Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i konw u guys one time just can answer one question. but please just this time help me, i have 20 questions need to upload

i konw u guys one time just can answer one question. but please just this time help me, i have 20 questions need to upload but i dont have enough time.

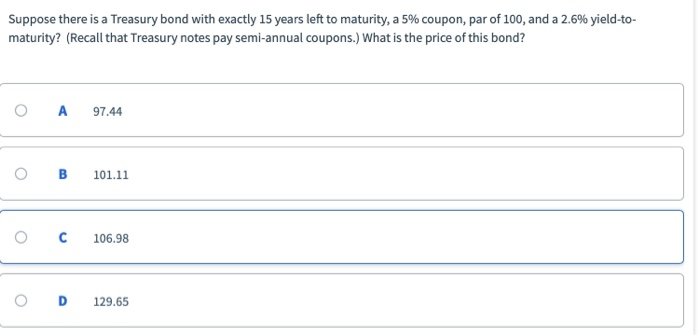

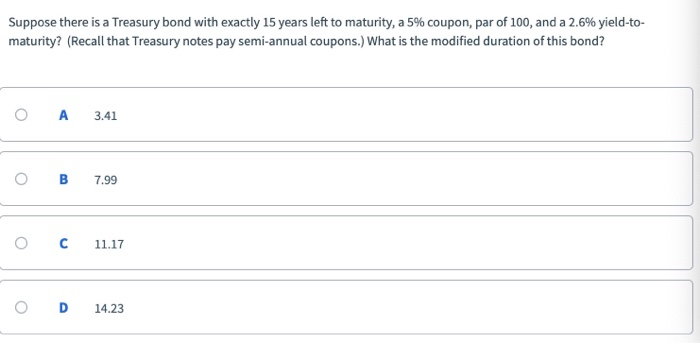

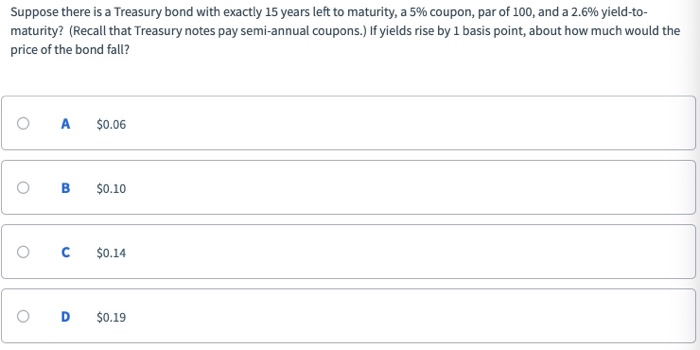

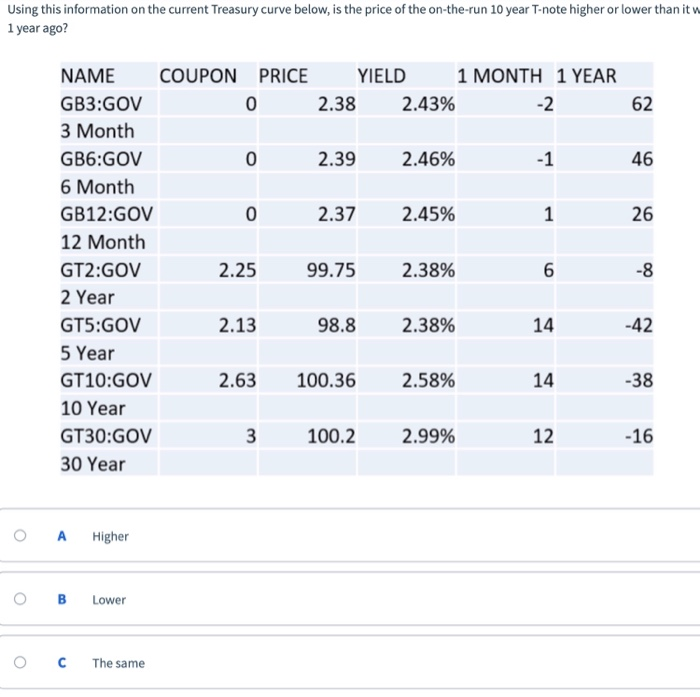

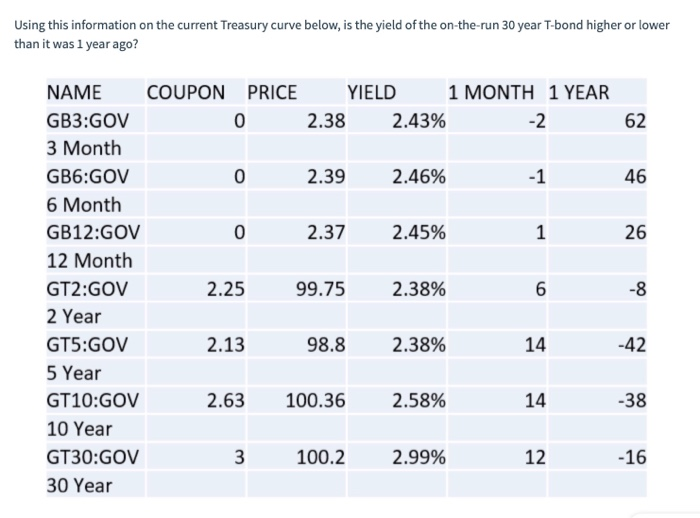

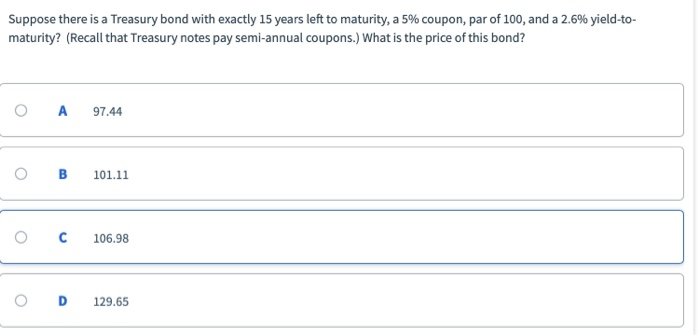

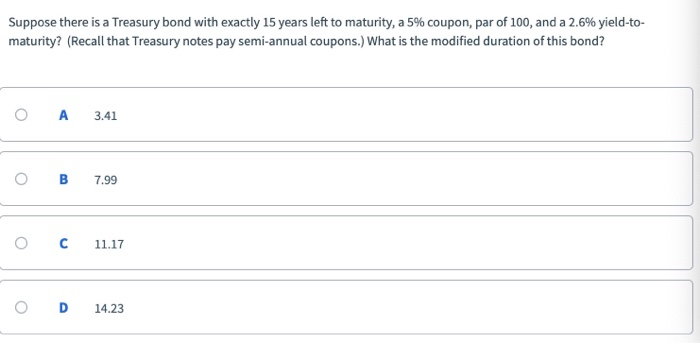

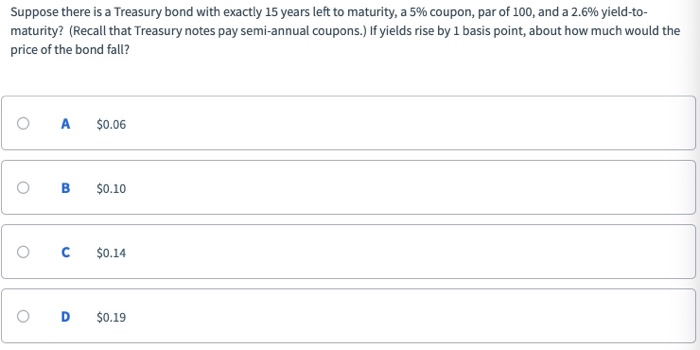

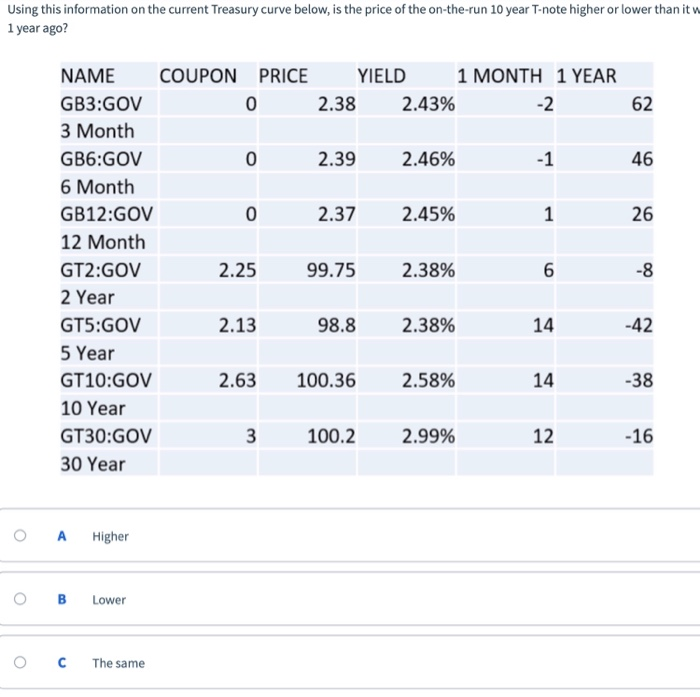

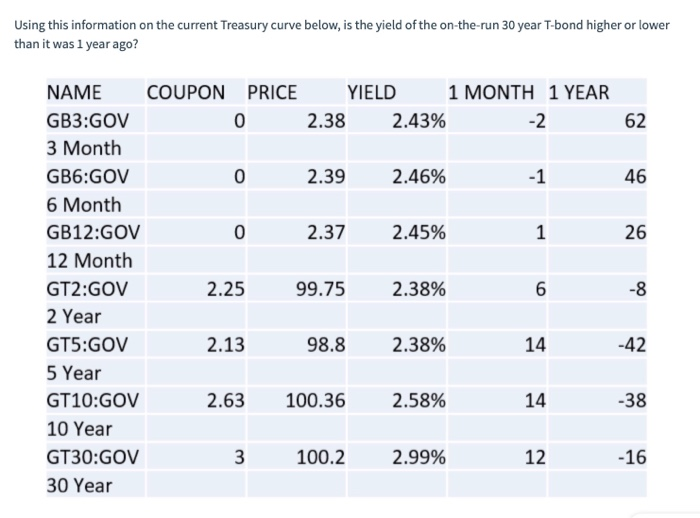

