Question

I need a good and understanding answer to this question in details. please help 1) What is the type of business? How does the business

I need a good and understanding answer to this question in details. please help

1) What is the type of business? How does the business generate income?

2) What is the size of the operation? (Depending on the business this may be expressed in terms of production/throughput levels, asset size, market share, # of acres, or # of cows. How does this compare to peers?)

3) Briefly summarize the owners and key managers and their relevant experience. Is the business dependent on only a few key individuals?

4) Describe the loans being requested by the company.

5) Identify potential risks the company is facing? For example, weather, water, labor market, economic risks (inflation/recession/growth/tariffs/exchange rates), concentration risk (product diversity), etc.

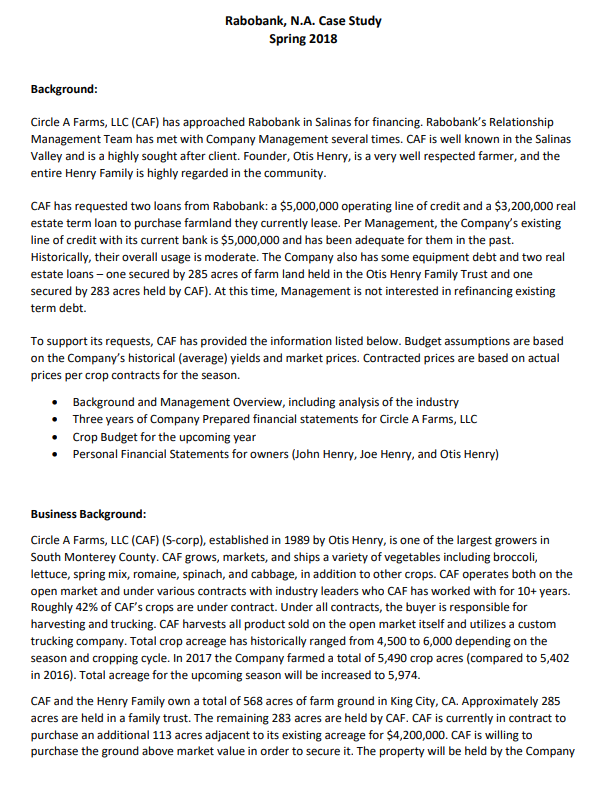

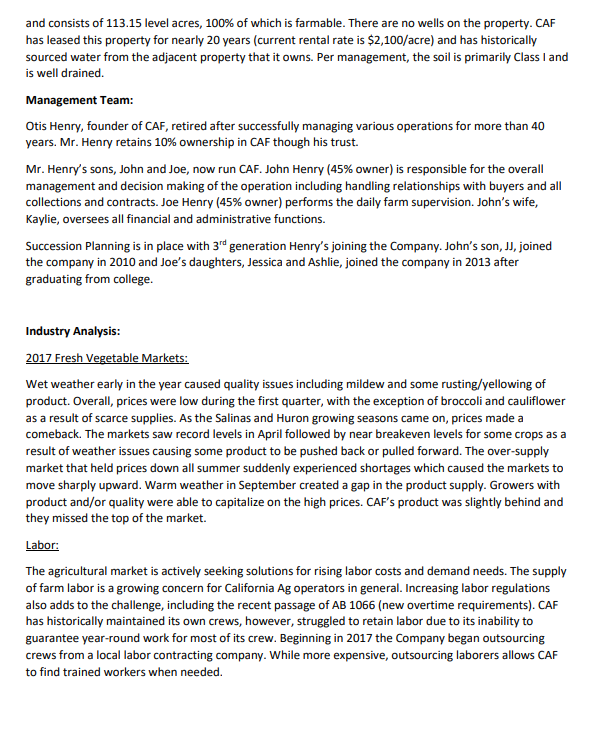

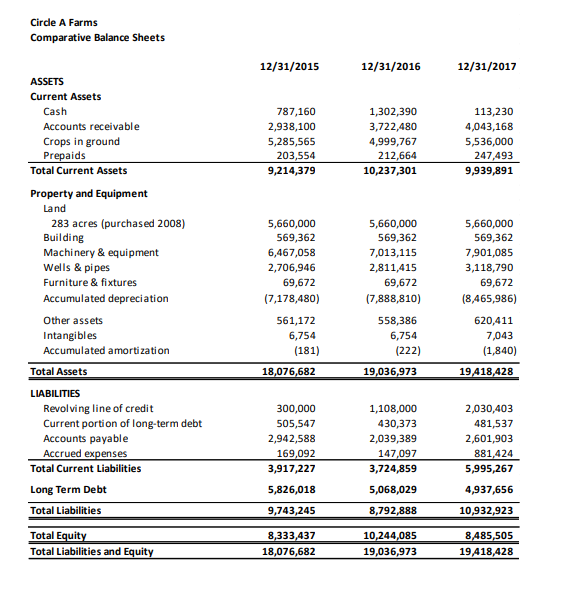

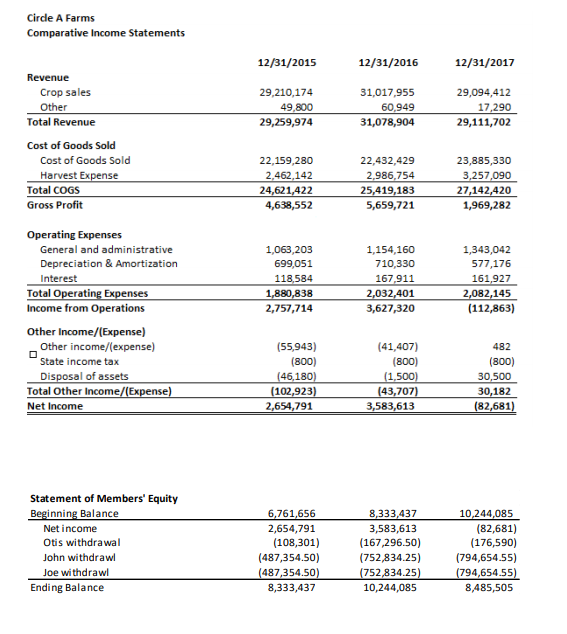

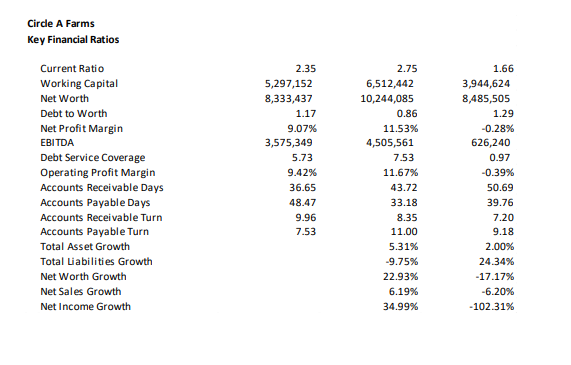

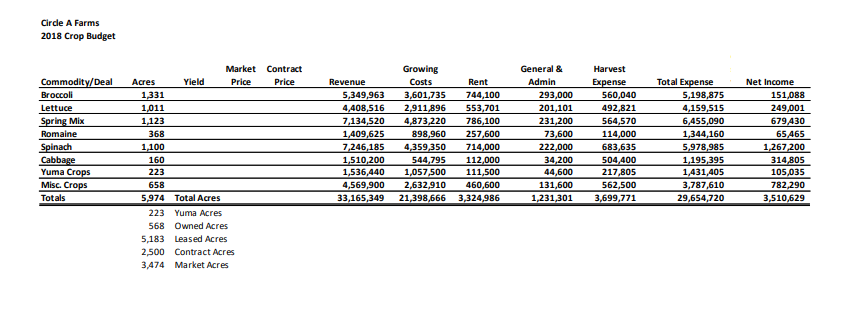

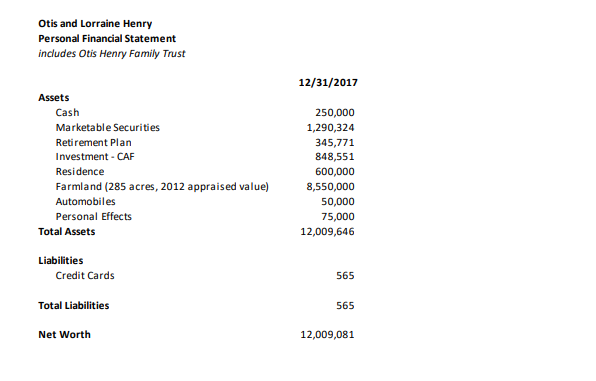

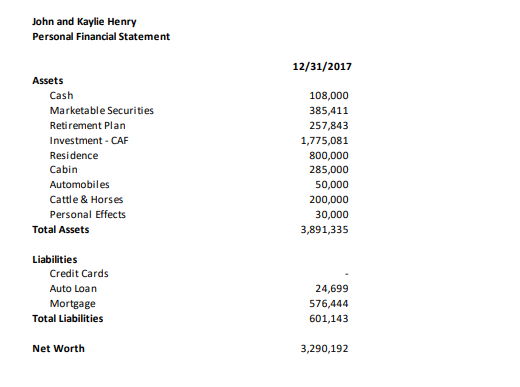

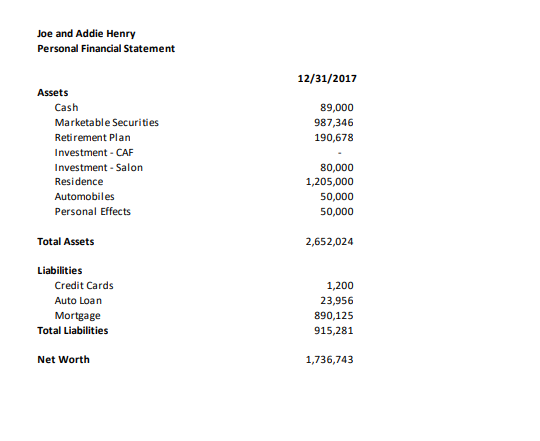

Rabobank, N.A. Case Study Spring 2018 Background: Circle A Farms, LLC (CAF) has approached Rabobank in Salinas for financing. Rabobank's Relationship Management Team has met with Company Management several times. CAF is well known in