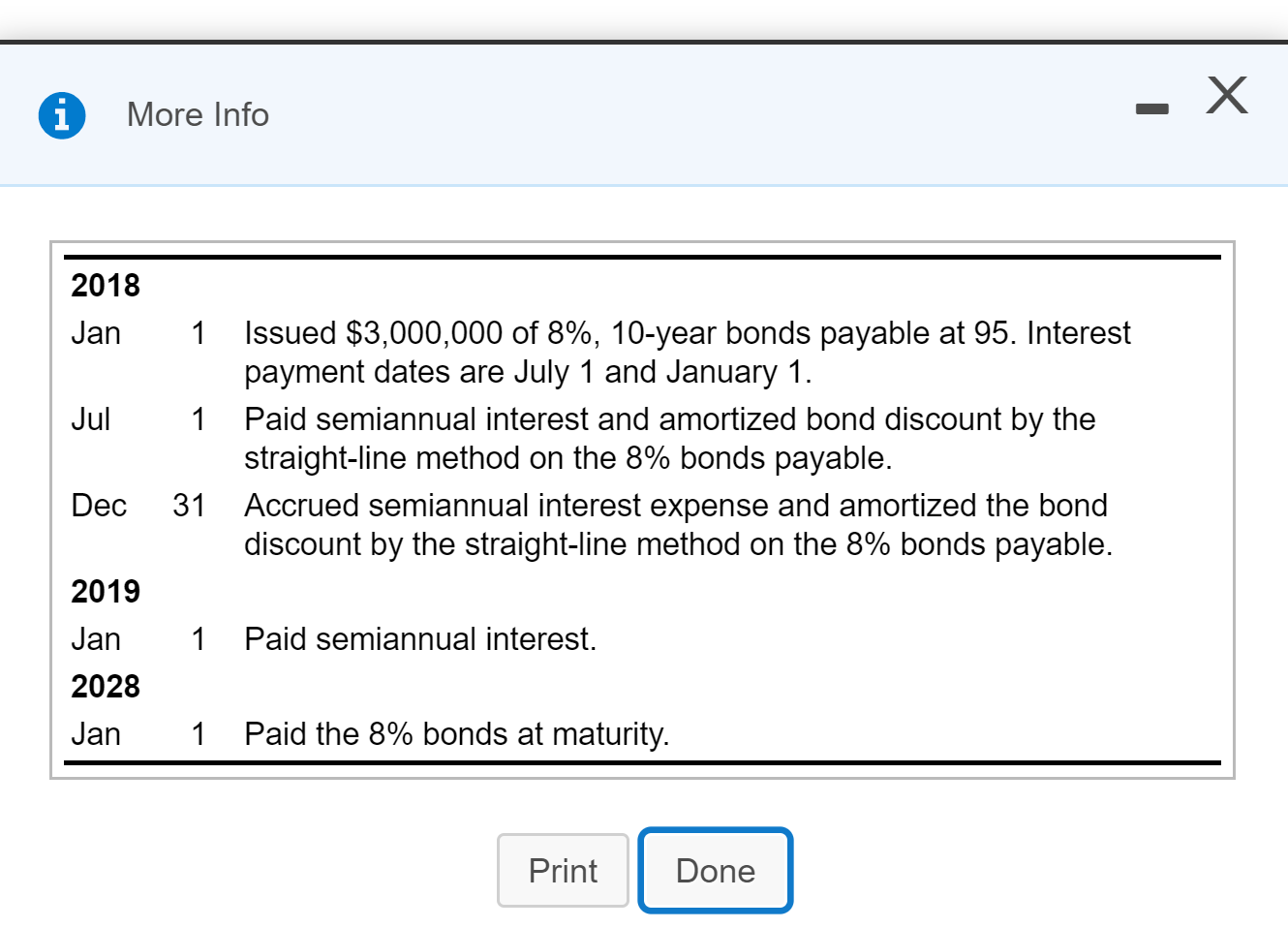

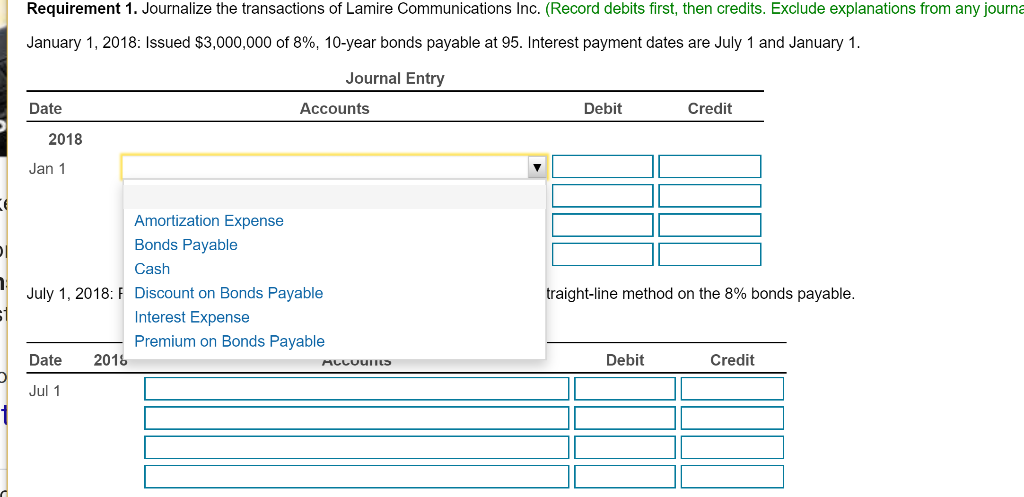

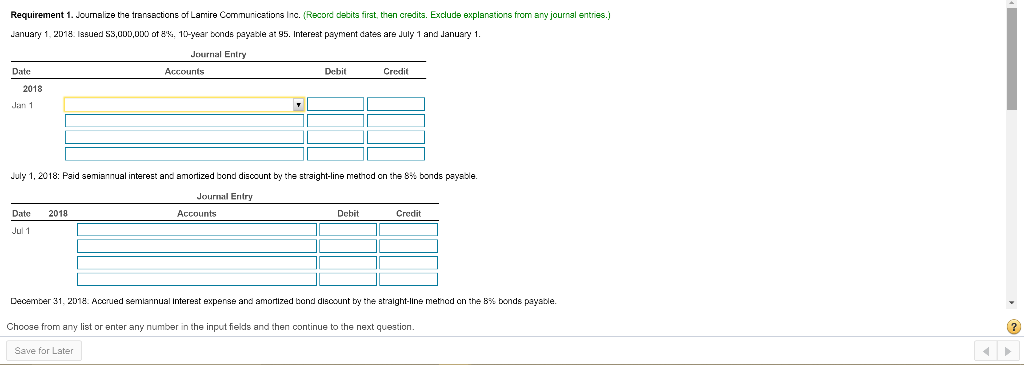

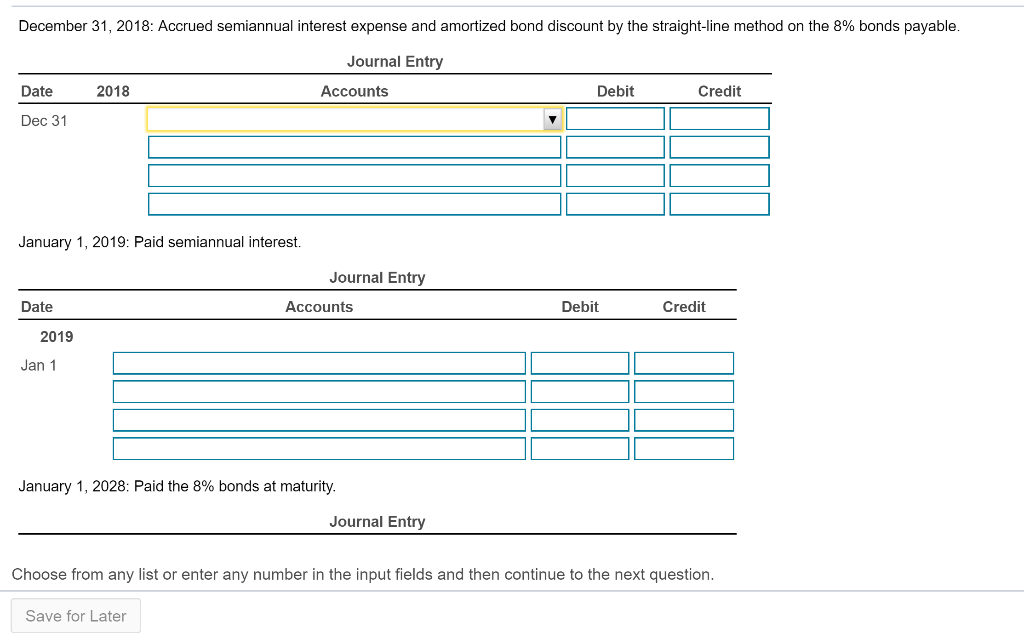

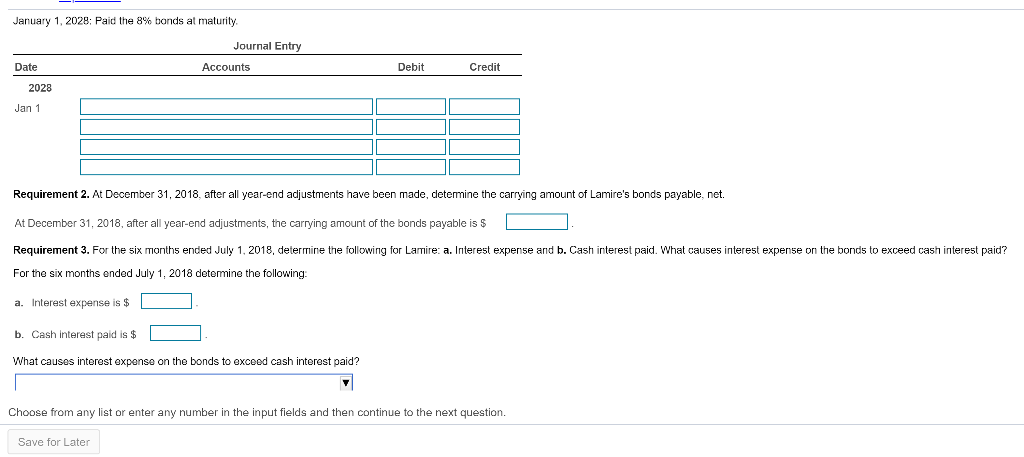

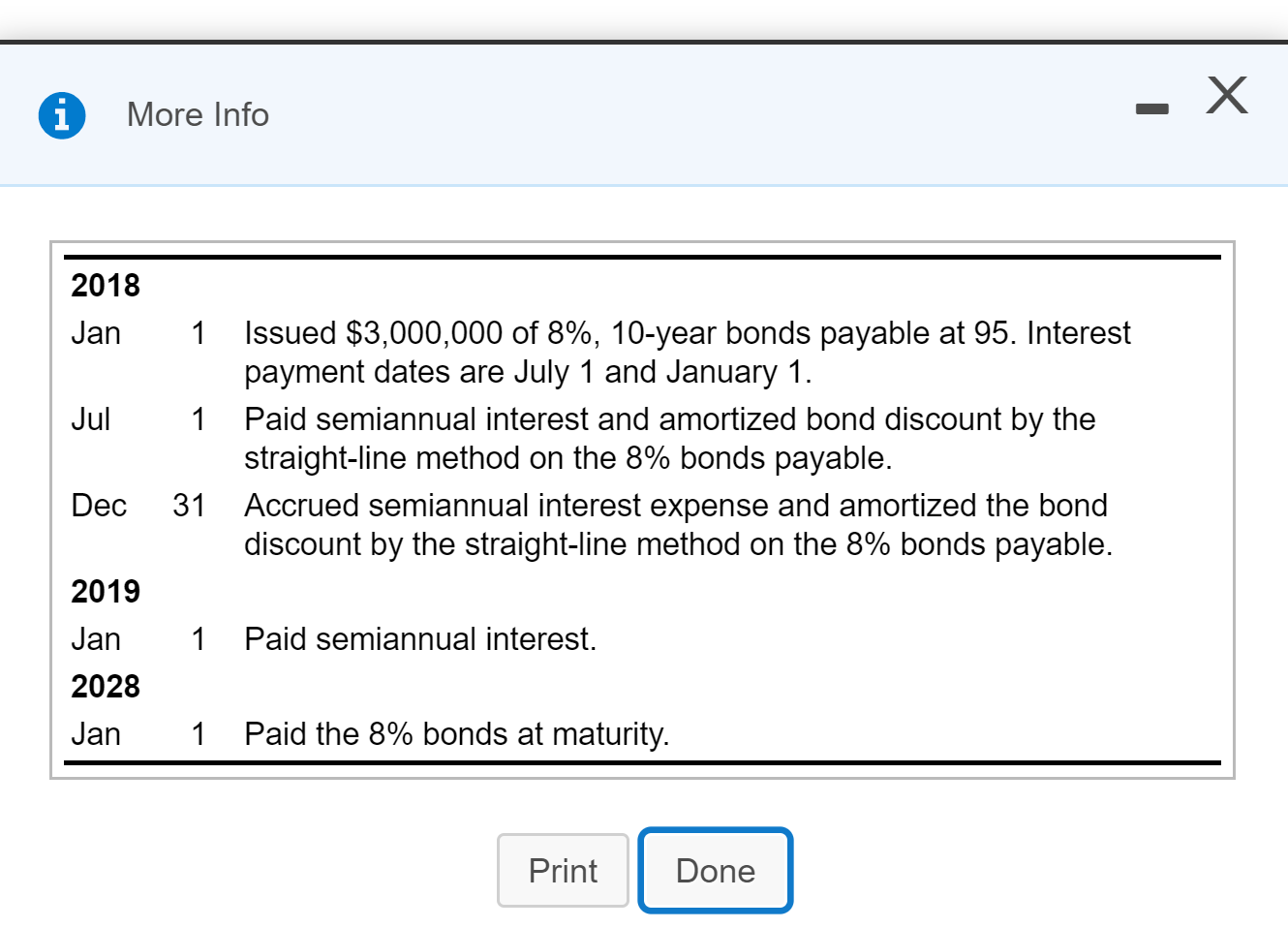

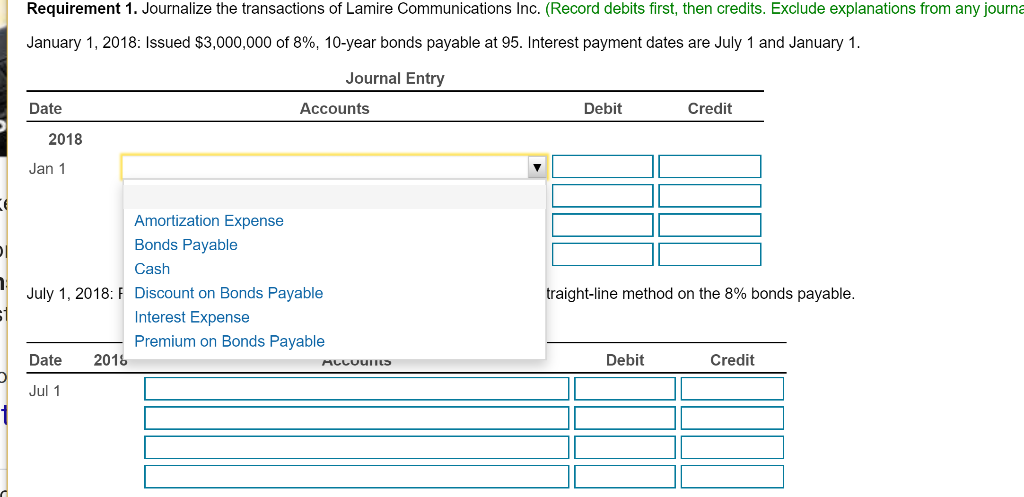

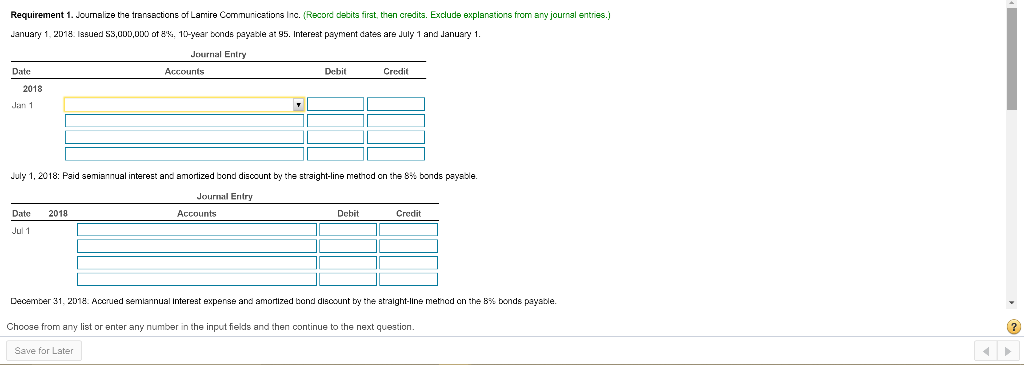

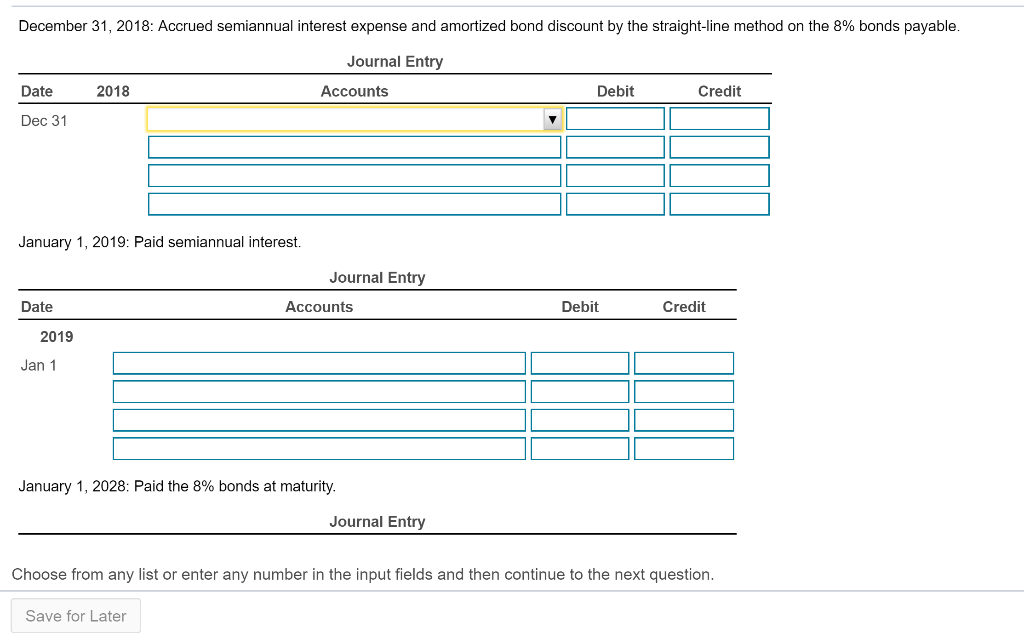

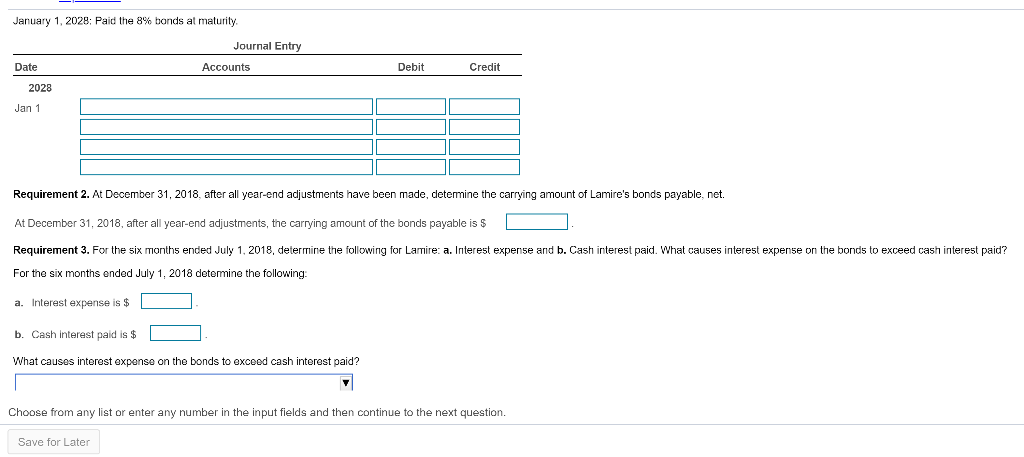

i More Info - X 2018 Jan Jul 1 Issued $3,000,000 of 8%, 10-year bonds payable at 95. Interest payment dates are July 1 and January 1. 