Answered step by step

Verified Expert Solution

Question

1 Approved Answer

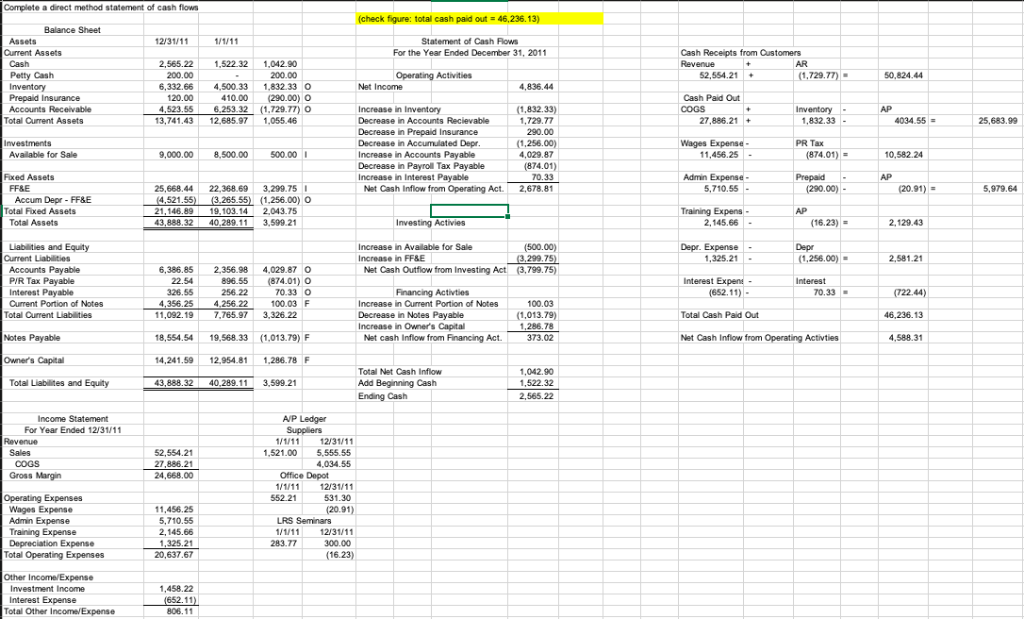

I need a double check on my cash flow statement using the direct method, any corrections would be very helpful. Complete a direct method statement

I need a double check on my cash flow statement using the direct method, any corrections would be very helpful.

Complete a direct method statement of cash flows (check figure: total cash paid out = 46,236.13 ) Balance Sheet Statement of Cash Flows Assets 12/31/11 1/1/11 For the Year Ended December 31, 2011 Cash Receipts from Customers Current Assets 1,522.32 2,565.22 1,042.90 52.554.21 (1,729.77) Petty Cash 200,00 200.00 Operating Activities 50,824.44 Inventory ,332.66 4,500.33 1,832.33 O Net Income 4.836.44 Cash Paid Out Ascounts Receivable 6 253 32 (1,729.77 ) O 521 55 Increase in Inventory Decrease (1,832.33) 1,729.77 COGS Inventory 1,832.33 AF 4034 55. 25,683.99 13,741.43 Total Current Assets 12,685.97 1.055.46 Accounts Recievable 7,886.21 Prepa d Deer PR Tax Investments (1 Wages Expense 1,456.25 9.000.00 Available for Sale 8,500.00 500.00 Increase in Accounts Payable Decrease 4.029.87 (874.01) 10.582.24 Payroll Tax Payable (874.01) Fixed Assets Admin E Prepaid AP 5.710.55 2.678.81 Net Cash Inflow from Operating Act 25.668.44 FESE 22,368.69 3.299.75 (290.00) (20.91)= 5.979.64 Accum Depr - FF&E sets Telel Ausls (4,521.55) (3.265.55) (1,256.00) O Trainin AP 43 980 25 40.289.11 Investing Activies 3 599 21 (16.23) 2,129.43 Liabilities and Equity Depr Increase in Avalable for Sale (500.00) Depr. Expense 1,325.21 (1,256.00) 2,581.21 Accounts Payable PIR Tax Payable (3 799.75) Nat Cash Outfiow from Investing Act 6.386.85 2,356.98 4,029.87 O (874.01) O 22.54 Interest Expens (652.11) 896.55 Interest 256.22 Financing Activties 70.33 (722.44) ePayabe 100 02 E Notes Notes Increase 100.03 11 092 19 7.765.97 Total Current Liabilities 3.326.22 Decrease in Notes Payable Increase in Owner's Capital Net cash Inflow from Financing Act (1,013.79) 1,286.78 373.02 Total Cash Paid Out 46.236,13 Notes Payable Net Cash Inflow from Operating Activties 19.568.33 18.554.54 (1,013.79) F 4,588.3 1 286 78 F Owner's Capital 14 241 59 12,954.81 ow 43.888.32 40,289.11 Total Liabilites and Equity 3.599.21 Cont Ending Cash 2,565.22 For Year Ended 12/31/11 Revenue 1/1/11 12/31/11 Sales 1,521.00 5,555.55 2,354.21 4,034.55 COGS 27,886.21 arain Gr Office Depo 1/1/11 12/31/11 Operating Expenses 552.21 531.30 11,456.2 .91) LRS Seminars drie Expense 5.710.55 Training Expense 2.145.66 12/31/11 1/1/11 283.77 atine Epenses (46 221 Other Income/Expense 1.458.22 Interest Expense (652.11) 806.11 Total Other Income/ExpenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started