i need 13, 14,15,16 and 17 do as u can pls Im stuck

i need 13, 14,15,16 and 17 do as u can pls Im stuck

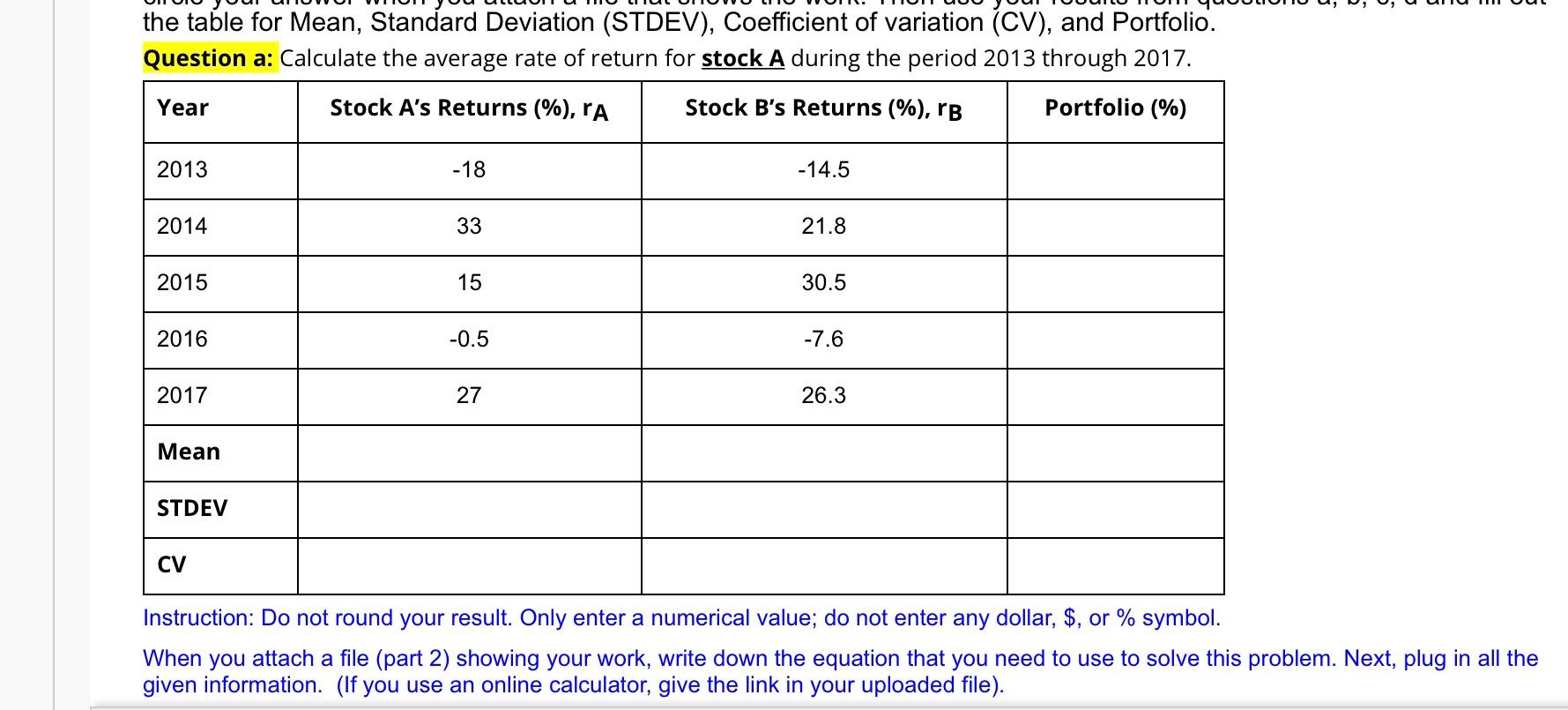

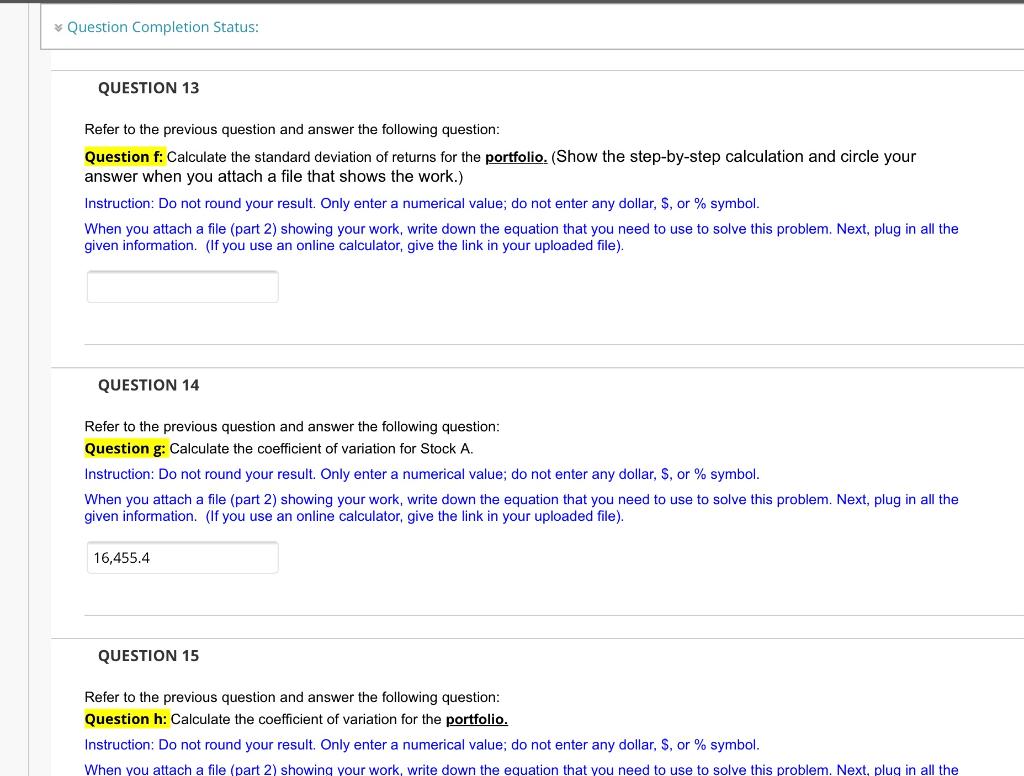

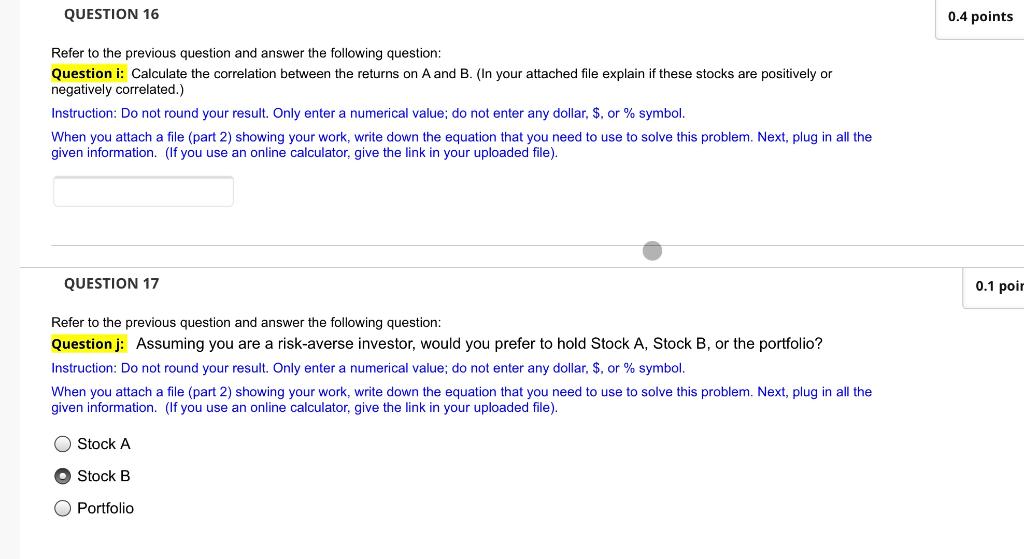

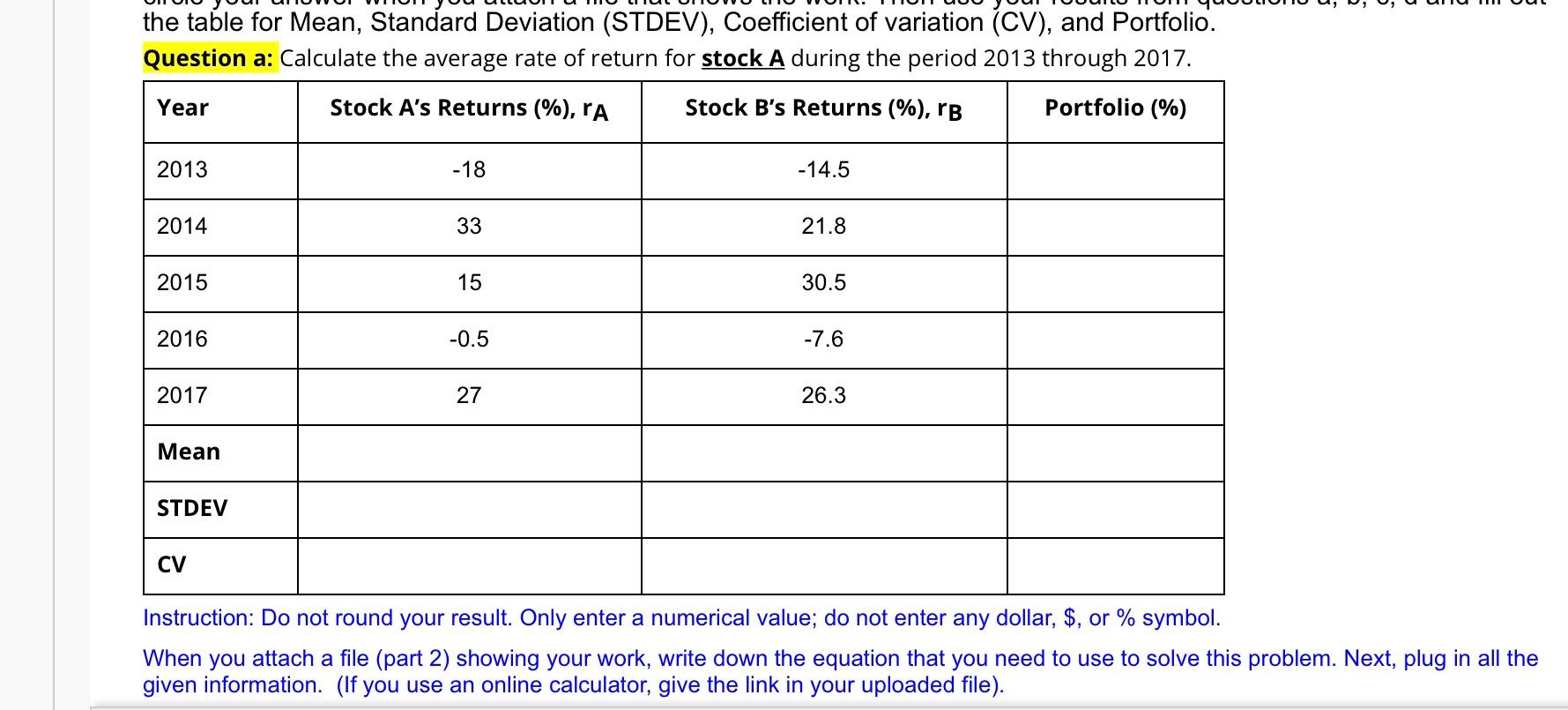

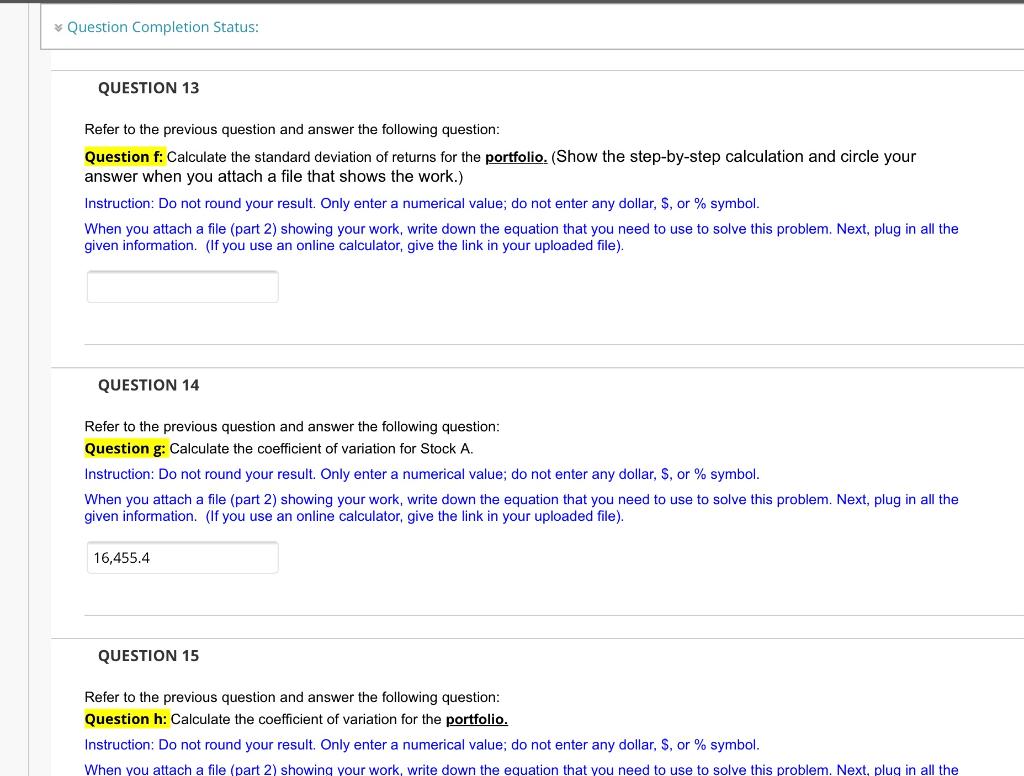

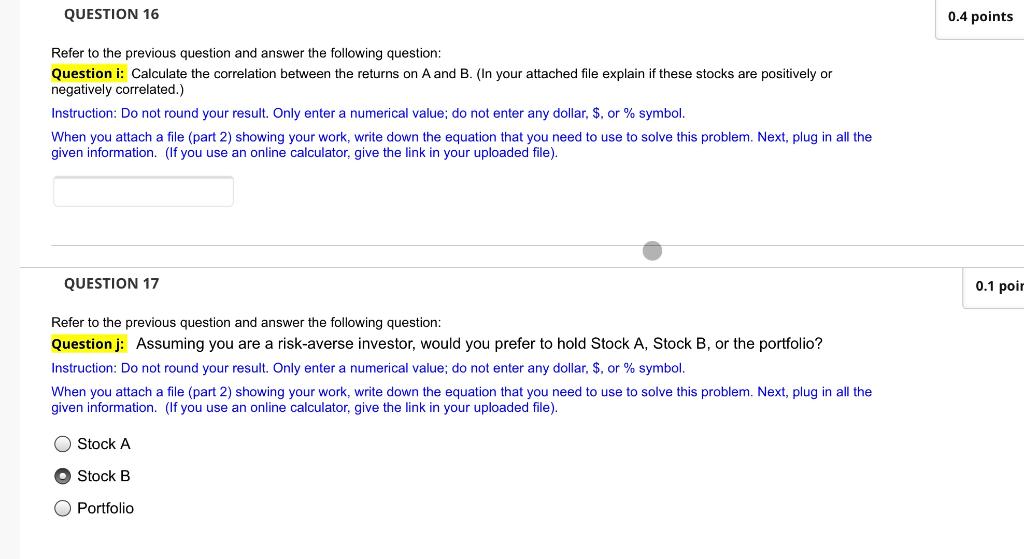

the table for Mean, Standard Deviation (STDEV), Coefficient of variation (CV), and Portfolio. Question a: Calculate the average rate of return for stock A during the period 2013 through 2017. Year Stock A's Returns (%), PA Stock B's Returns (%), rB Portfolio (%) 2013 -18 - 14.5 2014 33 21.8 2015 15 30.5 2016 -0.5 -7.6 2017 27 26.3 Mean STDEV CV Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). Question Completion Status: QUESTION 13 Refer to the previous question and answer the following question: Question f: Calculate the standard deviation of returns for the portfolio. (Show the step-by-step calculation and circle your answer when you attach a file that shows the work.) Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, S, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 14 Refer to the previous question and answer the following question: Question g: Calculate the coefficient of variation for Stock A. Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, S, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). 16,455.4 QUESTION 15 Refer to the previous question and answer the following question: Question h: Calculate the coefficient of variation for the portfolio. Instruction: Do not round your result. Only enter a numerical value, do not enter any dollar, S, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the QUESTION 16 0.4 points Refer to the previous question and answer the following question: Question i: Calculate the correlation between the returns on A and B. (In your attached file explain if these stocks are positively or negatively correlated.) Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $. or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 17 0.1 poir Refer to the previous question and answer the following question: Question j: Assuming you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $. or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). Stock A Stock B Portfolio

i need 13, 14,15,16 and 17 do as u can pls Im stuck

i need 13, 14,15,16 and 17 do as u can pls Im stuck