Answered step by step

Verified Expert Solution

Question

1 Approved Answer

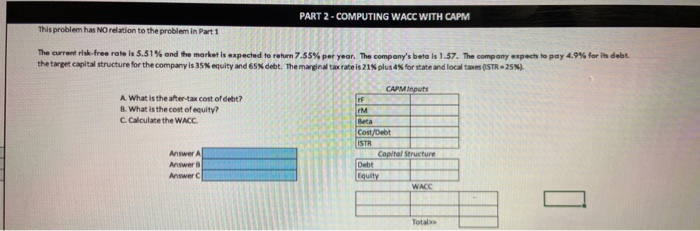

I mainly need all the table inputs on the right, another anonymous user posted the answers for the blue boxes. PART 2 -COMPUTING WACC WITH

I mainly need all the table inputs on the right, another "anonymous" user posted the answers for the blue boxes.

PART 2 -COMPUTING WACC WITH CAPM This problem has NO relation to the problem in Part 1 The current risk-free rate is 5.51% and the market is expected to return 7.55 per year. The company's beta is 1.57. The company expect to pay 4.9% for its debt the target capital structure for the company is equity and en debt. marginal tax rate is 21 plus en forstate and locales STR 25). CAPM Inputs A. What is the after-tax cost of debt? B. What is the cost of equity? calculate the WACC M Beta Cost/Debt Capital Structure Answer A Answers Answers DebtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started