Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Help Kerwin Industries is deciding whether to automate phase of its production process. The manufacturing equipment has a six-year life and will cost $900,000

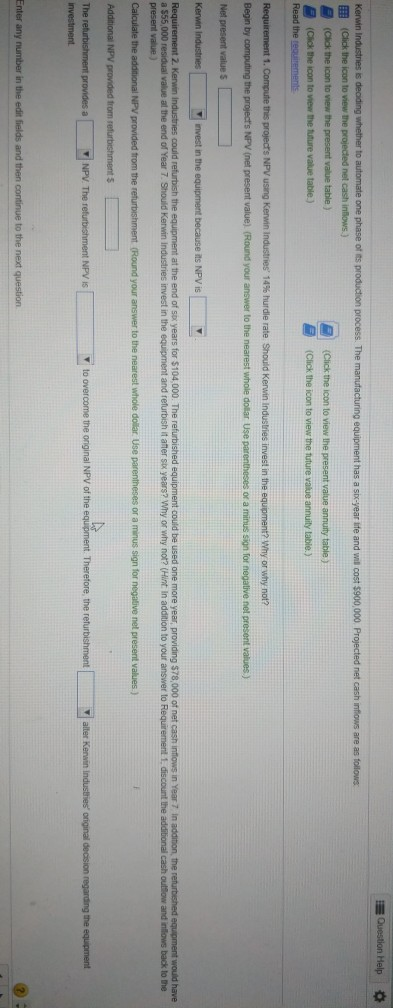

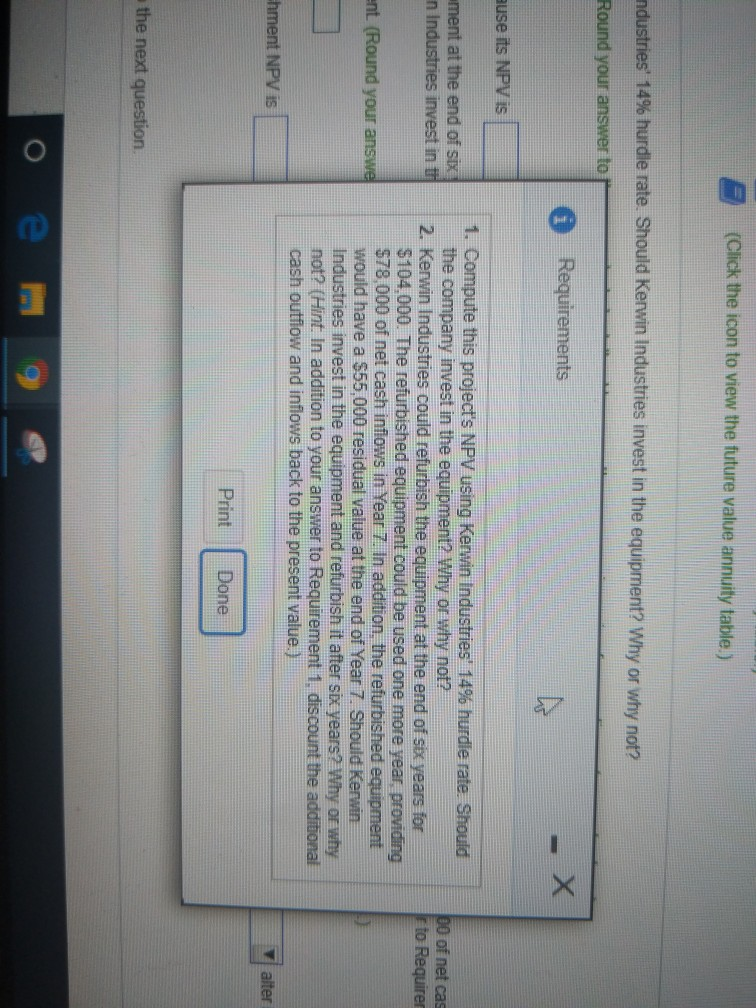

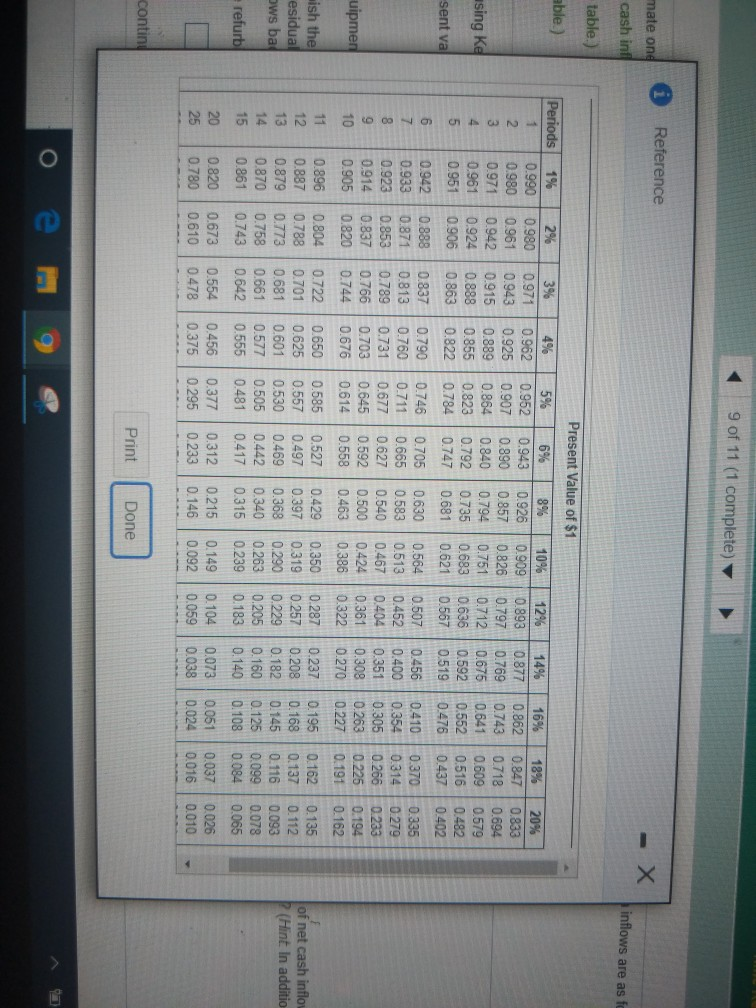

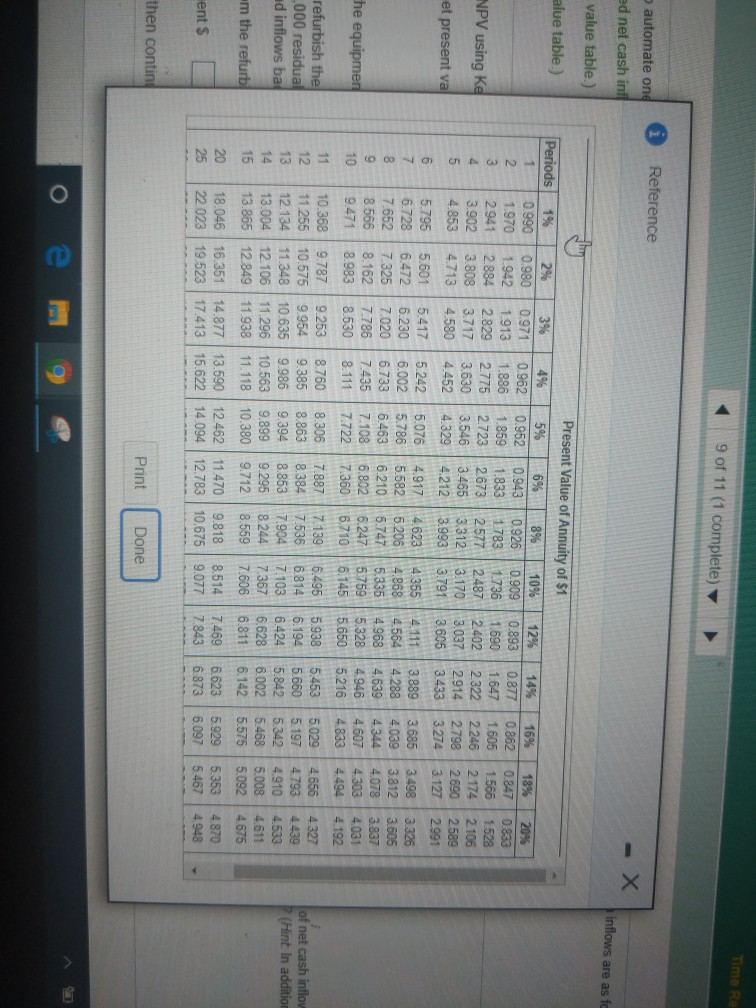

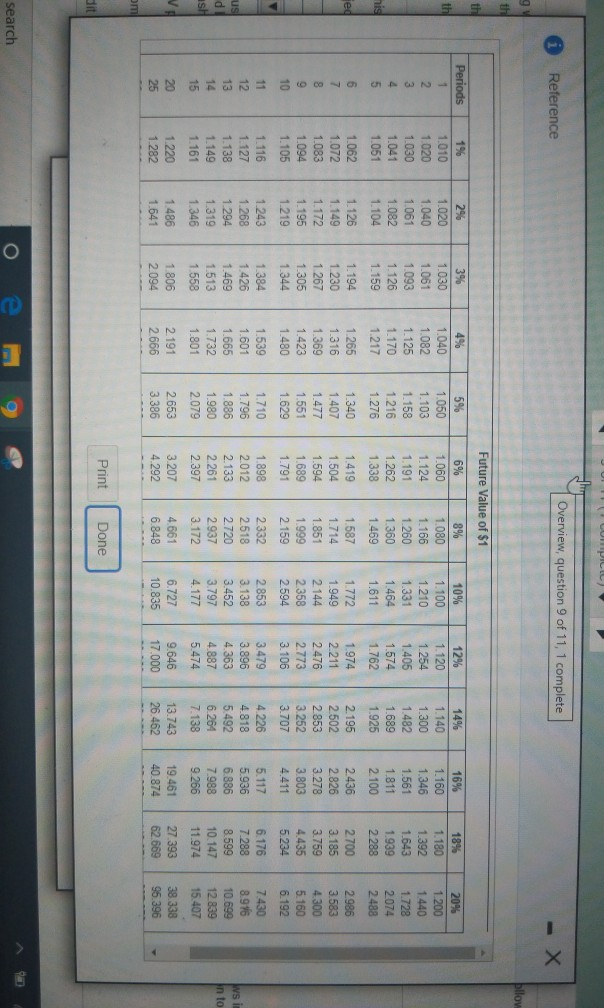

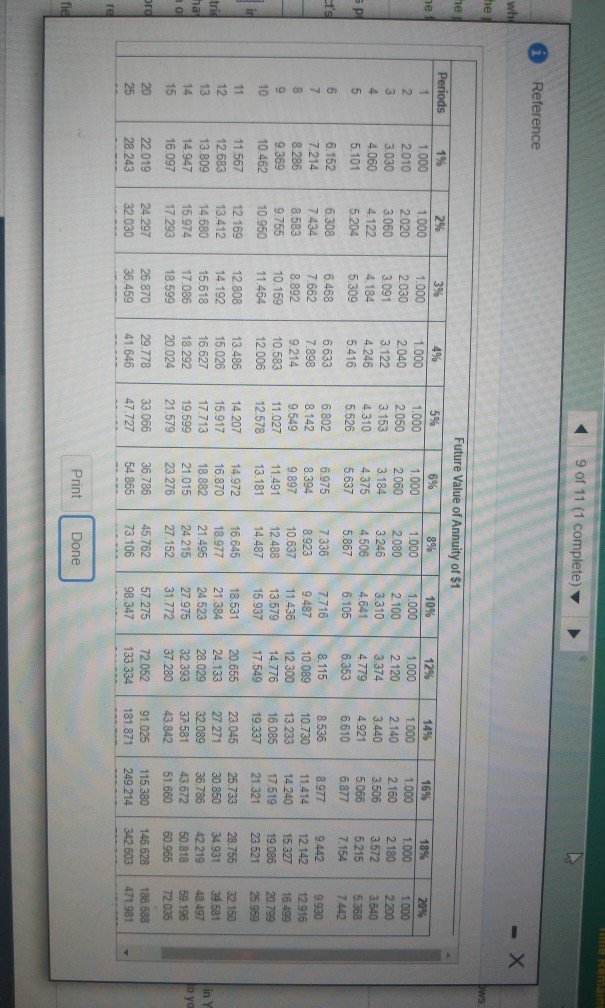

Question Help Kerwin Industries is deciding whether to automate phase of its production process. The manufacturing equipment has a six-year life and will cost $900,000 Projected net cash inflows are as follows: (Click the icon to view the projected net cash inflows) (Click the icon to view the present value table ) (Click the icon to view the present value annuity table) (Click the icon to view the future value table) (Click the icon to view the future value annuity table.) Read the requirements Requirement 1. Compute this project's NPV using Kerwin Industries 14% hurdle rate Should Kerwin Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (net present value) (Round your answer to the nearest whole dollar Use parentheses or a minus sign for negative nel present values) Net present values Kerwin Industries invest in the equipment because its NPV is Requirement 2. Kerwin Industries could refurbish the equipment at the end of six years for $104,000. The refurbished equipment could be used one more year, providing $78,000 of net cash inflows in Year 7 In addition, the returbished equipment would have a $55,000 residual value at the end of Year 7. Should Kerwin industries invest in the equipment