i need 8 a-d! everythjng needed is attached.

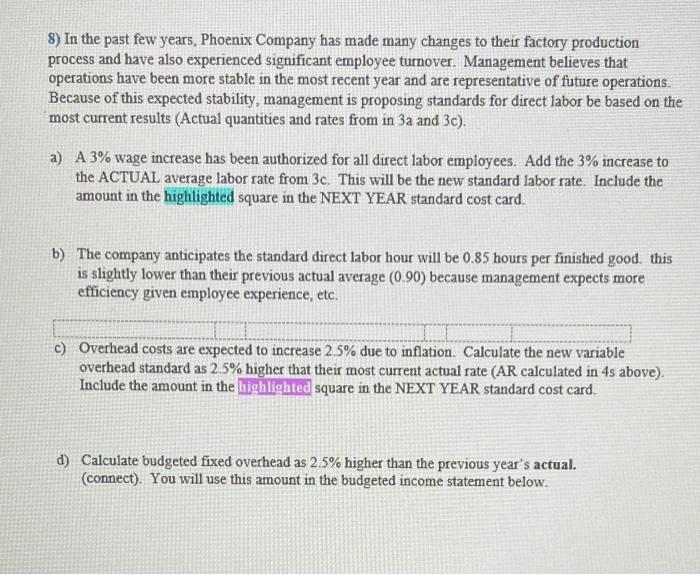

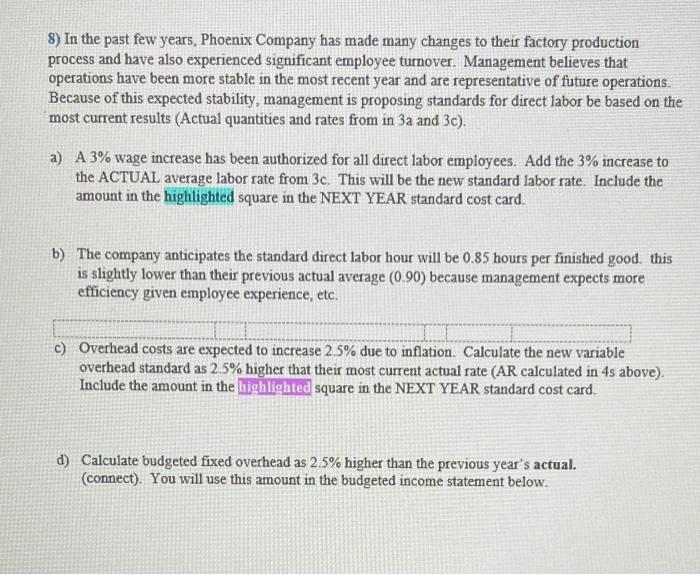

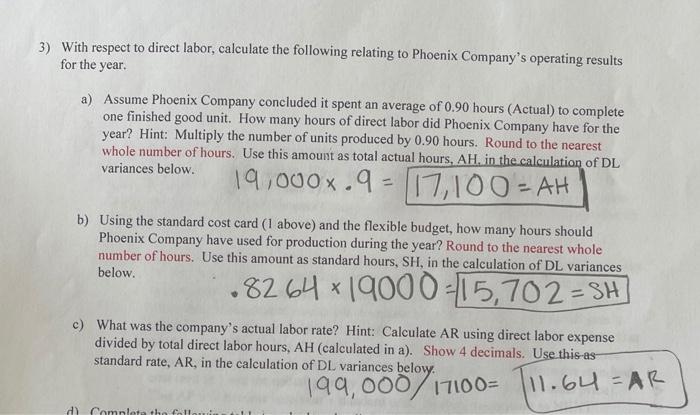

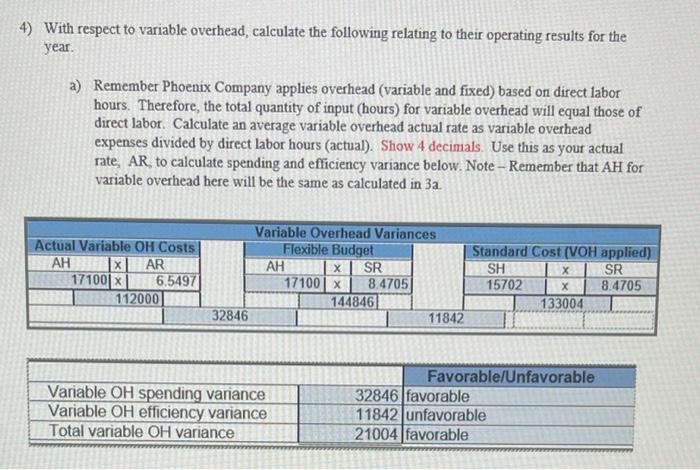

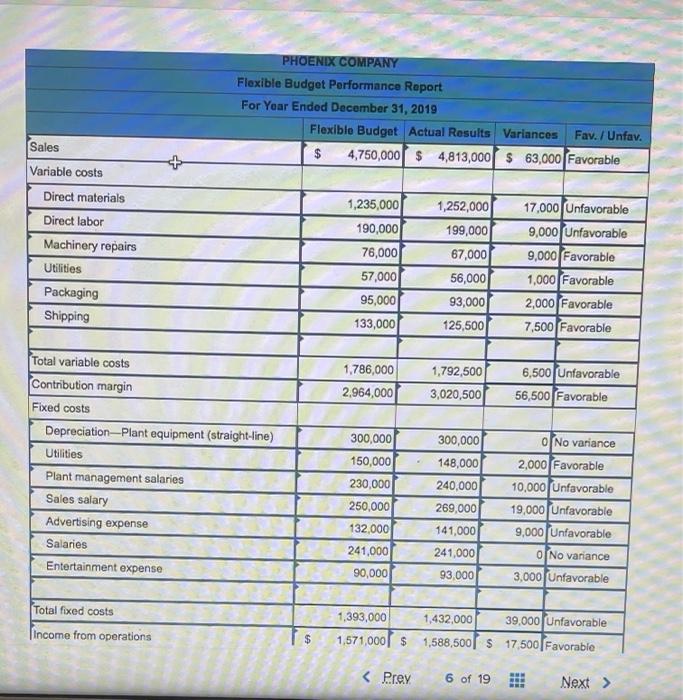

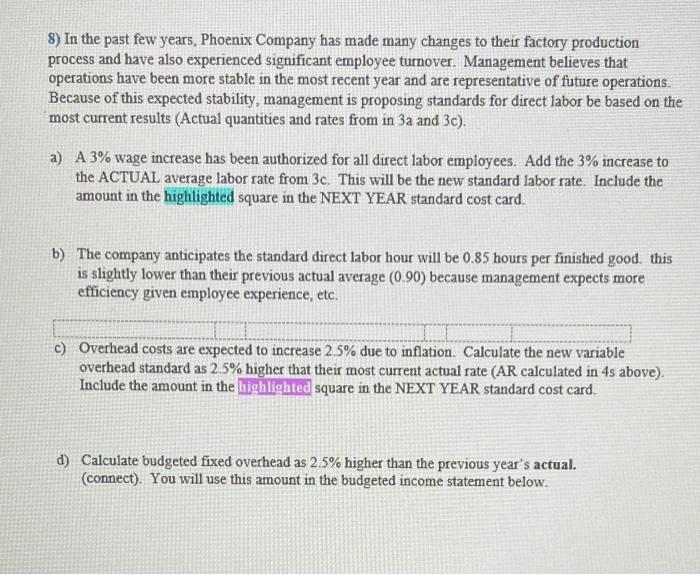

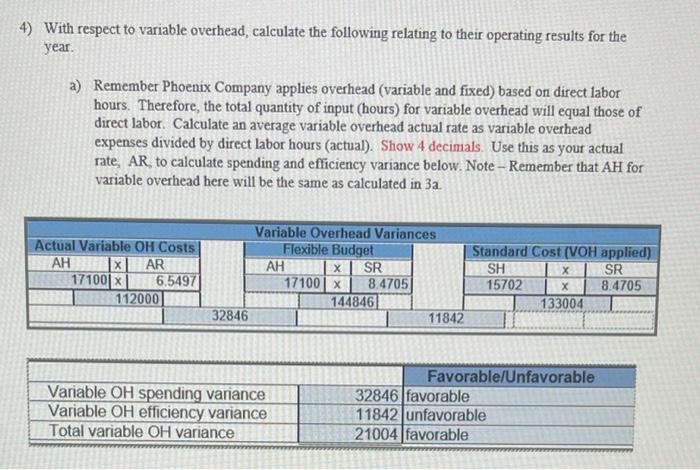

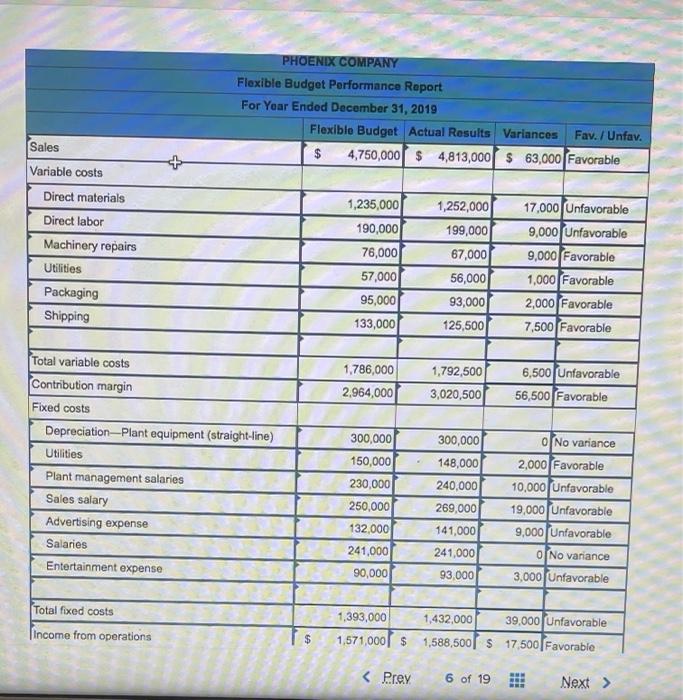

8) In the past few years, Phoenix Company has made many changes to their factory production process and have also experienced significant employee turnover. Management believes that operations have been more stable in the most recent year and are representative of future operations. Because of this expected stability, management is proposing standards for direct labor be based on the most current results (Actual quantities and rates from in 3a and 3c). a) A 3% wage increase has been authorized for all direct labor employees. Add the 3% increase to the ACTUAL average labor rate from 3c. This will be the new standard labor rate. Include the amount in the highlighted square in the NEXT YEAR standard cost card. b) The company anticipates the standard direct labor hour will be 0.85 hours per finished good. this is slightly lower than their previous actual average (0.90) because management expects more efficiency given employee experience, etc. c) Overhead costs are expected to increase 2.5% due to inflation. Calculate the new variable overhead standard as 2.5% higher that their most current actual rate (AR calculated in 4s above). Include the amount in the highlighted square in the NEXT YEAR standard cost card. d) Calculate budgeted fixed overhead as 2.5% higher than the previous year's actual. (connect). You will use this amount in the budgeted income statement below. 