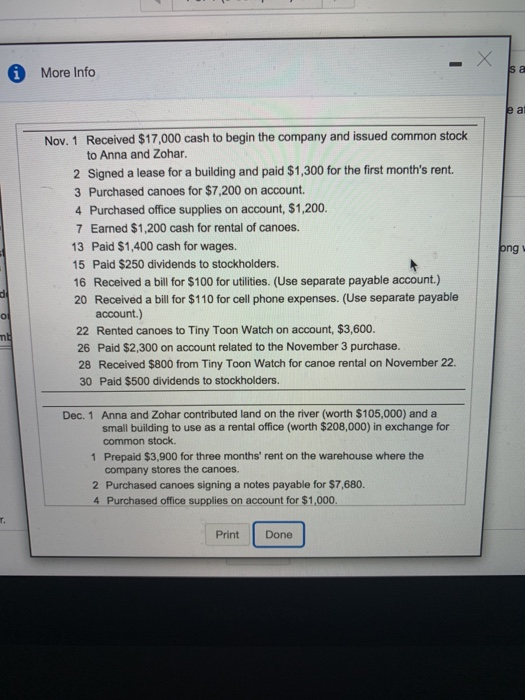

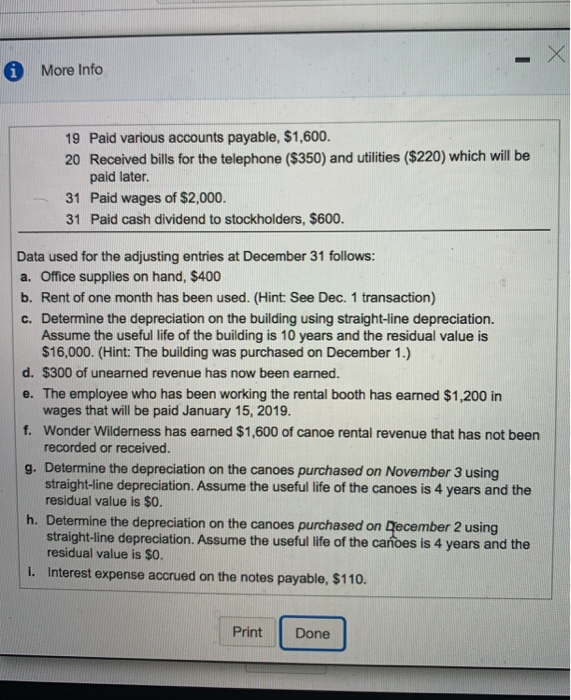

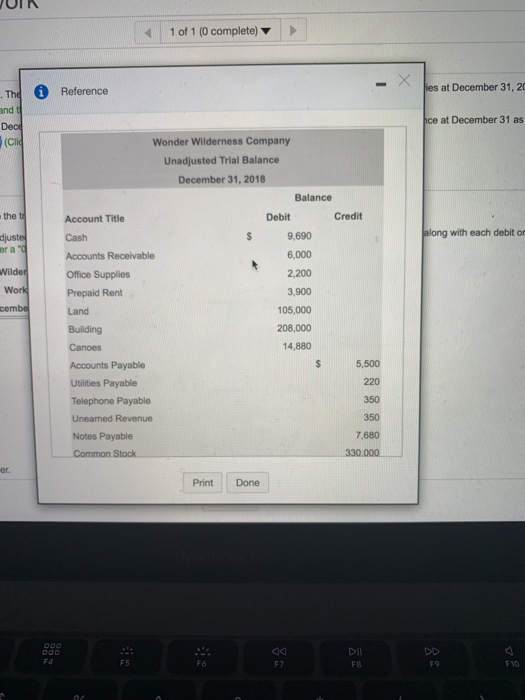

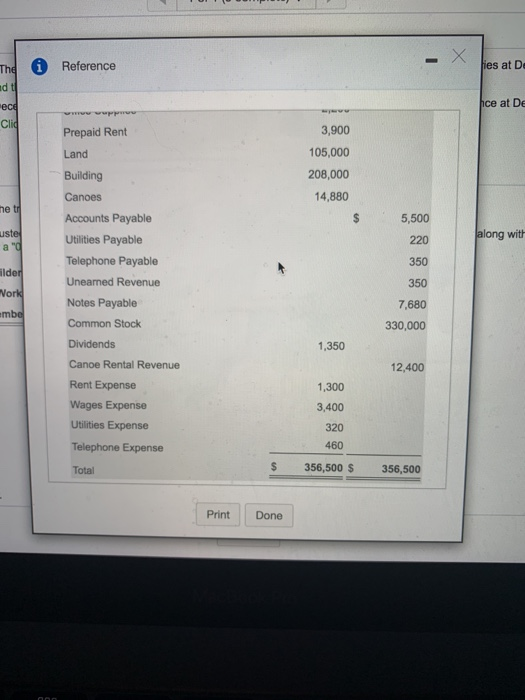

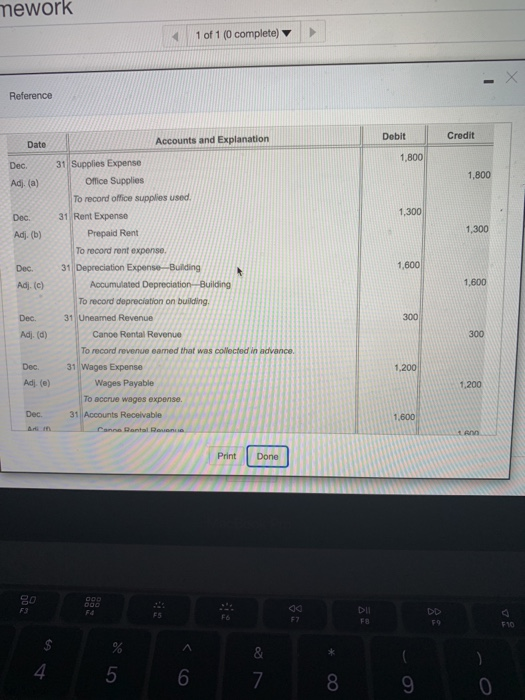

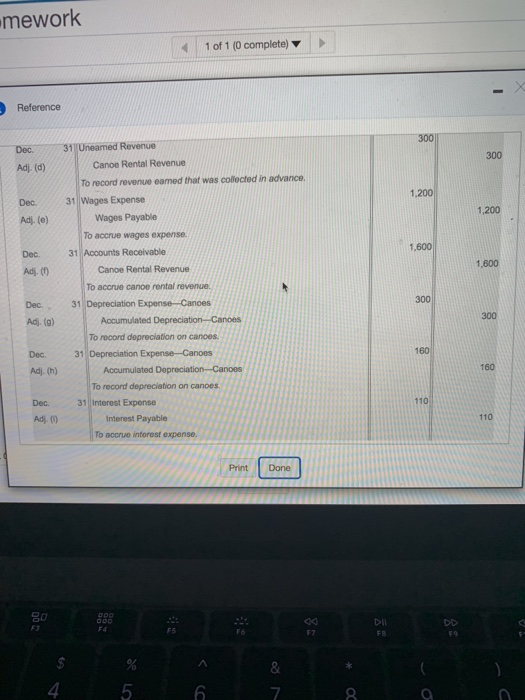

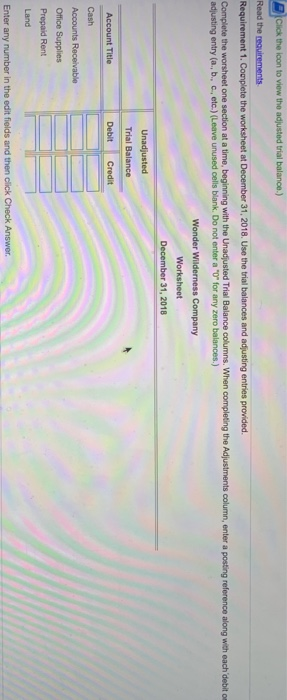

i More Info is Nov. 1 Received $17,000 cash to begin the company and issued common stock to Anna and Zohar. 2 Signed a lease for a building and paid $1,300 for the first month's rent. 3 Purchased canoes for $7,200 on account. 4 Purchased office supplies on account, $1,200. 7 Earned $1,200 cash for rental of canoes. 13 Paid $1,400 cash for wages. 15 Paid $250 dividends to stockholders. 16 Received a bill for $100 for utilities. (Use separate payable account.) 20 Received a bill for $110 for cell phone expenses. (Use separate payable account.) 22 Rented canoes to Tiny Toon Watch on account, $3,600. 26 Paid $2,300 on account related to the November 3 purchase. 28 Received $800 from Tiny Toon Watch for canoe rental on November 22. 30 Paid $500 dividends to stockholders. Dec. 1 Anna and Zohar contributed land on the river (worth $105,000) and a small building to use as a rental office (worth $208,000) in exchange for common stock. 1 Prepaid $3,900 for three months' rent on the warehouse where the company stores the canoes. 2 Purchased canoes signing a notes payable for $7,680. 4 Purchased office supplies on account for $1,000 Print Done C More Info 19 Paid various accounts payable, $1,600. 20 Received bills for the telephone ($350) and utilities ($220) which will be paid later. 31 Paid wages of $2,000. 