and refurbish it after six years? Why or why not? (Hint. In addition to your answer to Requiremeni 1. discount the additional cash outflow and inflows back to the present value Calculate the additional NPV provided from the refurbishment (Round your answer to the nearest whole dollar Use parentheses or a minus sign for negative net present values.) Additional NPV provided from refurbishments The returbishment provides a investment NPV. The refurbishment NPVIS V to overcome the original NPV of the equipment. Therefore, the refurbishment alter Kerwin Industries' original decision regarding the equipment Enter any number in the edit fields and then continue to the next question (Click the icon to view the future value annuity table.) win Industries' 14% hurdle rate. Should Kerwin Industries invest in the equipment? Why or why not? je). (Round your answer to the nearest whole present values.) Data Table X because its NPV is Year 1 equipment at the end of six years for $104,000 Kerwin Industries invest in the equipment and i providing $78,000 of tion to your answer to F Year 2 Year 3 shment (Round your answer to the nearest w $261.000 $251.000 5228.000 $210.000 $204.000 $175.000 net present values.) Year 4 Year 5 Year 6 furbishment NPV is to over efurbishment Print Done nue to the next question (Click the icon to view the future value annuity table.) ndustries' 14% hurdle rate. Should Kerwin Industries invest in the equipment? Why or why not? Round your answer to Requirements ause its NPV is ament at the end of six n Industries invest in th Do of net cas to Requirer ent. (Round your answe 1. Compute this project's NPV using Kerwin Industries' 14% hurdle