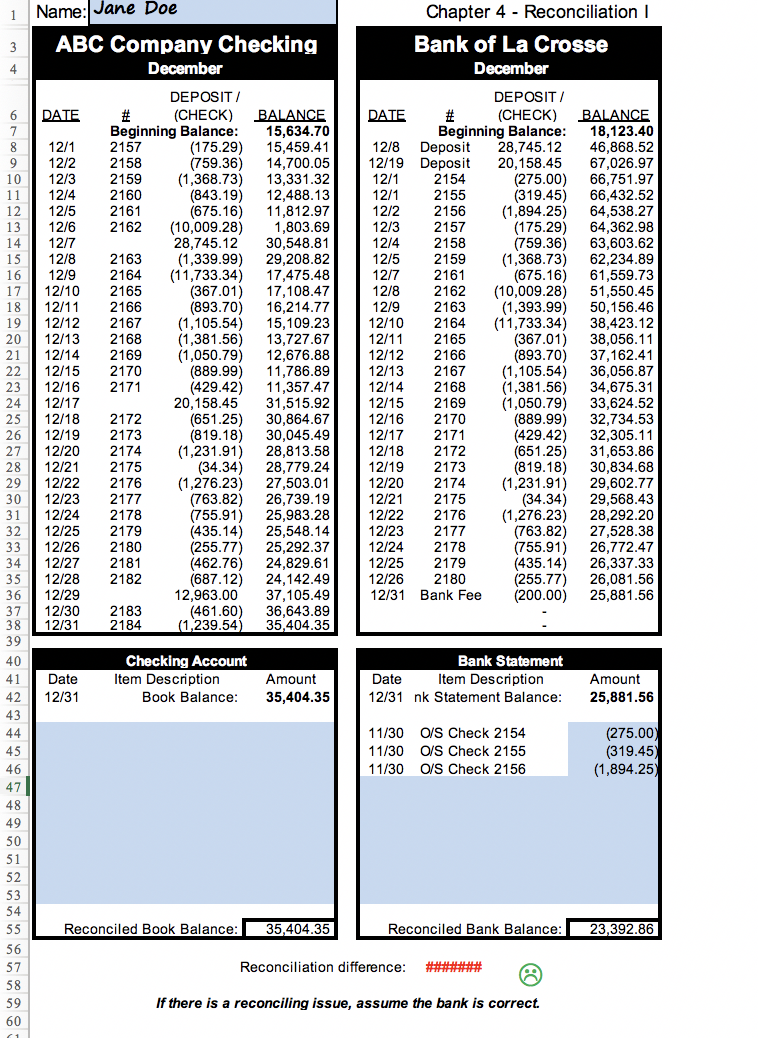

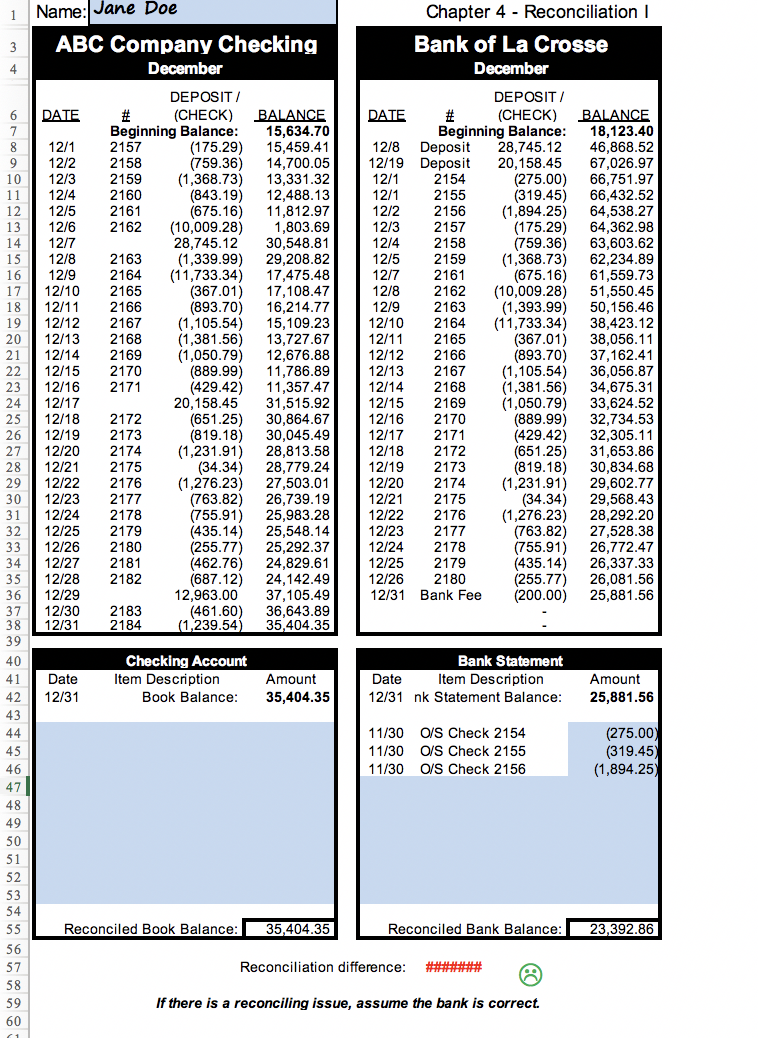

i Name: Jane Doe ABC Company Checking December DEPOSIT / DATE (CHECK) BALANCE Beginning Balance: 15,634.70 12/1 2157 (175.29) 15,459.41 12/2 2158 (759.36) 14,700.05 12/3 2159 (1,368.73) 13,331.32 12/4 2160 (843.19) 12,488.13 12/5 2161 (675.16) 11,812.97 12/6 2162 (10,009.28) 1,803.69 12/7 28,745.12 30,548.81 12/8 2163 (1,339.99) 29,208.82 12/9 2164 (11,733.34) 17,475.48 12/10 2165 (367.01) 17,108.47 12/11 2166 (893.70) 16,214.77 12/12 2167 (1,105.54) 15,109.23 12/13 2168 (1,381.56) 13,727.67 12/14 2169 (1,050.79) 12,676.88 12/15 2170 (889.99) 11,786.89 12/16 2171 (429.42) 11,357.47 12/17 20,158.45 31,515.92 12/18 2172 (651.25) 30,864.67 12/19 2173 (819.18) 30,045.49 12/20 2174 (1,231.91) 28,813.58 12/21 2175 (34.34) 28,779.24 12/22 2176 (1,276.23) 27,503.01 12/23 2177 (763.82) 26,739.19 12/24 2178 (755.91) 25,983.28 12/25 2179 (435.14) 25,548.14 12/26 2180 (255.77) 25,292.37 12/27 2181 (462.76) 24,829.61 12/28 2182 (687.12) 24,142.49 12/29 12,963.00 37,105.49 12/30 2183 (461.60) 36,643.89 12/31 2184 (1,239.54) 35,404.35 39 Checking Account Date Item Description Amount 12/31 Book Balance: 35,404.35 Chapter 4 - Reconciliation Bank of La Crosse December DEPOSIT / DATE # (CHECK) BALANCE Beginning Balance: 18,123.40 12/8 Deposit 28,745.12 46,868.52 2/19 Deposit 20,158.45 67,026.97 12/1 2154 (275.00) 66,751.97 12/1 2155 (319.45) 66,432.52 12/2 2156 (1,894.25) 64,538.27 12/3 2157 (175.29) 64,362.98 12/4 2158 (759.36) 63,603.62 12/5 2159 (1,368.73) 62,234.89 12/7 2161 (675.16) 61,559.73 12/8 2162 (10,009.28) 51,550.45 12/9 2163 (1,393.99) 50,156.46 12/10 2164 (11,733.34) 