i need 4th question answer

i need 4th question answer

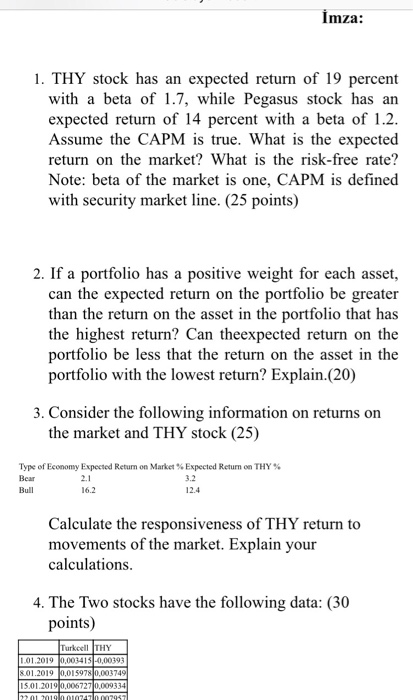

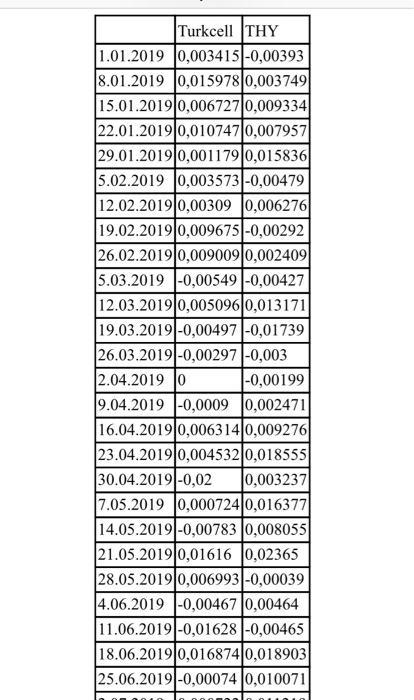

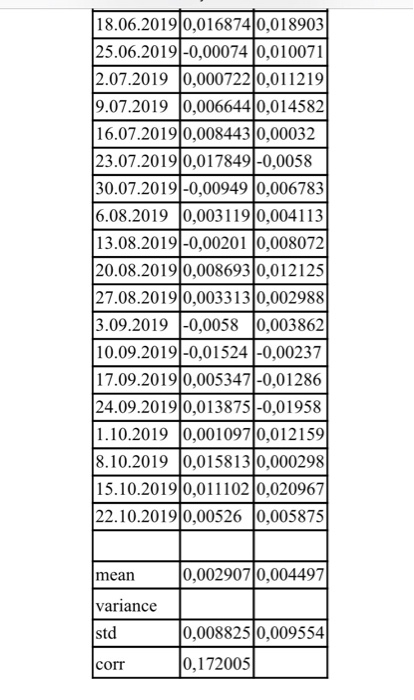

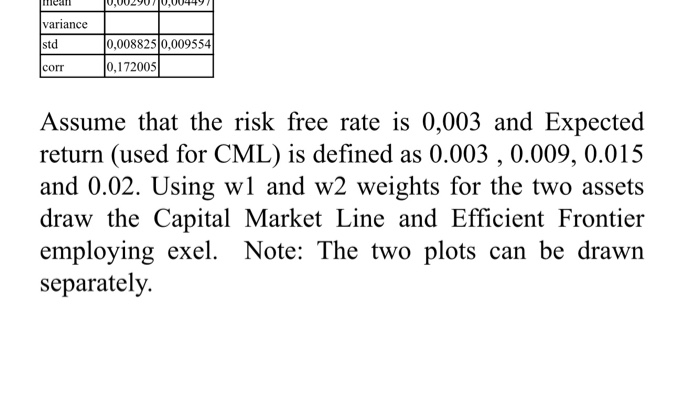

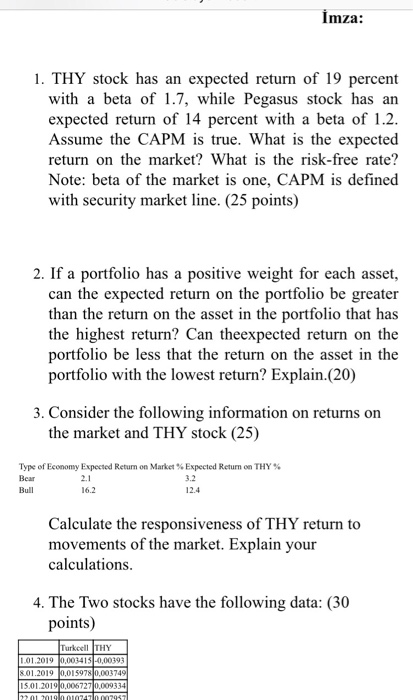

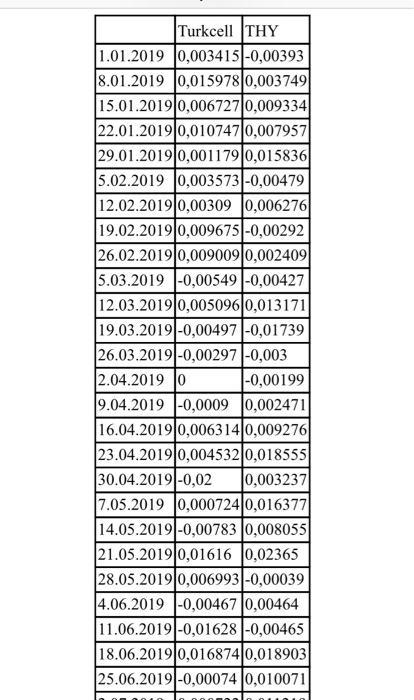

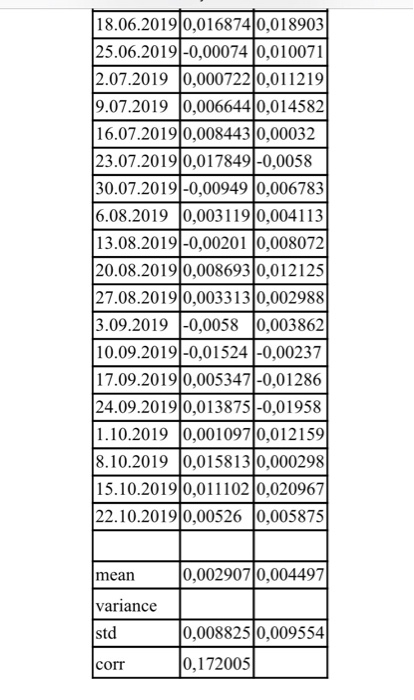

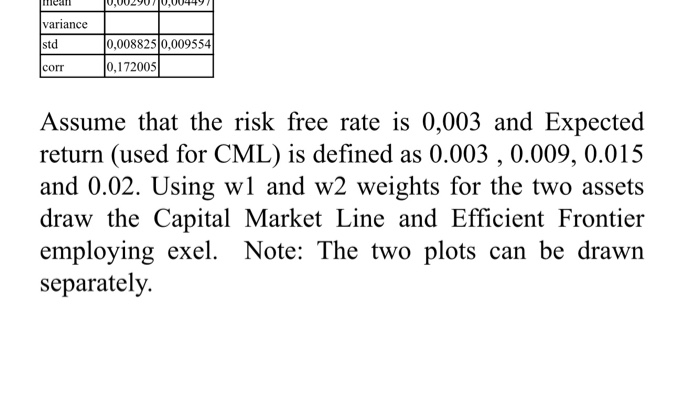

mza: 1. THY stock has an expected return of 19 percent with a beta of 1.7, while Pegasus stock has an expected return of 14 percent with a beta of 1.2. Assume the CAPM is true. What is the expected return on the market? What is the risk-free rate? Note: beta of the market is one, CAPM is defined with security market line. (25 points) 2. If a portfolio has a positive weight for each asset, can the expected return on the portfolio be greater than the return on the asset in the portfolio that has the highest return? Can theexpected return on the portfolio be less that the return on the asset in the portfolio with the lowest return? Explain.(20) 3. Consider the following information on returns on the market and THY stock (25) Type of Economy Expected Return on Market Expected Return on THY% Bear Bull 16.2 12.4 Calculate the responsiveness of THY return to movements of the market. Explain your calculations. 4. The Two stocks have the following data: (30 points) Turkcell THY 1.01.2019 0,003413-0,00393 8.01.2019 0,0159780.003749 15.01.20190,0067270.009334 201 2019 10747100179871 Turkcell THY 1.01.2019 10,003415 -0,00393 8.01.2019 0,0159780,003749 15.01.2019 0,0067270,009334 22.01.20190,0107470,007957 29.01.2019 0,0011790,015836 5.02.2019 0,003573 -0,00479 12.02.2019 0,00309 0,006276 19.02.2019 0,009675 -0,00292 26.02.2019 0,0090090,002409 5.03.2019 -0,00549 -0,00427 12.03.2019 0,005096 0,013171 19.03.2019 -0,00497 -0,01739 26.03.2019 -0,00297 -0,003 2.04.2019 JO |-0,00199 9.04.2019 -0,0009 0,002471 16.04.20190,0063140,009276 23.04.2019 0,004532|0,018555 30.04.2019 -0,02 10,0032371 