Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need 100% correct answer will be upvote Janet Marshall, a fixed investment manager at Premium S&B, has a short position in 10-year Treasury bond

I need 100% correct answer will be upvote

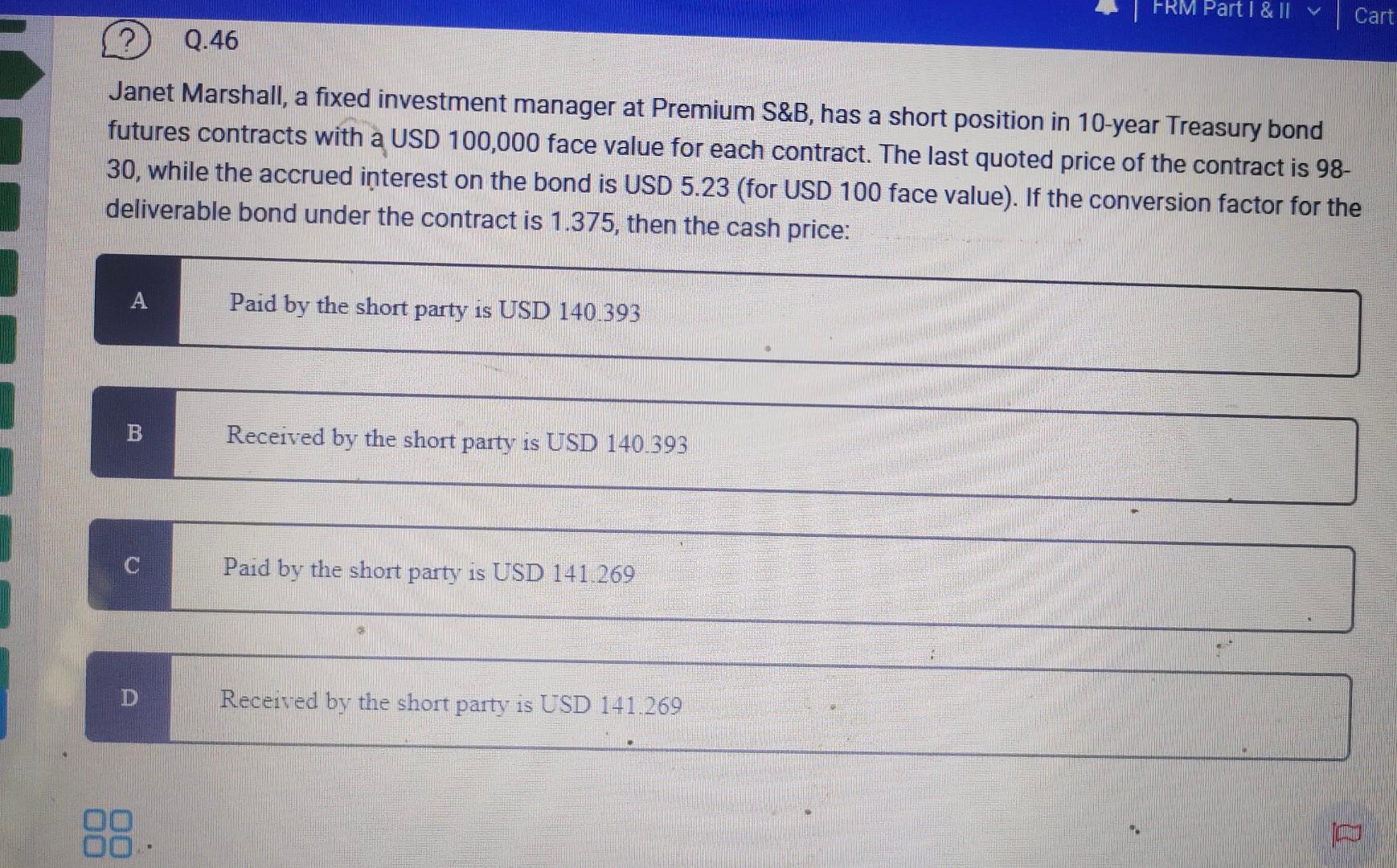

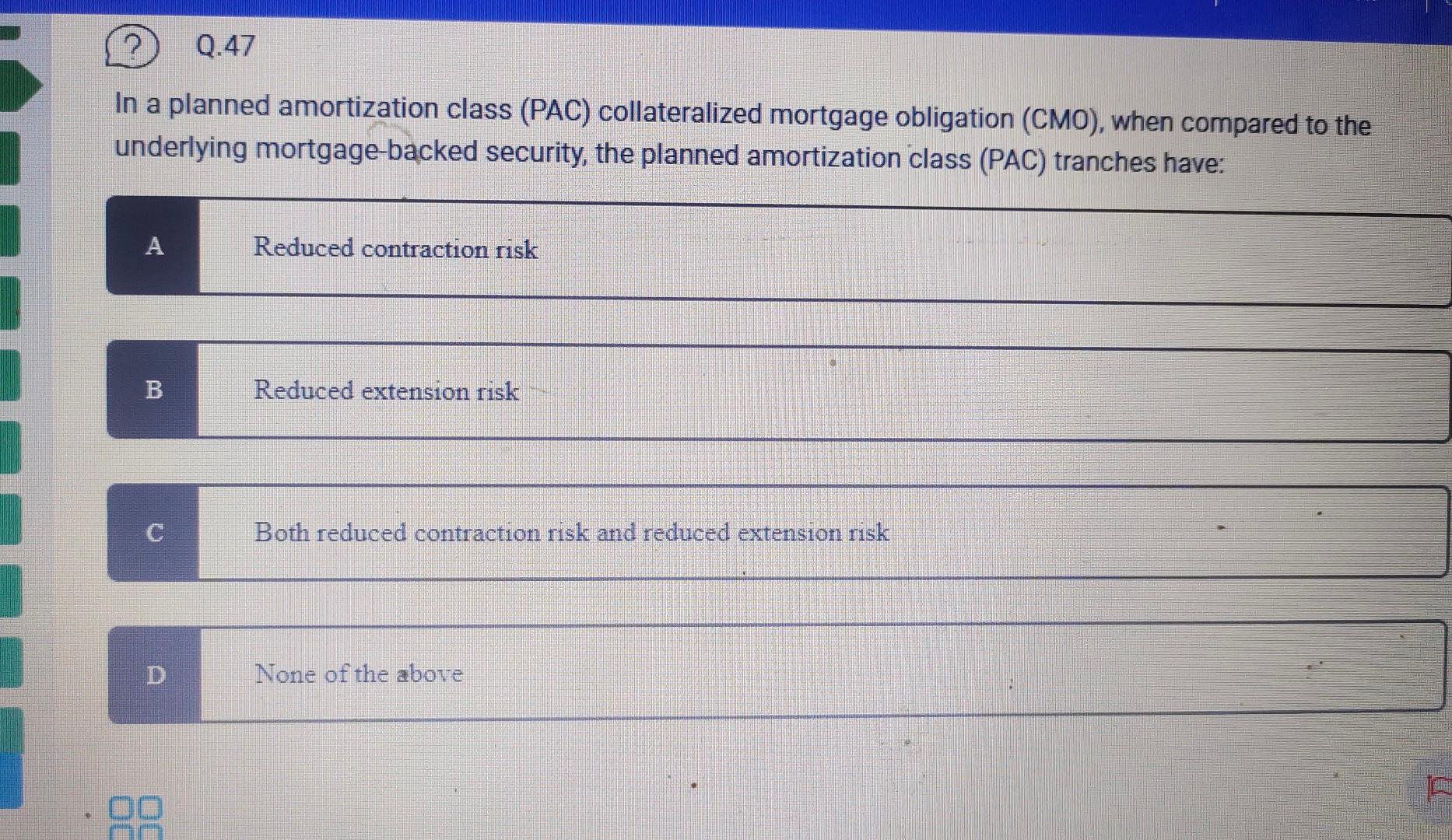

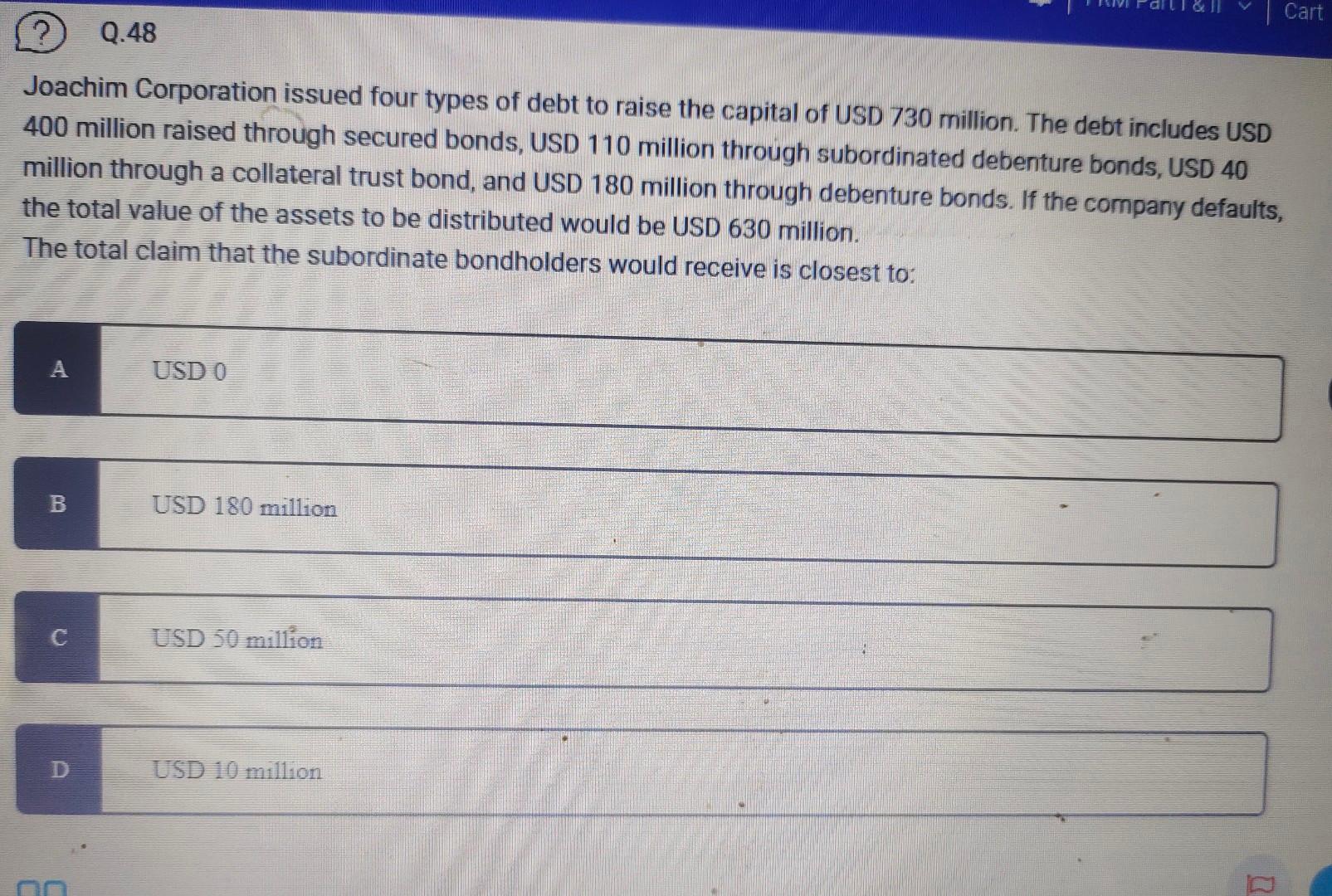

Janet Marshall, a fixed investment manager at Premium S\&B, has a short position in 10-year Treasury bond futures contracts with a USD 100,000 face value for each contract. The last quoted price of the contract is 98 30, while the accrued interest on the bond is USD 5.23 (for USD 100 face value). If the conversion factor for the deliverable bond under the contract is 1.375 , then the cash price: B Received by the short party is USD 140.393 In a planned amortization class (PAC) collateralized mortgage obligation (CMO), when compared to the underlying mortgage-backed security, the planned amortization class (PAC) tranches have: A Reduced contraction risk B Reduced extension risk C Both reduced contraction risk and reduced extension risk Joachim Corporation issued four types of debt to raise the capital of USD 730 million. The debt includes USD 400 million raised through secured bonds, USD 110 million through subordinated debenture bonds, USD 40 million through a collateral trust bond, and USD 180 million through debenture bonds. If the company defaults, the total value of the assets to be distributed would be USD 630 million. The total claim that the subordinate bondholders would receive is closest toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started