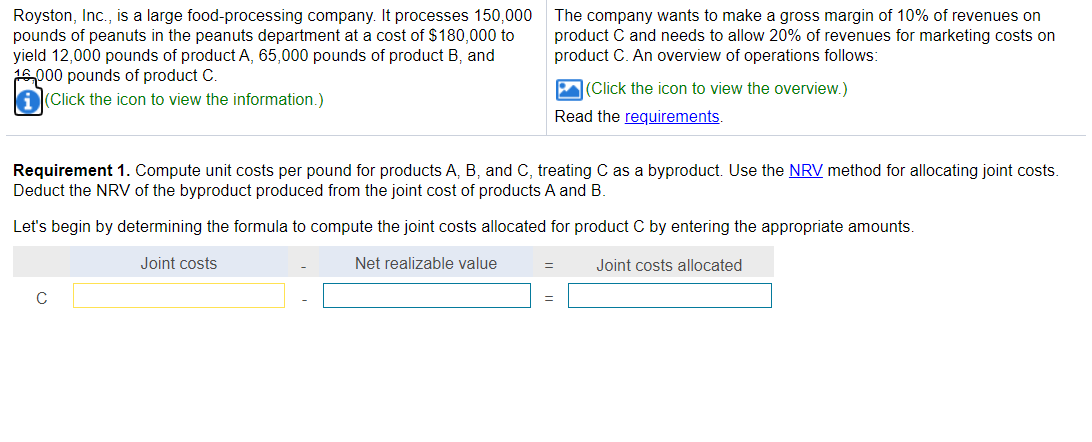

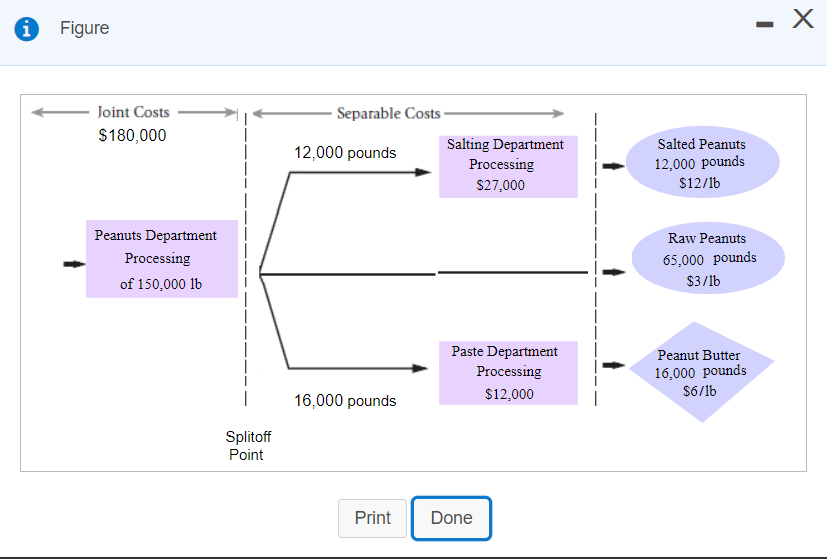

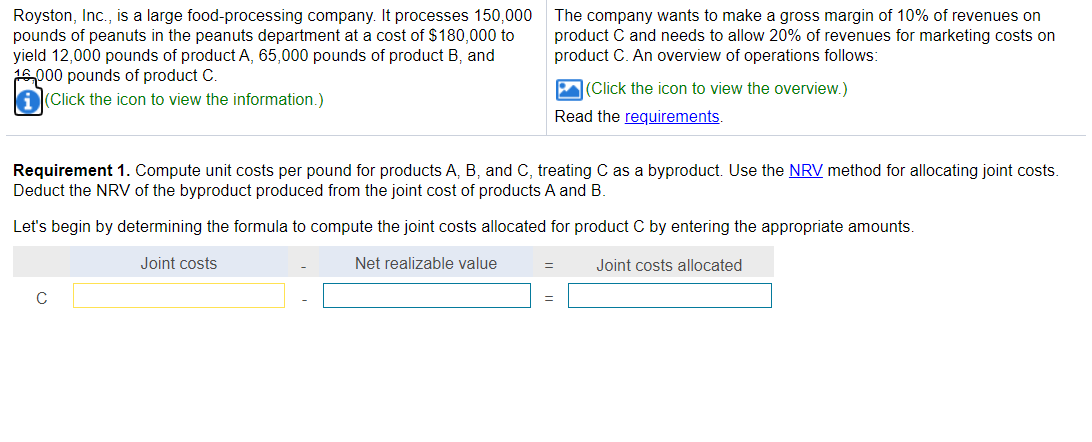

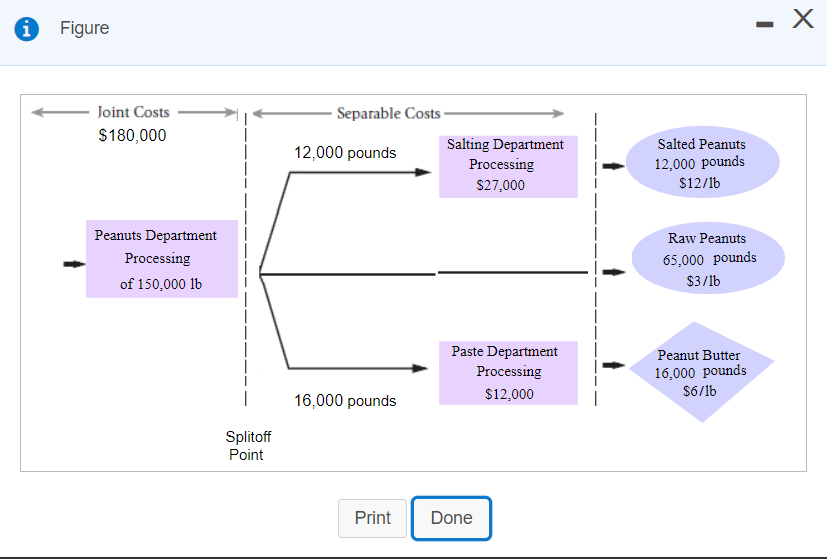

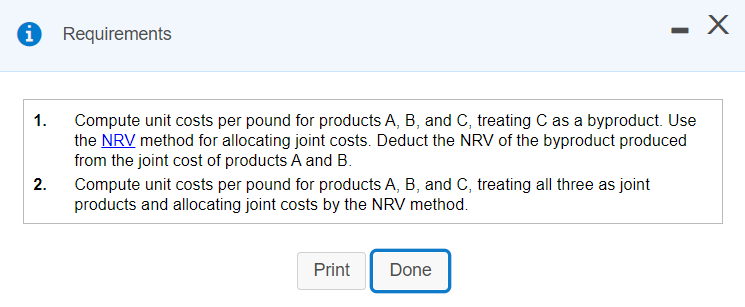

i More Info - X Product A is processed further in the salting department at a cost of $27,000. It yields 12,000 pounds of salted peanuts, which are sold for $12 per pound. Product B (raw peanuts) is sold without further processing at $3 per pound. Product C is considered a byproduct and is processed further in the paste department at a cost of $12,000. It yields 16,000 pounds of peanut butter, which are sold for $6 per pound. . Print Done Royston, Inc., is a large food-processing company. It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield 12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C. Click the icon to view the information.) The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows: Click the icon to view the overview.) Read the requirements. Requirement 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B. Let's begin by determining the formula to compute the joint costs allocated for product C by entering the appropriate amounts. Joint costs Net realizable value Joint costs allocated i - X Figure Joint Costs $180,000 Separable Costs 12,000 pounds Salting Department Processing $27,000 Salted Peanuts 12.000 pounds $12/16 Peanuts Department Processing of 150,000 16 Raw Peanuts 65,000 pounds $3/16 Paste Department Processing $12,000 Peanut Butter 16,000 pounds $6/16 16,000 pounds Splitoff Point Print Done i Requirements 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method. 2. Print Done i More Info - X Product A is processed further in the salting department at a cost of $27,000. It yields 12,000 pounds of salted peanuts, which are sold for $12 per pound. Product B (raw peanuts) is sold without further processing at $3 per pound. Product C is considered a byproduct and is processed further in the paste department at a cost of $12,000. It yields 16,000 pounds of peanut butter, which are sold for $6 per pound. . Print Done Royston, Inc., is a large food-processing company. It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield 12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C. Click the icon to view the information.) The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows: Click the icon to view the overview.) Read the requirements. Requirement 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B. Let's begin by determining the formula to compute the joint costs allocated for product C by entering the appropriate amounts. Joint costs Net realizable value Joint costs allocated i - X Figure Joint Costs $180,000 Separable Costs 12,000 pounds Salting Department Processing $27,000 Salted Peanuts 12.000 pounds $12/16 Peanuts Department Processing of 150,000 16 Raw Peanuts 65,000 pounds $3/16 Paste Department Processing $12,000 Peanut Butter 16,000 pounds $6/16 16,000 pounds Splitoff Point Print Done i Requirements 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method. 2. Print Done