7.05.2019 0,0007240,016377 14.05.2019 -0,00783 0,008055 21.05.2019 0,01616 0,02365 28.05.20190,006993 -0,00039 4.06.2019 -0,004670,00464 11.06.2019 -0,01628 -0,00465 18.06.2019 0,016874|0,018903 25.06.2019 -0,00074 0,010071 18.06.2019 0,016874|0,018903 25.06.2019 -0,00074 0,010071 12.07.2019 10,000722|0,011219 9.07.2019 0,006644 0,014582 16.07.2019 0,008443|0,00032 23.07.2019 0,017849 -0,0058 30.07.2019 -0,00949 0,006783 6.08.2019 0,003119|0,004113| 13.08.2019 -0,00201 0,008072| 20.08.2019 0,008693|0,012125 27.08.20190,0033130,002988 3.09.2019 -0,0058 0,003862 10.09.2019 -0,01524 -0,00237 17.09.2019 0,005347 -0,01286 24.09.2019|0,013875 -0,01958 (1.10.2019 0,001097|0,012159 8.10.2019 0,015813|0,000298 (15.10.2019 0,01110210,020967 22.10.20190,00526 0,005875 0,002907|0,004497 mean variance std 10,0088250,009554 corr 0,172005 mean variance std 10,0088250,009554 10,172005 corr Assume that the risk free rate is 0,003 and Expected return (used for CML) is defined as 0.003 , 0.009, 0.015 and 0.02. Using wl and w2 weights for the two assets draw the Capital Market Line and Efficient Frontier employing exel. Note: The two plots can be drawn separately. mza: 1. THY stock has an expected return of 19 percent with a beta of 1.7, while Pegasus stock has an expected return of 14 percent with a beta of 1.2. Assume the CAPM is true. What is the expected return on the market? What is the risk-free rate? Note: beta of the market is one, CAPM is defined with security market line. (25 points) 2. If a portfolio has a positive weight for each asset, can the expected return on the portfolio be greater than the return on the asset in the portfolio that has the highest return? Can theexpected return on the portfolio be less that the return on the asset in the portfolio with the lowest return? Explain.(20) 3. Consider the following information on returns on the market and THY stock (25) Type of Economy Expected Return on Market Expected Return on THY% Bear Bull 16.2 12.4 Calculate the responsiveness of THY return to movements of the market. Explain your calculations. 