rate. Should the company invest in the equipment? Why or why not? 2. Kerwin Industries could refurbish the equipment at the end of six years for $104,000. The refurbished equipment could be used one more year, providing $78,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $55,000 residual value at the end of Year 7. Should Kerwin Industries invest in the equipment and refurbish it after six years 2 Why or why not? (Hint. In addition to your answer to Requirement 1. discount the additional cash outflow and inflows back to the present value.) chment NPV is alter Print Done the next question 9 of 11 (1 complete) Reference mate one cash inf - X inflows are as fc table.) Present Value of $1 able.) Periods 1 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 2% 0.980 0.961 0.942 0.924 0.906 3% 0.971 0.943 0.915 0.888 0.863 4% 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.864 0.823 0.784 asing ke 0.516 sent va 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 6 7 8 9 10 18% 20% 0.847 0.833 0.718 0.694 0.609 0.579 0.482 0.437 0.402 0.370 0.335 0.314 0.279 0.266 0.233 0.225 0.194 0.191 0.162 0.942 0.933 0.923 0.914 0.905 0.888 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.703 0.676 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.746 0.711 0.677 0.645 0.614 10% 12% 14% 16% 0.909 0.893 0.877 0.862 0.826 0.797 0.769 0.743 0.751 0.712 0.676 0.641 0.683 0.636 0.592 0.621 0.567 0.519 0.476 0.564 0.507 0.456 0.410 0.513 0.452 0.400 0.354 0.467 0.404 0.351 0.305 0.424 0.361 0.308 0.263 0.386 0.322 0.270 0.227 0.350 0.287 0.237 0.195 0.319 0.257 0.168 0.290 0.229 0.182 0.145 0.263 0.205 0.160 0.125 0.239 0.183 0.140 0.108 0.149 0.104 0,073 0.051 0.092 0.059 0.038 0.024 uipmen wish the esidual ws bal 0.722 0.701 0.208 11 12. 