I need 5.18, 5.20, 5.22

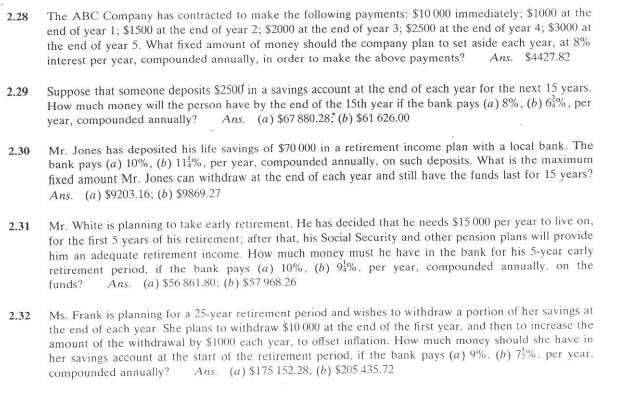

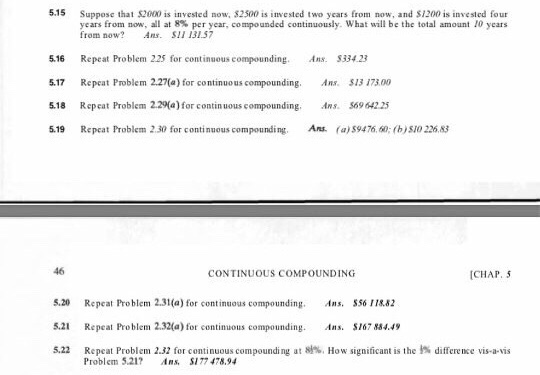

The ABC Company has contracted to make the following payments: $10000 immediately; $1000 at the end of year1 $1500 at the end of year 2; $2000 at the end of year 3; $2500 at the end of year 4; $3000 at the end of year 5, What fixed amount of money should the company plan to set aside each year, at 890 interest per year, compounded annually, in order to make the above payments? Ans. $4427.82 2.28 Suppose that someone deposits $2500 in a savings account at the end of each year for the next 15 years. How much money will the person have by the end of the 15th year if the bank pays (a) 8%, (b) 6 %, per year, compounded annually? Ans. (a) $67 880.28; (b) S61 626.00 2.29 Mr. Jones has deposited his life savings of $70 000 in a retirement income plan with a local bank. The bank pays (a) 10%, (b) 11%, per year, compounded annually, on such deposits. What is the maximum fixed amount Mr. Jones can withdraw at the end of each year and still have the funds last for 15 years? Ans. (a) $9203.16; (b) $9869.27 2.30 Mr. White is planning to take early retirement. He has decided that he needs $15000 per year to live on for the first 5 years of his retirement; after that, his Social Security and other pension plans will provide him an adequate retirement income. How much money must he have in the bank for his 5-ycar carly retirement period, if the bank pays (a) 1096, (b) 93%, per year, compounded annually, on the funds? Ans. (a) $56 861.80; (b) $57 968.26 2.31 Ms. Frank is planning for a 25-year retirement period and wishes to withdraw a portion of her savings at the end of each year. She plans to withdraw $10000 at the end of the first year, and then to increase the amount of the withdrawal by S1000 each year, to offset inflation. How much money should she have in her savings account at the start of the retirement period, if the bank pays (a)996. (b) 73%, per year compounded annually? Ans. (a) $175 152.28: (b) $205 435.72 2.32 5.15 Suppose that S2000 is invested now, $2500 is nvested two ycars from no and S1200 is invested four years from now, all at 8% per year, compounded continuously. What will be the total amount 10 years from now? AnsS11 131.57 5.16 Repeat Problem 225 for continuous compounding. Ans. $334.23 5.17 Repeat Problem 2.27(a) for continuous compounding. Ans. S13 173.00 518 Repeat Problem 2.29(a) for contin uous compounding. Ans. 569 642 25 5.19 Repeat Problem 2.30 for continuous compounding. Ans (a)9476.D:(b)S1O 226.83 46 CONTINUOUS COMPOUNDING CHAP, 5 Problem 2.3(a) for continuous compounding. Ans. S 5.20 Repeat 56 118.82 5.21 Repeat Problem 2.32(a) for continuous compounding. Ans 167 884.49 5.22 Repeat Problem 2.32 for continuous compounding at 8 %. How significant is the % difference vis-a-vis Problem 5217 Ans, S177 478.94