3) With respect to direct labor, calculate the following relating to Phoenix Company's operating results for the year. a) Assume Phoenix Company concluded it spent an average of 0.90 hours (Actual) to complete one finished good unit. How many hours of direct labor did Phoenix Company have for the year? Hint: Multiply the number of units produced by 0.90 hours. Round to the nearest whole number of hours. Use this amount as total actual hours, AH, in the calculation of DL variances below. 19,000x.9 - 17,100 - AH b) Using the standard cost card (1 above) and the flexible budget, how many hours should Phoenix Company have used for production during the year? Round to the nearest whole number of hours. Use this amount as standard hours, SH, in the calculation of DL variances below. .8264*19000-15,702 = SH c) What was the company's actual labor rate? Hint: Calculate AR using direct labor expense divided by total direct labor hours, AH (calculated in a). Show 4 decimals. Use this as standard rate, AR, in the calculation of DL variances below. 199,000/17100= 76.64AR d) Comnlete the follow 4) With respect to variable overhead, calculate the following relating to their operating results for the year. a) Remember Phoenix Company applies overhead (variable and fixed) based on direct labor hours. Therefore, the total quantity of input (hours) for variable overhead will equal those of direct labor. Calculate an average variable overhead actual rate as variable overhead expenses divided by direct labor hours (actual). Show 4 decimals. Use this as your actual rate, AR to calculate spending and efficiency variance below. Note - Remember that AH for variable overhead here will be the same as calculated in 3a. Actual Variable OH Costs AH XAR 17100 x 6.5497 112000 Variable Overhead Variances Flexible Budget Standard Cost (VOH applied) AH SR SH SR 17100 x 8.4705 15702 8.4705 144846 133004 32846 11842 Variable OH spending variance Variable OH efficiency variance Total variable OH variance Favorable/Unfavorable 32846 favorable 11842 unfavorable 21004 favorable PHOENIX COMPANY Flexible Budget Performance Report For Year Ended December 31, 2019 Flexible Budget Actual Results Variances Fav. / Unfav. 4,750,000 $ 4,813,000 $ 63,000 Favorable Sales Variable costs Direct materials Direct labor Machinery repairs Utilities Packaging Shipping 1,235,000 190,000 76,000 57,000 1,252,000 199,000 67,000 56,000 93,000 125,500 17,000 Unfavorable 9,000 Unfavorable 9,000 Favorable 1,000 Favorable 2,000 Favorable 7,500 Favorable 95,000 133,000 1,786,000 2,964,000 1,792,500 3,020,500 6,500 Unfavorable 56,500 Favorable 300,000 Total variable costs Contribution margin Fixed costs Depreciation-Plant equipment (straight-line) Utilities Plant management salaries Sales salary Advertising expense Salaries Entertainment expense 150,000 230,000 250,000 132,000 241,000 90,000 300,000 148,000 240,000 269,000 141,000 241,000 93,000 O No variance 2,000 Favorable 10,000 Unfavorable 19,000 (Unfavorable 9,000 Unfavorable O No variance 3,000 Unfavorable Total fixed costs 1,432,000 39,000 Unfavorable Income from operations 1,393,000 1.571,000 $ $ 1,588,500 $ 17 500 Favorable