38,423.12 12/11 2165 (367.01) 38,056.11 12/12 2166 (893.70) 37,162.41 12/13 2167 (1,105.54) 36,056.87 12/14 2168 (1,381.56) 34,675.31 12/15 2169 (1,050.79) 33,624.52 12/16 2170 (889.99) 32.734.53 12/17 2171 (429.42) 32,305.11 12/18 2172 (651.25) 31,653.86 12/19 2173 (819.18) 30,834.68 12/20 2174 (1,231.91) 29,602.77 12/21 2175 (34.34) 29,568.43 12/22 2176 (1,276.23) 28,292.20 12/23 2177 (763.82) 27,528.38 12/24 2178 (755.91) 26,772.47 12/25 2179 (435.14) 26,337.33 12/26 2180 (255.77) 26,081.56 12/31 Bank Fee (200.00) 25,881.56 33 40 Bank Statement Date Item Description 12/31 nk Statement Balance: Amount 25,881.56 11/30 11/30 11/30 O/S Check 2154 O/S Check 2155 O/S Check 2156 (275.00) (319.45) (1,894.25 Reconciled Book Balance: 35,404.35 Reconciled Bank Balance: 23,392.86 Reconciliation difference: #****## If there is a reconciling issue, assume the bank is correct. i Name: Jane Doe ABC Company Checking December DEPOSIT / DATE (CHECK) BALANCE Beginning Balance: 15,634.70 12/1 2157 (175.29) 15,459.41 12/2 2158 (759.36) 14,700.05 12/3 2159 (1,368.73) 13,331.32 12/4 2160 (843.19) 12,488.13 12/5 2161 (675.16) 11,812.97 12/6 2162 (10,009.28) 1,803.69 12/7 28,745.12 30,548.81 12/8 2163 (1,339.99) 29,208.82 12/9 2164 (11,733.34) 17,475.48 12/10 2165 (367.01) 17,108.47 12/11 2166 (893.70) 16,214.77 12/12 2167 (1,105.54) 15,109.23 12/13 2168 (1,381.56) 13,727.67 12/14 2169 (1,050.79) 12,676.88 12/15 2170 (889.99) 11,786.89 12/16 2171 (429.42) 11,357.47 12/17 20,158.45 31,515.92 12/18 2172 (651.25) 30,864.67 12/19 2173 (819.18) 30,045.49 12/20 2174 (1,231.91) 28,813.58 12/21 2175 (34.34) 28,779.24 12/22 2176 (1,276.23) 27,503.01 12/23 2177 (763.82) 26,739.19 