Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I n order t o complete the case analysis successfully, you must Project Technology / Assigned Name Fair Value Current identify the role you are

order complete the case analysis successfully, you must Project TechnologyAssigned Name Fair Value Current

identify the role you are playing;

assess the financial reporting landscape, considering the user needs, constraints, and business environment;

identify the issues;

analyze the issues and quantitatively; and

provide a recommendation and conclusion.

Rosetta Inc.

Rosetta Inc. a new corporation that just acquired the assets unincorporated technology business September from Jess Stone. Extracts from the purchase and sale agreement entered into and Jess Stone are provided Exhibit I. owned three shareholders: Carlos Guevara, the CEO who owns the shares ; and two investors, who each own the shares. Jess Stone not a shareholder

Exhibit

Extracts from the Purchase and Sale Agreement Between and Jess Stone

Purchase and Sale the Business Assets Jess Stone

will purchase the technology and the research findings Jess Stone September

agrees purchase the equipment owned Jess Stone September

Jess Stone agrees responsible for all liabilities September

Purchase and Sale Price

will pay Jess Stone amount $ million for the technology and the research findings

agrees pay Jess Stone the appraised value $ for the equipment

Contingent Consideration

agrees pay Jess Stone amount equal net income accordance with generally accepted accounting principles excess $ for the fiscal year ending August

Employment Contract with Jess Stone

and Jess Stone agree enter into a twoyear employment contract, and agrees pay Jess Stone annual salary $

Jess Stone agrees that all research findings during the employment are the property

Jess Stone developed new touch screen technology but lacked the financial resources necessary benefit commercially from this technology. The touch screen technology far superior the current technology and has many potential uses, ranging from mobile devices, computer screens, and laptops.

put the technology purchased work immediately entering into a licensing agreement with Mica Inc. addition, has developed a new computer monitor with the touch screen and entered into agreement with Ferrous Inc. distribute the technology.

Exhibit

Extracts from the Licensing Agreement Between and MICA Inc.

Licensing Arrangement

agrees provide Mica the exclusive right use the touch screen technology referred FeldsparX for a term three years commencing December

agrees deliver the technology Mica December

Mica agrees pay a licensing fee the amount $ with the first payment $ due December ; and agrees make payments the amount $ plus interest $ December and $ plus interest $ December

Royalty

Mica agrees pay a royalty fee the amount the gross margin accordance with generally accepted accounting principles realized Mica from sales goods that use the FeldsparX technology

Mica agrees provide a quarterly statement gross margin realized Mica that subject the royalty payable

its representative, has the right access the records and information Mica necessary audit the gross margin reported Mica

You, CPA, have been recently employed the special assistant Carlos Guevara. July Carlos calls you into his office and says has assignment for you:

"The financial statements for the fiscal year ending August are required audited. I want you address the significant financial accounting issues pertaining the preparation RI's financial statements for its first fiscal year ending August and provide your recommendations the accounting treatments used."

you leave Carlos's office, provides you with a file that includes some additional information about the operations III

Exhibit III

Information Obtained About the Operations

Licensing Arrangement with Mica

Revenue the amount $ has been recognized the accounting records

Royalty revenue the amount $ has been recognized the accounting records based a gross margin $ reported Mica for the six months from December May

Mica a financially sound entity

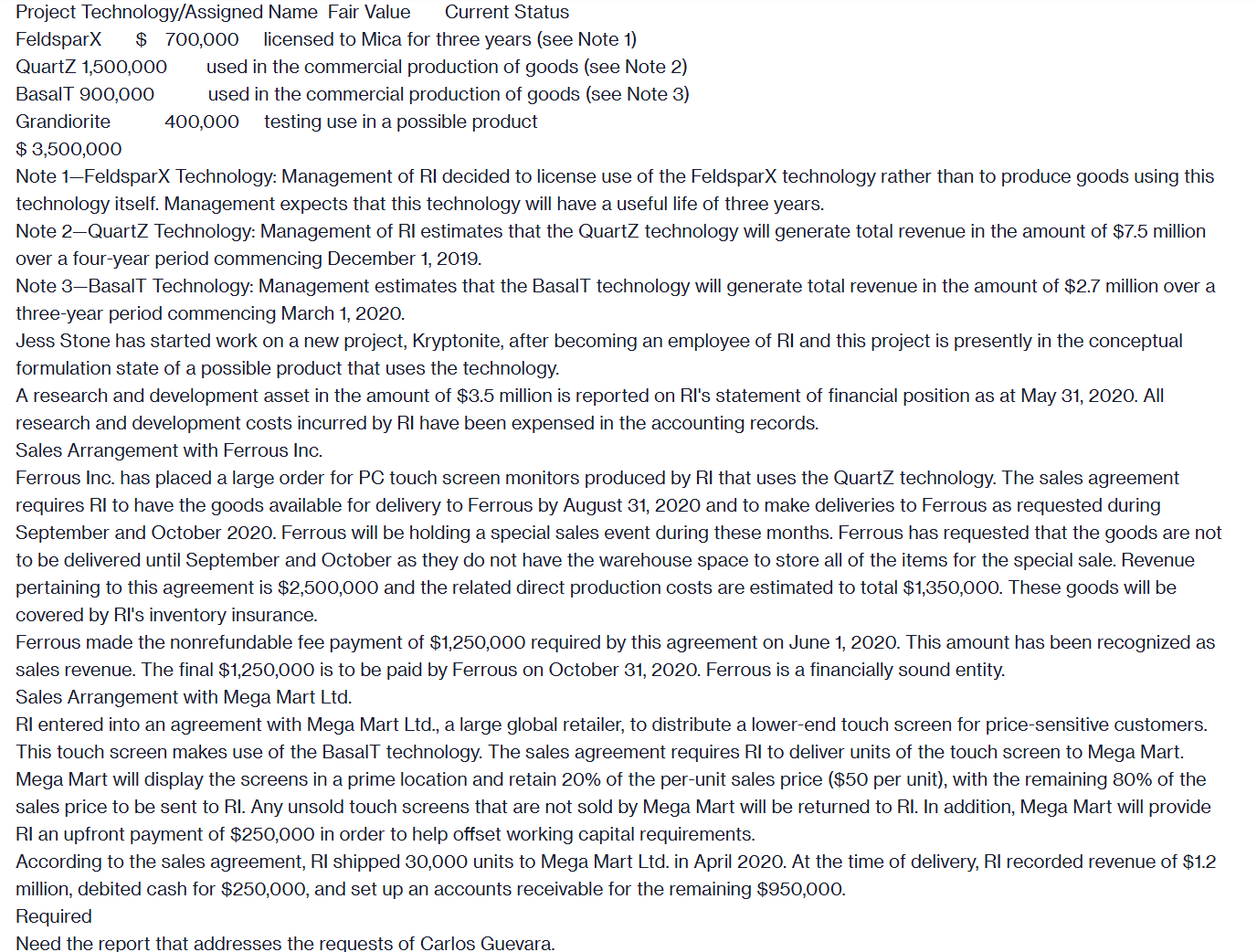

Research and Development

acquired the following technology and research findings from Jess Stone:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started