gifts to the 529 Plan which assets they should leave to their son 29-1 and 2. Sally and Damon are determining Lake, and which assets they should leave to their favorite charity. Jake is a successful surgeon and has a high income. most efficient from an income tax perspective A. The value of Jim and Helen's estate is well below the federal exemption amount and no estate tax is expected to be due. B. Helen is a surgeon and is currently being sued for medical malpractice by one of her patients C. Assets are expected to appreciate significantly between the time of the first spouse's death and the second spouse's death. They are not concerned with federal estate tax but are concerned with income tax. to leave to Jake? A Life insurance with a death benefit of $1,000,000 B. A stock account currently valued at $1,000,000 with a basis of $575,000. c Damon's 401(k) valued at $1,000,000. D. Sally's Roth IRA valued at $1,000,000. D. Helen is comfortable managing the family finances 29-2. Which of the following assets would be most efficient from an income tax perspective to leave to the American Cancer Society rather than to Jake? 29-4. Annie is 50 years old and is very charitably inclined. She gives $15,000 each year to various charitable organizations. Which of the following factors should Annie consider from an income tax perspective when making charitable gifts each year? A. Life insurance with a death benefit of $1,000,000 A Annie has no itemized deductions other than her charitable gifts. B. Annie has significantly appreciated stock holdings. B. A stock account currently valued at $1,000,000 with a basis of $575,000. C Damon's 401(k) valued at $1,000,000 D. Sally's Roth IRA valued at $1,000,000 C. Annie has an IRA and wants to take advantage of OCD D. Annie has established a donor advised fund. 29-3. Jim and Helen have an estate plan that leaves all assets outright to the surviving spouse. Following Jim's death, if Helen disclaims her interest in assets, they will pass to a bypass trust. Helen is a beneficiary of the bypass trust. Following both Jim and Helen's deaths, assets will pass to their two the following situations is bypass planning sons, Christopher and Brian. In which of appropriate? 29-5. Which of the following is the most appropriate asset for Colleen to give to her nephew James so that he can start saving for his children's education? A. Colleen establishes a 529 Plan and makes gifts to the 529 PlanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started