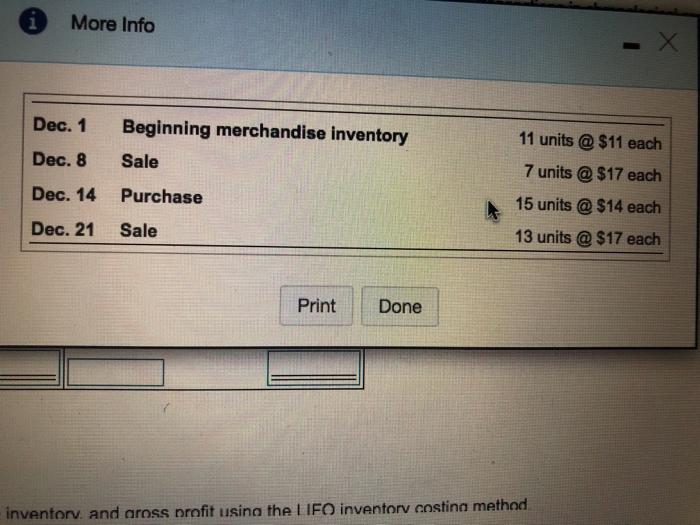

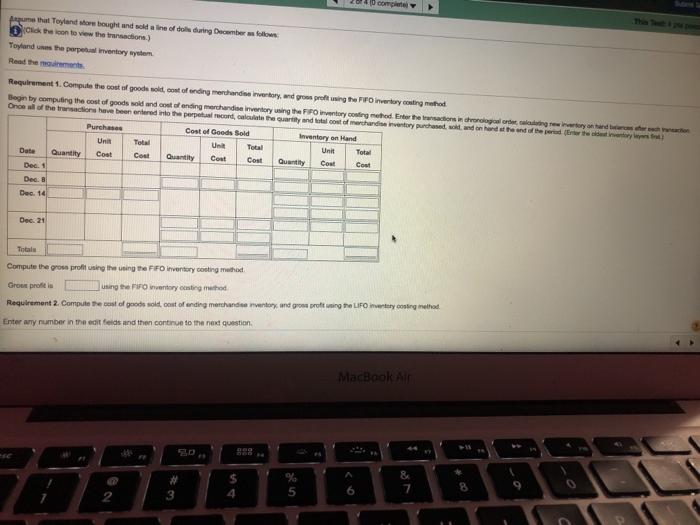

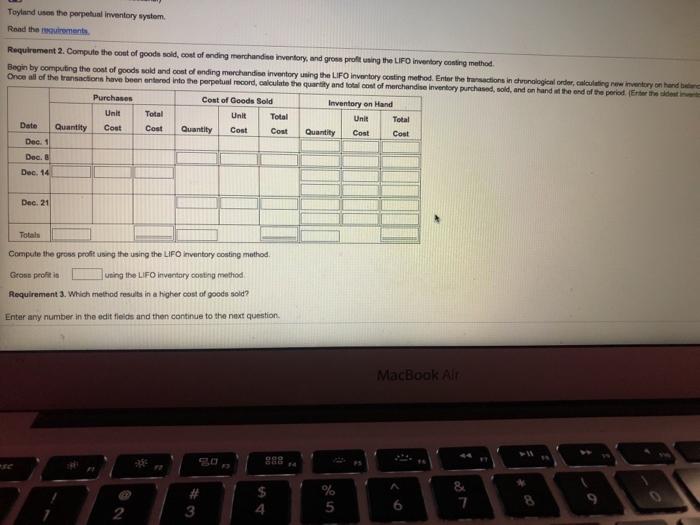

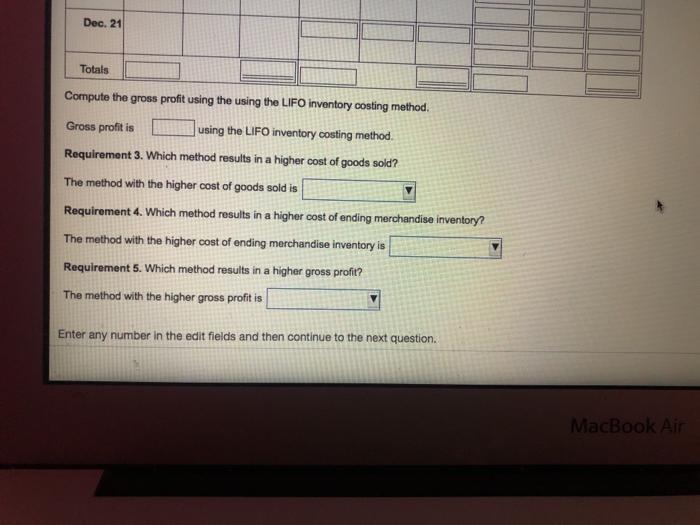

i More Info Dec. 1 Beginning merchandise inventory Dec. 8 Sale Dec. 14 Purchase 11 units @ $11 each 7 units @ $17 each 15 units @ $14 each 13 units @ $17 each Dec. 21 Sale Print Done inventorv. and aross profit using the LIFO inventory costing method 0 comme use that Toyland or band sold a line of dole during December follow Click the loon to view the transaction) Yoyards the perpentry wystem Read the Requirement 1. Compute the cost of goods sold, con fonding merchandienvertory, and from profusing the PFO invertory conting method Begin by computing the cost of goods sold and contending merchandienertoring the FIFO entory conting method.Enter the actions in order tory and reach the Once all of the trans have been entered in the preconcerty and cost of merchandise inventory purchased and on to the end of the per te Purchase Cost of Goods Sold Inventory on Hand Unit Total Une Total Unit Total Date Quantity Cost Cost Quantity Cout Cost Quantity Cost Cost Dec. 1 Dec Dec. 14 Dec. 21 Total Compute the gros profit using the using the FIFO inventory conting method Groot profit is using their writory casting method Requirement 2. Compute the cost of goods sold cost of ending merchandisentory and profit using the LIFO mentory costing ind Enter any number in the edit fields and then continue to the next question MacBook Air 4 5 6. 8 Toyland use the perpetual Inventory system Read the airments Requirement 2. Compute the cost of goods sold cost of ending merchandise inventory, and gross profit using the LIFO inventory conting method Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in onological order, calculating new inventory on hand be Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise Inventory purchased, sold, and on hand the end of the periode the Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Dec. 1 Dec. Dec, 14 Dec. 21 Totals Compute the gross profit using the using the LIFO inventory conting method Gross profit is using the LIFO inventory costing method Requirement 3. Which method results in a higher cost of goods sold? Enter any number in the edit fields and then continue to the next question MacBook Air 888 # 3 $ 4 7 2 5 Dec. 21 Totals Compute the gross profit using the using the LIFO inventory costing method, Gross profit is using the LIFO inventory costing method. Requirement 3. Which method results in a higher cost of goods sold? The method with the higher cost of goods sold is Requirement 4. Which method results in a higher cost of ending merchandise inventory? The method with the higher cost of ending merchandise inventory is Requirement 5. Which method results in a higher gross profit? The method with the higher gross profit is Enter any number in the edit fields and then continue to the next question. MacBook Air