13 14 15 0.896 0.887 0.879 0.870 0.861 0.804 0.788 0.773 0.758 0.743 0.650 0.625 0.601 0.577 0.555 0.681 0.585 0.557 0.530 0.505 0.481 of net cash inflo ? (Hint In additio 0.527 0.497 0.469 0.442 0.417 0.312 0.233 0.162 0.137 0.116 0.099 0.084 0.135 0.112 0.093 0.078 0.065 0.661 0.642 refurb 20 25 0.820 0.780 0.673 0.610 0.554 0.478 0.456 0.375 0.377 0.295 0.215 0.146 0.037 0.016 0.026 0.010 conting Print Done 9 of 11 (1 complete) Reference 0 automate one ed net cash infi - X inflows are as fc value table.) alue table.) NPV using ke 2096 0.833 1.528 2106 2589 2991 et present va Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 1 8% 10% 12% 0.990 0.980 14% 0.971 0.962 0.952 0.943 2 1.970 0.926 1.942 0.909 0.893 0.877 1.913 1.886 1.859 3 1.833 1783 2.941 1.736 2.884 1.690 1.647 2.829 2.775 2.723 2673 2.577 | 2.487 2.402 4 3.902 2.322 3.808 3.717 3.630 3.546 3.465 3.312 3.170 5 4.853 3.037 4713 2.914 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 6 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 7 6.728 3.889 4111 6.472 6.230 6.002 5.786 5.5825.206 4.868 4.564 4 288 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4968 4.639 9 8.566 8.162 7.786 7.435 7.108 6.8026.247 5.759 5.328 4.946 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 11 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 12 11 255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 13 12.134 11.348 10,635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 14 13.004 12.106 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 15 13.865 12.849 11.938 11.118 10.380 