31 Paid cash dividend to stockholders, $600. Data used for the adjusting entries at December 31 follows: a. Office supplies on hand, $400 b. Rent of one month has been used. (Hint: See Dec. 1 transaction) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is 10 years and the residual value is $16,000. (Hint: The building was purchased on December 1.) d. $300 of unearned revenue has now been earned. e. The employee who has been working the rental booth has earned $1,200 in wages that will be paid January 15, 2019. f. Wonder Wilderness has earned $1,600 of canoe rental revenue that has not been recorded or received. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is 4 years and the residual value is $0. h. Determine the depreciation on the canoes purchased on December 2 using straight-line depreciation. Assume the useful life of the canoes is 4 years and the residual value is $0. I. Interest expense accrued on the notes payable, $110. Print Done JUIK 1 of 1 (0 complete) - A les at December 31, 20 0 Reference The and to Deco (CO pce at December 31 as -thet along with each debitor djuste er a "g Wilder Work cembe Wonder Wilderness Company Unadjusted Trial Balance December 31, 2018 Balance Account Title Debit Credit Cash 9,690 Accounts Receivable 6,000 Office Supplies 2,200 Prepaid Rent 3,900 Land 105,000 Building 208,000 Canoes 14,880 Accounts Payable 5,500 Utilities Payable Telephone Payable Unearned Revenue 350 Notes Payable 7,680 Common Stock 330.000 220 350 Print Done DD G The i Reference jes at De ndt ece hice at De Prepaid Rent Land 3,900 105,000 208,000 14,880 Building Canoes me to uste along with a "g filder 5,500 220 350 350 7,680 330,000 "Vork embe Accounts Payable Utilities Payable Telephone Payable Uneamed Revenue Notes Payable Common Stock Dividends Canoe Rental Revenue Rent Expense Wages Expense Utilities Expense 1,350 12,400 1,300 3,400 320 460 Telephone Expense Total 356,500 $ 356,500 Print Done mework 1 of 1 (0 complete) Reference Accounts and Explanation Debit Date Credit 1,800 Dec. Adj. (a) 1,800 31 Supplies Expense Oflice Supplies To record office supplies used. 31 Rent Expense Prepaid Rent 1,300 Dec Adj. (b) 1,300 1,600 Dec. Adj. (c) 1,600 300 Dec. Adj. (d) To record rent expense. 