1 Paid semiannual interest and amortized bond discount by the straight-line method on the 8% bonds payable. 31 Accrued semiannual interest expense and amortized the bond discount by the straight-line method on the 8% bonds payable. Dec 1 Paid semiannual interest. 2019 Jan 2028 Jan 1 Paid the 8% bonds at maturity. Print Done Requirement 1. Journalize the transactions of Lamire Communications Inc. (Record debits first, then credits. Exclude explanations from any journa January 1, 2018: Issued $3,000,000 of 8%, 10-year bonds payable at 95. Interest payment dates are July 1 and January 1. Journal Entry Date Accounts Debit Credit 2018 Jan 1 Amortization Expense Bonds Payable Cash July 1, 2018: F Discount on Bonds Payable Interest Expense Premium on Bonds Payable Date 2016 traight-line method on the 8% bonds payable. MULUUTILS Debit Credit Jul 1 Requirement 1. Journalize the transactions of Lamire Communications Inc. (Record decits first, then credits. Exclude explanations from any journal entries. January 1, 2018. Issued S3,000,000 of 8%. 10-year bonds payable at 95. Interest payment dates are July 1 and January 1, Journal Entry Accounts Debit Credit Date 2018 Jan 1 July 1, 2018: Paid semiannual interest and amortized bond discount by the straight-line method on the 8% bonds payable Journal Entry Date 2018 Accounts Dcbit Credit Jul 1 December 31, 2018. Accrued semiannual interest expense and amortized band discount by the straight-line method on the 8% bonds payable. Choose from any list or enter any number in the input fields and then continue to the next question Save for Later December 31, 2018: Accrued semiannual interest expense and amortized bond discount by the straight-line method on the 8% bonds payable. Journal Entry Accounts Date 2018 Debit Credit Dec 31 January 1, 2019: Paid semiannual interest. Journal Entry Date Accounts Debit Credit 2019 Jan 1 January 1, 2028: Paid the 8% bonds at maturity. Journal Entry Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later January 1, 2028: Paid the 8% bonds at malurily. Journal Entry Date Accounts Debit Credit 2028 Jan 1 Requirement 2. At December 31, 2018, after all year-end adjustments have been made, determine the carrying amount of Lamire's bonds payable, net. At December 31, 2018, after all year-end adjustments, the carrying amount of the bonds payable is $ Requirement 3. For the six months ended July 1, 2018, determine the following for Lamire: a. Interest expense and b. Cash interest paid. What causes interest expense on the bonds to exceed cash interest paid? For the six months onded July 1, 2018 dotomine the following: a. Interest expense is $ . b. Cash interest paid is $ . What causes interest expense on the bonds to exceed cash interest paid? Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later