4. The Two stocks have the following data: (30 points) Turkcell THY 1.01.2019 0,003413-0,00393 8.01.2019 0,0159780.003749 15.01.20190,0067270.009334 201 2019 10747100179871 Turkcell THY 1.01.2019 10,003415 -0,00393 8.01.2019 0,0159780,003749 15.01.2019 0,0067270,009334 22.01.20190,0107470,007957 29.01.2019 0,0011790,015836 5.02.2019 0,003573 -0,00479 12.02.2019 0,00309 0,006276 19.02.2019 0,009675 -0,00292 26.02.2019 0,0090090,002409 5.03.2019 -0,00549 -0,00427 12.03.2019 0,005096 0,013171 19.03.2019 -0,00497 -0,01739 26.03.2019 -0,00297 -0,003 2.04.2019 JO |-0,00199 9.04.2019 -0,0009 0,002471 16.04.20190,0063140,009276 23.04.2019 0,004532|0,018555 30.04.2019 -0,02 10,0032371 7.05.2019 0,0007240,016377 14.05.2019 -0,00783 0,008055 21.05.2019 0,01616 0,02365 28.05.20190,006993 -0,00039 4.06.2019 -0,004670,00464 11.06.2019 -0,01628 -0,00465 18.06.2019 0,016874|0,018903 25.06.2019 -0,00074 0,010071 18.06.2019 0,016874|0,018903 25.06.2019 -0,00074 0,010071 12.07.2019 10,000722|0,011219 9.07.2019 0,006644 0,014582 16.07.2019 0,008443|0,00032 23.07.2019 0,017849 -0,0058 30.07.2019 -0,00949 0,006783 6.08.2019 0,003119|0,004113| 13.08.2019 -0,00201 0,008072| 20.08.2019 0,008693|0,012125 27.08.20190,0033130,002988 3.09.2019 -0,0058 0,003862 10.09.2019 -0,01524 -0,00237 17.09.2019 0,005347 -0,01286 24.09.2019|0,013875 -0,01958 (1.10.2019 0,001097|0,012159 8.10.2019 0,015813|0,000298 (15.10.2019 0,01110210,020967 22.10.20190,00526 0,005875 0,002907|0,004497 mean variance std 10,0088250,009554 corr 0,172005 mean variance std 10,0088250,009554 10,172005 corr Assume that the risk free rate is 0,003 and Expected return (used for CML) is defined as 0.003 , 0.009, 0.015 and 0.02. Using wl and w2 weights for the two assets draw the Capital Market Line and Efficient Frontier employing exel. Note: The two plots can be drawn separately

i need 4th question answer

i need 4th question answer