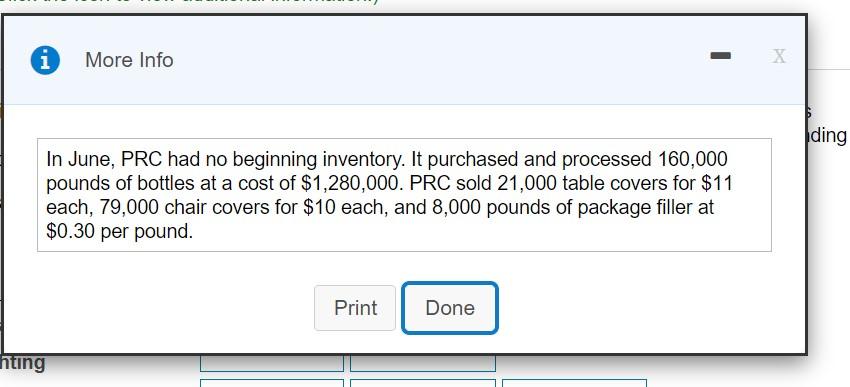

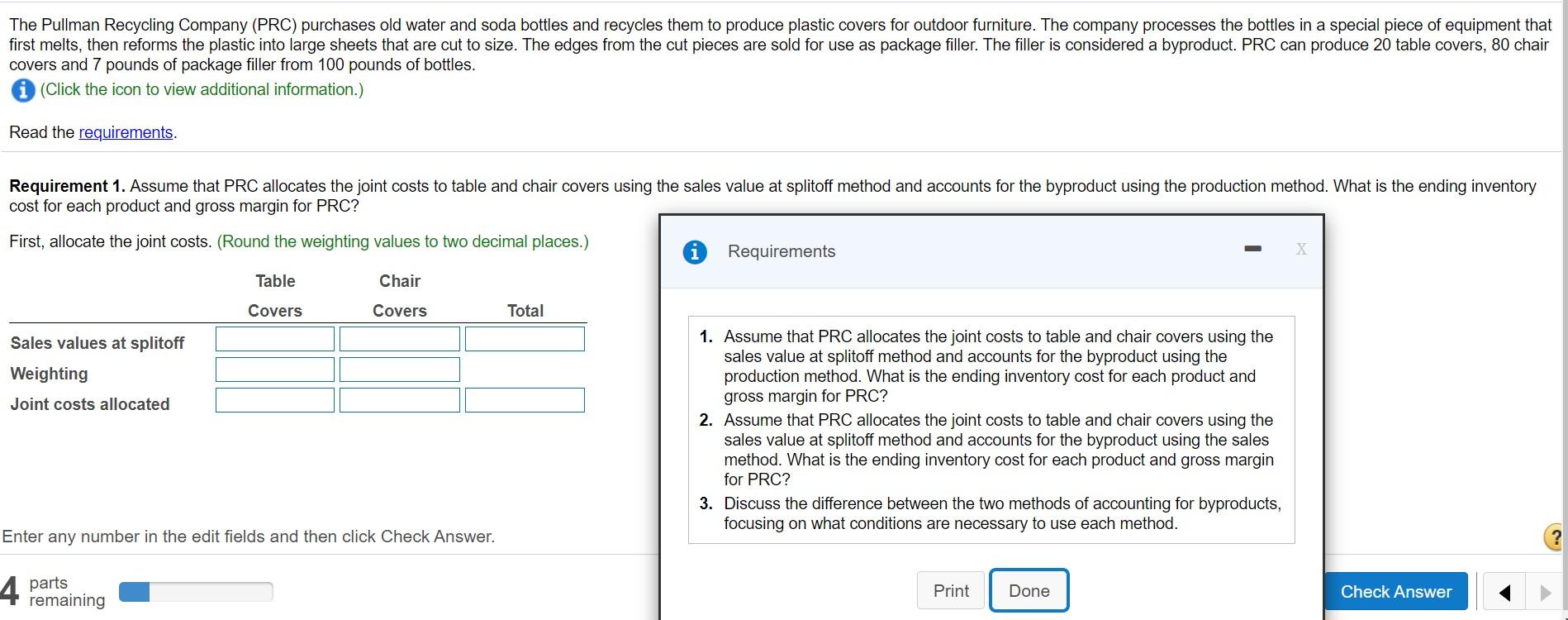

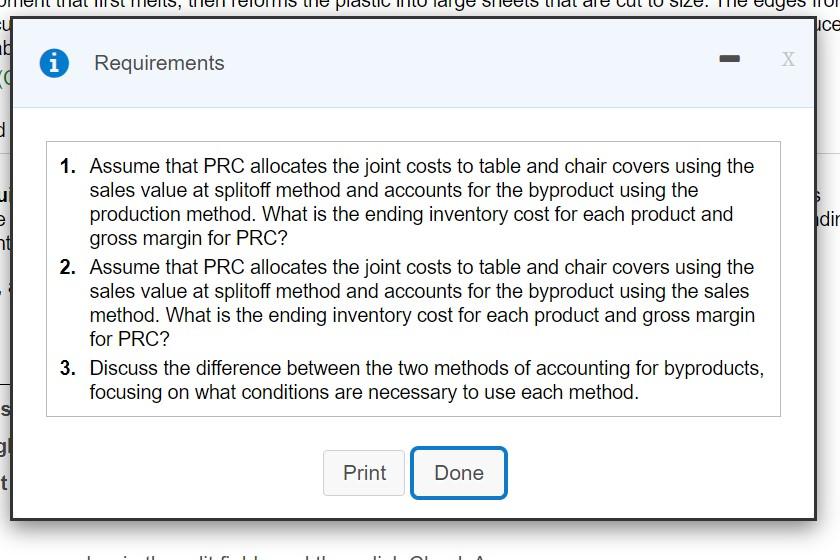

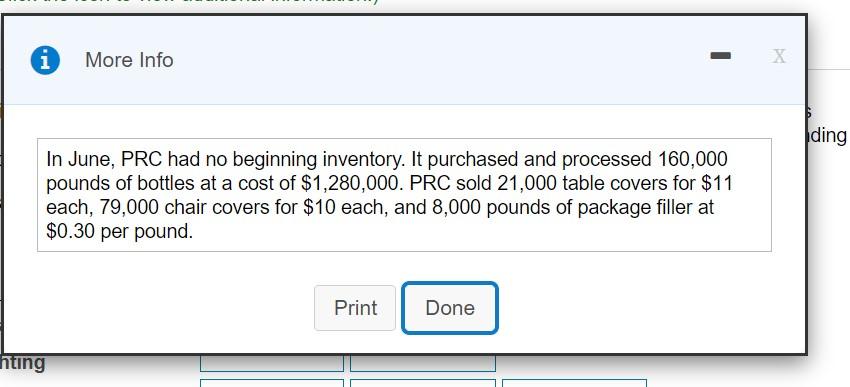

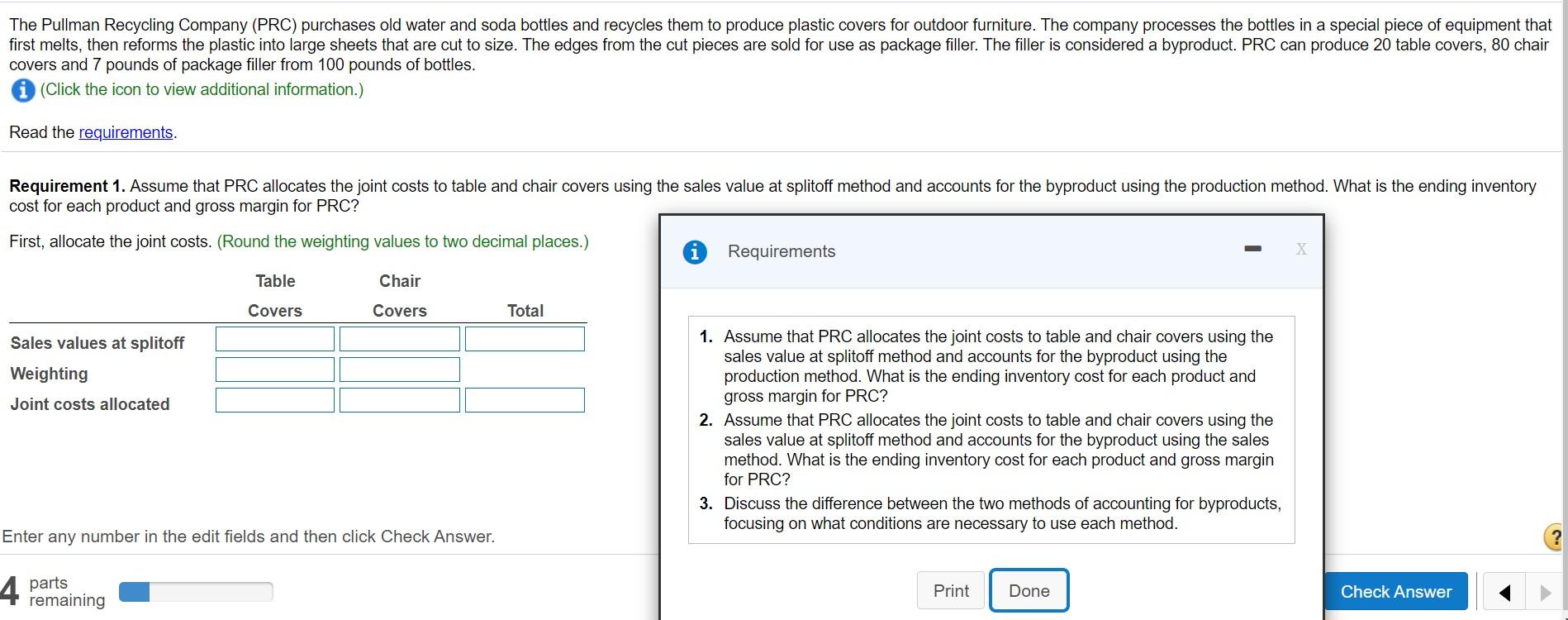

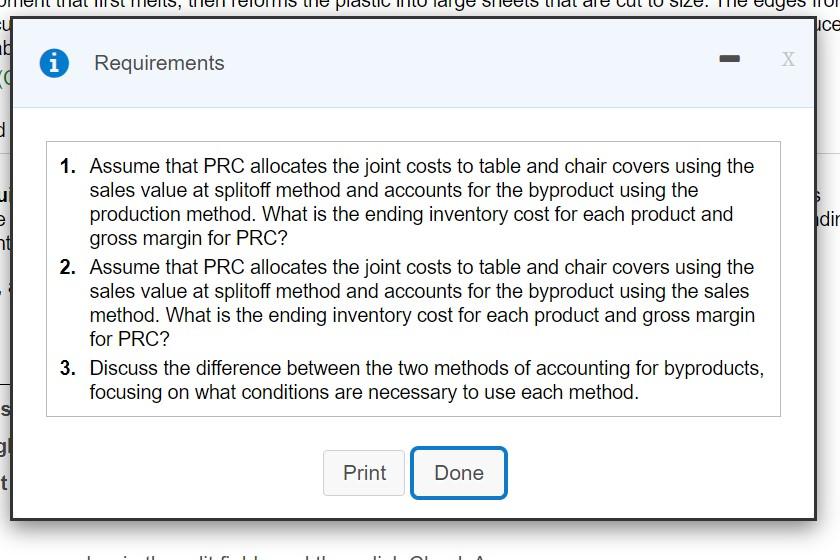

i More Info X ding In June, PRC had no beginning inventory. It purchased and processed 160,000 pounds of bottles at a cost of $1,280,000. PRC sold 21,000 table covers for $11 each, 79,000 chair covers for $10 each, and 8,000 pounds of package filler at $0.30 per pound. Print Done nting The Pullman Recycling Company (PRC) purchases old water and soda bottles and recycles them to produce plastic covers for outdoor furniture. The company processes the bottles in a special piece of equipment that first melts, then reforms the plastic into large sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filler is considered a byproduct. PRC can produce 20 table covers, 80 chair covers and 7 pounds of package filler from 100 pounds of bottles. (Click the icon to view additional information.) Read the requirements. Requirement 1. Assume that PRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the production method. What is the ending inventory cost for each product and gross margin for PRC? First, allocate the joint costs. (Round the weighting values to two decimal places.) Requirements - Table Chair Covers Covers Total Sales values at splitoff Weighting Joint costs allocated 1. Assume that PRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the production method. What is the ending inventory cost for each product and gross margin for PRC? 2. Assume that PRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the sales method. What is the ending inventory cost for each product and gross margin for PRC? 3. Discuss the difference between the two methods of accounting for byproducts, focusing on what conditions are necessary to use each method. Enter any number in the edit fields and then click Check Answer. ? 4 parts Print Done Check Answer remaining jice 16 i Requirements X e dir 1. Assume that PRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the production method. What is the ending inventory cost for each product and gross margin for PRC? 2. Assume that PRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the sales method. What is the ending inventory cost for each product and gross margin for PRC? 3. Discuss the difference between the two methods of accounting for byproducts, focusing on what conditions are necessary to use each method. si Print Done t