Suppose there is a Treasury bond with exactly 15 years left to maturity, a 5% coupon, par of 100, and a 2.6% yield-to- maturity? (Recall that Treasury notes pay semi-annual coupons.) What is the price of this bond? O A97.44 B 101.11 C 106.98 D 129.65 Suppose there is a Treasury bond with exactly 15 years left to maturity, a 5% coupon, par of 100, and a 2.6% yield-to- maturity? (Recall that Treasury notes pay semi-annual coupons.) What is the modified duration of this bond? O A3.41 7.99 O D 14.23 Suppose there is a Treasury bond with exactly 15 years left to maturity, a 5% coupon, par of 100, and a 2.6% yield-to- maturity? (Recall that Treasury notes pay semi-annual coupons,)Ifyields rise by 1 basis point,about how much would the price of the bond fall? O A$0.06 B $0.10 C $0.14 D $0.19 Using this information on the current Treasury curve below, is the price of the on-the-run 10 year T-note higher or lower than it w 1 year ago? YIELD 2.38 2.43% NAME COUPON GB3:GOV 3 Month GB6:GOV 6 Month GB12:GOV 12 Month GT2:GOV 2 Year GT5:GOV 5 Year GT10:GOV 10 Year GT30:GOV 30 Year PRICE 0 1 MONTH 1 YEAR 62 -2 2.46% 46 2.39 0 0 2.25 2.13 -1 2.37 2.45% 26 99.75 2.38% 6 -8 14 14 12 -42 98.8 2.38% 2.63 100.36 2.58% -38 -16 100.2 2.99% O A Higher O BLower C The same O A Higher B Lower C The same O D Not enough information Using this information on the current Treasury curve below, is the yield of the on-the-run 30 year T-bond higher or lower than it was 1 year ago? NAME COUPON GB3:GOV 3 Month GB6:GOV 6 Month GB12:GOV 12 Month GT2:GOV 2 Year GT5:GOV 5 Year GT10:GOV 10 Year GT30:GOV 30 Year PRICE 0 YIELD 1 MONTH 1 YEAR 2 2.43% 62 46 26 2.38 0 2.39 2.46% -1 0 2.37 2.45% 2.25 99.75 2.38% -8 -42 14 2.13 98.8 2.38% -38 14 2.63 100.36 2.58% 12 100.2 2.99% -16 O A Higher O B Lower C The same O D Not enough Info

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started