Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need 100% correct answer will be upvote Tiara Enterprises (TIEN) has just announced its plans to establish a facility in New York, USA, to

I need 100% correct answer will be upvote

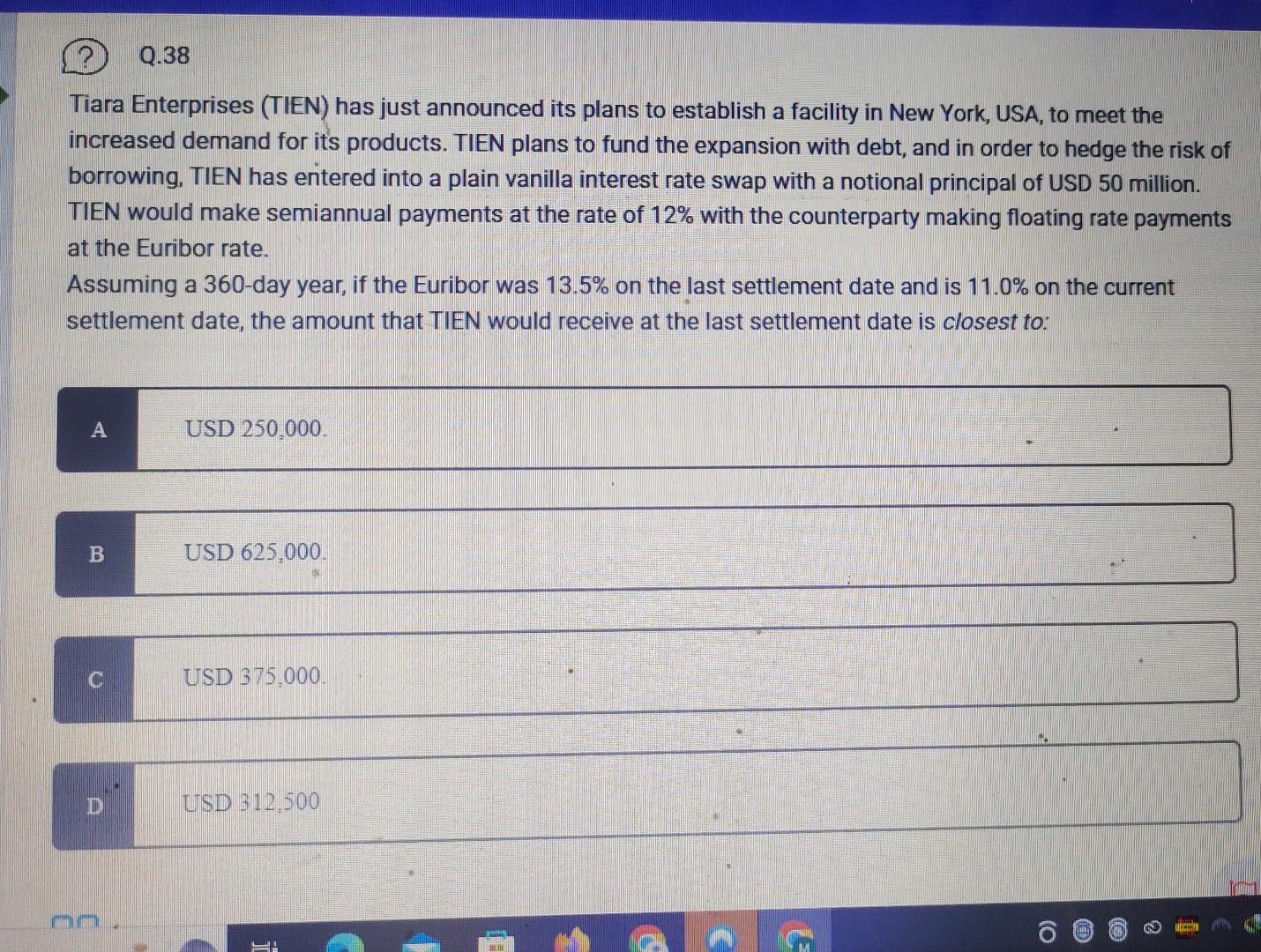

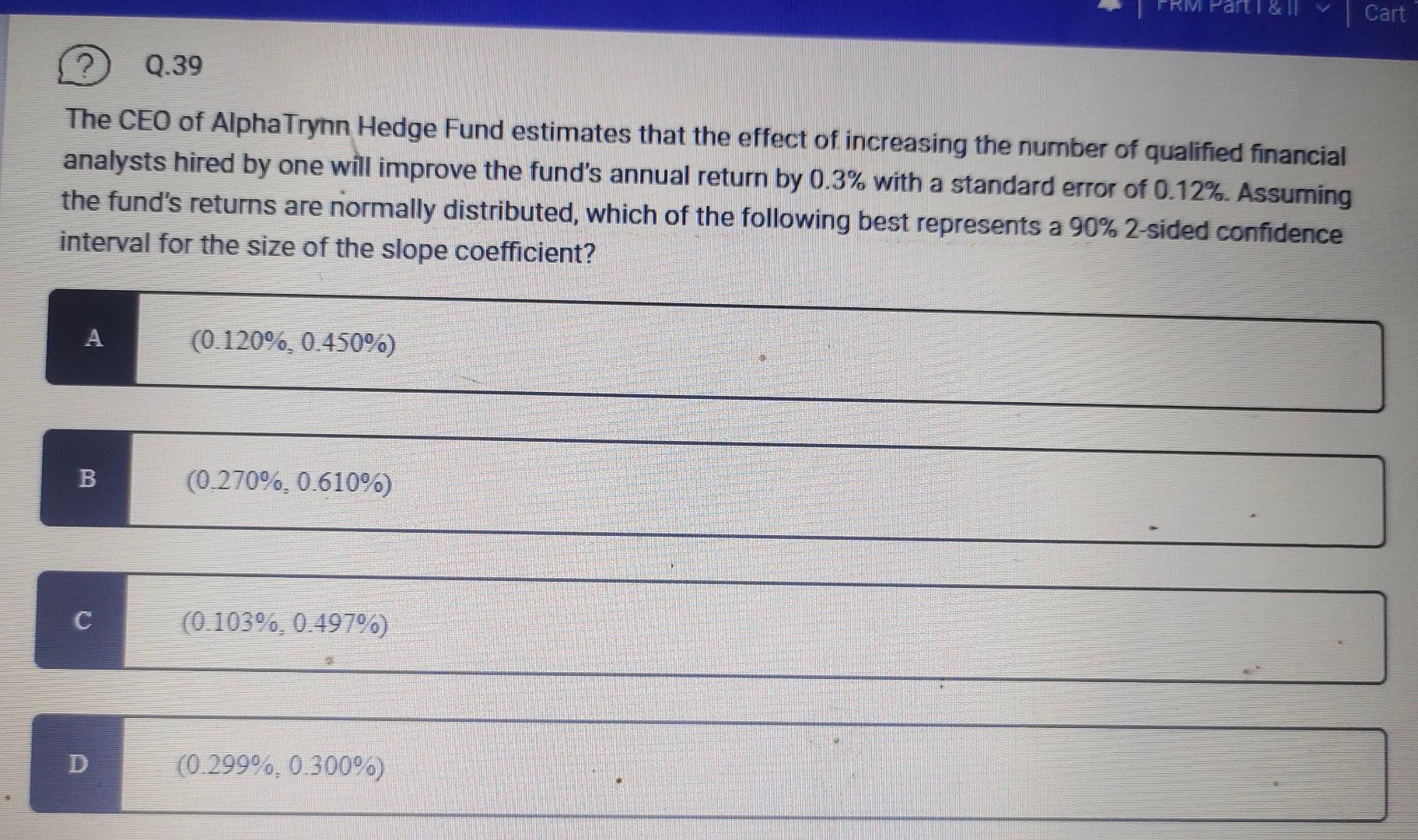

Tiara Enterprises (TIEN) has just announced its plans to establish a facility in New York, USA, to meet the increased demand for its products. TIEN plans to fund the expansion with debt, and in order to hedge the risk of borrowing, TIEN has entered into a plain vanilla interest rate swap with a notional principal of USD 50 million. TIEN would make semiannual payments at the rate of 12% with the counterparty making floating rate payments at the Euribor rate. Assuming a 360-day year, if the Euribor was 13.5% on the last settlement date and is 11.0% on the current settlement date, the amount that TIEN would receive at the last settlement date is closest to: The CEO of AlphaTrynn Hedge Fund estimates that the effect of increasing the number of qualified financial analysts hired by one will improve the fund's annual return by 0.3% with a standard error of 0.12%. Assuming the fund's returns are normally distributed, which of the following best represents a 90%2-sided confidence interval for the size of the slope coefficientStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started