9.712 8.559 7.606 6.811 6.142 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7 843 6.873 16% 18% 0.862 0.847 1.605 1.566 2.246 2174 2798 2690 3.274 3.127 3.685 3.498 4.039 3.812 4.344 4078 4.607 4.303 4.833 4494 3.326 3.605 3.837 4.031 4192 the equipment refurbish the ,000 residual ad inflows ba 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5008 5.092 of net cash inflow (Hint In additio 4.327 4.439 4.533 4611 4.675 m the refurbi 5.929 ents 5.353 5.467 4.870 4.948 6.097 then contind Print Done Overview question 9 of 11, 1 complete Reference 20% Periods 1% 1.010 1 020 1030 1.041 1.051 2% 1.020 1040 1 061 1082 1.104 3% 1.030 1051 no 1126 1.159 4% 1.040 1 082 1125 1 170 1217 5% 1.050 1.103 1 158 240 1 276 Future Value of $1 6% 8% 10% 12% 14% 1.060 1.080 1.100 1.120 1.140 1 124 1 166 1210 1 254 1 300 1.191 1 260 1331 1.405 1482 1.262 1360 1.464 1.574 1.689 1.338 1469 1.762 1.925 16% 1 160 1 346 1561 1 811 1 180 200 1623 1939 2.288 1.728 2074 2488 2.100 24 1082 1073 1.014 1126 0 +230 1.401 1.41 1.551 1.629 2476 2.773 2.502 2.853 3.252 1.594 1.689 1.791 2826 3.278 3.803 4411 3.185 3.759 4435 5.234 1.305 1.344 2.900 3.583 4.300 5.160 6.192 1.423 1.480 3 Boco 1.00 1.094 1.105 1 116 1 127 1 138 1.149 1 161 7420 1.195 1.219 1942 1269 1.294 1310 1.949 2.144 2.358 2.594 2853 3.138 3.452 3.797 204 1406 1469 1513 1558 ze 1.714 1.851 1.999 2. 159 2332 2518 2.720 2.937 3.172 1520 1 601 1 665 1 732 1.801 1740 1706 1.886 1980 2079 517 5936 6.888 2012 2. 