12/24 2178 (755.91) 25,983.28 12/25 2179 (435.14) 25,548.14 12/26 2180 (255.77) 25,292.37 12/27 2181 (462.76) 24,829.61 12/28 2182 (687.12) 24,142.49 12/29 12,963.00 37,105.49 12/30 2183 (461.60) 36,643.89 12/31 2184 (1,239.54) 35,404.35 39 Checking Account Date Item Description Amount 12/31 Book Balance: 35,404.35 Chapter 4 - Reconciliation Bank of La Crosse December DEPOSIT / DATE # (CHECK) BALANCE Beginning Balance: 18,123.40 12/8 Deposit 28,745.12 46,868.52 2/19 Deposit 20,158.45 67,026.97 12/1 2154 (275.00) 66,751.97 12/1 2155 (319.45) 66,432.52 12/2 2156 (1,894.25) 64,538.27 12/3 2157 (175.29) 64,362.98 12/4 2158 (759.36) 63,603.62 12/5 2159 (1,368.73) 62,234.89 12/7 2161 (675.16) 61,559.73 12/8 2162 (10,009.28) 51,550.45 12/9 2163 (1,393.99) 50,156.46 12/10 2164 (11,733.34) 38,423.12 12/11 2165 (367.01) 38,056.11 12/12 2166 (893.70) 37,162.41 12/13 2167 (1,105.54) 36,056.87 12/14 2168 (1,381.56) 34,675.31 12/15 2169 (1,050.79) 33,624.52 12/16 2170 (889.99) 32.734.53 12/17 2171 (429.42) 32,305.11 12/18 2172 (651.25) 31,653.86 12/19 2173 (819.18) 30,834.68 12/20 2174 (1,231.91) 29,602.77 12/21 2175 (34.34) 29,568.43 12/22 2176 (1,276.23) 28,292.20 12/23 2177 (763.82) 27,528.38 12/24 2178 (755.91) 26,772.47 12/25 2179 (435.14) 26,337.33 12/26 2180 (255.77) 26,081.56 12/31 Bank Fee (200.00) 25,881.56 33 40 Bank Statement Date Item Description 12/31 nk Statement Balance: Amount 25,881.56 11/30 11/30 11/30 O/S Check 2154 O/S Check 2155 O/S Check 2156 (275.00) (319.45) (1,894.25 Reconciled Book Balance: 35,404.35 Reconciled Bank Balance: 23,392.86 Reconciliation difference: #****## If there is a reconciling issue, assume the bank is correct