Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know there is two question, and I know the policy, but there is no more question limits are left, con you please help me

I know there is two question, and I know the policy, but there is no more question limits are left, con you please help me to solve these problems.. Thank you.

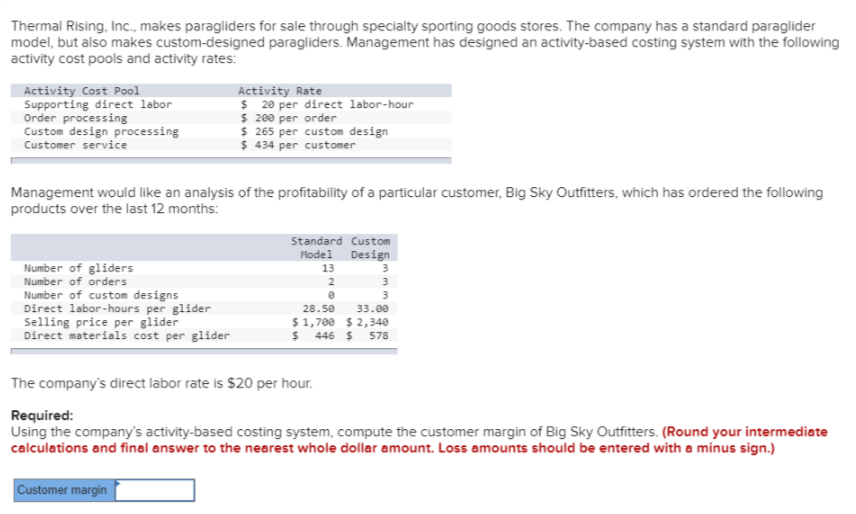

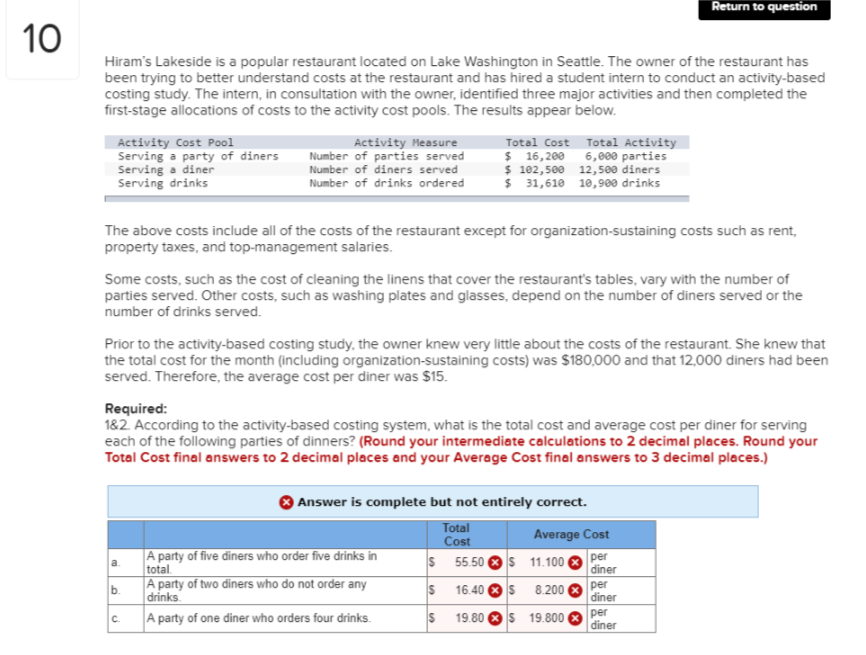

Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 20 per direct labor-hour $ 200 per order 265 per custom design 434 per customer Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Standard Custom Model Design Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider 13 28.50 33.00 1,700 $ 2,348 $446 578 The company's direct labor rate is $20 per hour. Required: Using the company's activity-based costing system, compute the customer margin of Big Sky Outfitters. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered with a minus sign. omer margin Return to question Hiram's Lakeside is a popular restaurant located on Lake Washington in Seattle. The owner of the restaurant has been trying to better understand costs at the restaurant and has hired a student intern to conduct an activity-based costing study. The intern, in consultation with the owner, identified three major activities and then completed the first-stage allocations of costs to the activity cost pools. The results appear below Activity Cost Pool Serving a party of diners Serving a diner Serving drinks Activity Measure Number of parties served Number of diners served Number of drinks ordered Total Cost Total Activity $ 16,200 6,000 parties $102,500 12,500 diners $ 31,610 10,900 drinks The above costs include all of the costs of the restaurant except for organization-sustaining costs such as rent, property taxes, and top-management salaries. Some costs, such as the cost of cleaning the linens that cover the restaurant's tables, vary with the number of parties served. Other costs, such as washing plates and glasses, depend on the number of diners served or the number of drinks served Prior to the activity-based costing study, the owner knew very little about the costs of the restaurant. She knew that the total cost for the month (including organization-sustaining costs) was $180,000 and that 12,000 diners had been served. Therefore, the average cost per diner was $15 Required: 1&2. According to the activity-based costing system, what is the total cost and average cost per diner for serving each of the following parties of dinners? (Round your intermediate calculations to 2 decimal places. Round your Total Cost final answers to 2 decimal places and your Average Cost final answers to 3 decimal places.) Answer is complete but not entirely correct Average Cost aA party of five diners who order five drinks in b. A party of two diners who do not order any C A party of one diner who orders four drinks S 5550 $ 11.100 3 pe 16.40 s 8200p S 1980 S 19.800er total diner drinks dinerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started