133 2.261 2.397 Ooh 5178 7289 8.599 10 147 11.974 8.948 10.699 12839 1 346 9 1 486 1 806 2653 1220 1.282 NN w N 3 207 4.292 4.661 6.848 62669 Print Done O E 9 of 11 (1 complete) Reference whe the he he 18% 1.000 Periods 1 2 3 4 5 19 1.000 2010 3.030 4.060 5.101 2% 1.000 2020 3.060 4.122 5.204 3% 1.000 2030 3.091 4.184 5.309 4% 1.000 2040 3.122 4.246 5.416 2 180 20% 1.000 2200 3.640 5368 7442 3.572 5.215 7.154 et's 6 7 8 9 10 6.468 7.662 8.892 10.159 11.464 6.633 7.898 9.214 10.583 12.006 6.152 7.214 8.286 9.369 10.462 11 567 12.683 13.809 14.947 16.097 6.308 7.434 8.583 9.755 10.950 12. 169 13.412 14.680 15.974 17 293 Future Value of Annuity of $1 5% 6% 8% 10% 1.000 1.000 1.000 1.000 2.050 2.060 2080 2.100 3.153 3.184 3.246 3.310 4.310 4 375 4.506 4.641 5.526 5.637 5.867 6.105 6.802 6.975 7.336 7.716 8.142 8.394 8.923 9.487 9.549 9.897 10.637 11.436 11.027 11.491 12.488 13.579 12578 13.181 14.487 15.937 14207 14.972 16.645 18.531 15.917 16.870 18.977 21.384 17.713 18.882 21.495 24.523 19.599 21.015 24 215 27.975 21.579 23.276 27.152 31.772 33.066 36.786 45.762 57 275 47.727 54.865 73.106 98 347 12% 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 20.655 24. 133 28.029 32.393 37 280 14% 1.000 2140 3.440 4.921 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27 271 32 089 37.581 43.842 91.025 181.871 16% 1.000 2 160 3.506 5.066 6.877 8.977 11.414 14.240 17 519 21.321 25.733 30.850 36.786 43.672 51.660 115.380 249.214 9.930 12916 16.499 20.799 25.959 32.150 36 581 9.442 12.142 15.327 19.086 23.521 28.755 34 931 42.219 50 818 60.965 146.628 11 12 13 14 15 trie ha no 12.808 14.192 15.618 17.086 18.599 13.486 15.026 16.627 18.292 20.024 to yo 48.497 59.196 72035 ord 20 25 22.019 28 243 24 297 32.030 26.870 36.459 29.778 41.646 72.052 133 334 186 688 471981 342 603 re Print Done Done fie

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started