31 Depreciation Expense-Building Accumulated Depreciation--Building To record depreciation on building, 31 Uneamed Revenue Canoe Rental Revenue To record revenue eamed that was collected in advance 31 Wages Expense Wages Payable To accrue wages expense. 31 Accounts Receivable Canna Bantal Rouen 300 1,200 Dec. Adj. (c) 1.200 Dec. 1,600 4 5 6 7 8 9 0 mework 1 of 1 (0 complete) Reference 300 Dec. Adj. (d) 300 1,200 Dec 1,200 Adj. (0) 1,600 Dec. Adj.) 1,600 31 Uneamed Revenue Canoe Rental Revenue To record revenue eamed that was collected in advance. 31 Wages Expense Wages Payable To accrue wages expense. 31 Accounts Receivable Canon Rental Revenue To accrue canoe rental revenue. 31 Depreciation Expense--Canoes Accumulated Depreciation-Canoes To record depreciation on canoes. 31 Depreciation Expense-Canoes Accumulated Depreciation-Canoes To record depreciation on canoes. 31 Interest Expense Interest Payable To accrue interest expense. 300 Dec. Adj. (g) Dec. Adj. (h) 160 Dec. Adj. 110 Print Done Click the icon to view the adjusted trial balance.) Read the requirements Requirement 1. Complete the worksheet at December 31, 2018. Use the trial balances and adjusting entries provided. Complete the worsheet one section at a time, beginning with the Unadjusted Trial Balance columns. When completing the Adjustments column, enter a posting reference along with each debito adjusting entry (a, b, c, etc.) (Leave unused cells blank. Do not enter a o for any zero balances.) Wonder Wilderness Company Worksheet December 31, 2018 Unadjusted Trial Balance Account Title Debit Credit Cash Accounts Receivable Office Supplies Prepaid Rent Land Enter any number in the edit fields and then click Check