the Salinas Valley and is a highly sought after client. Founder, Otis Henry, is a very well respected farmer, and the entire Henry Family is highly regarded in the community. CAF has requested two loans from Rabobank: a $5,000,000 operating line of credit and a $3,200,000 real estate term loan to purchase farmland they currently lease. Per Management, the Company's existing line of credit with its current bank is $5,000,000 and has been adequate for them in the past. Historically, their overall usage is moderate. The Company also has some equipment debt and two real estate loans - one secured by 285 acres of farm land held in the Otis Henry Family Trust and one secured by 283 acres held by CAF). At this time, Management is not interested in refinancing existing term debt. To support its requests, CAF has provided the information listed below. Budget assumptions are based on the Company's historical (average) yields and market prices. Contracted prices are based on actual prices per crop contracts for the season. Background and Management Overview, including analysis of the industry Three years of Company Prepared financial statements for Circle A Farms, LLC Crop Budget for the upcoming year Personal Financial Statements for owners (John Henry, Joe Henry, and Otis Henry) Business Background: Circle A Farms, LLC (CAF) (S-corp), established in 1989 by Otis Henry, is one of the largest growers in South Monterey County. CAF grows, markets, and ships a variety of vegetables including broccoli, lettuce, spring mix, romaine, spinach, and cabbage, in addition to other crops. CAF operates both on the open market and under various contracts with industry leaders who CAF has worked with for 10+ years. Roughly 42% of CAF's crops are under contract. Under all contracts, the buyer is responsible for harvesting and trucking. CAF harvests all product sold on the open market itself and utilizes a custom trucking company. Total crop acreage has historically ranged from 4,500 to 6,000 depending on the season and cropping cycle. In 2017 the Company farmed a total of 5,490 crop acres (compared to 5,402 in 2016). Total acreage for the upcoming season will be increased to 5,974. CAF and the Henry Family own a total of 568 acres of farm ground in King City, CA. Approximately 285 acres are held in a family trust. The remaining 283 acres are held by CAF. CAF is currently in contract to purchase an additional 113 acres adjacent to its existing acreage for $4,200,000. CAF is willing to purchase the ground above market value in order to secure it. The property will be held by the Company and consists of 113.15 level acres, 100% of which is farmable. There are no wells on the property. CAF has leased this property for nearly 20 years (current rental rate is $2,100/acre) and has historically sourced water from the adjacent property that it owns. Per management, the soil is primarily Class I and is well drained. Management Team: Otis Henry, founder of CAF, retired after successfully managing various operations for more than 40 years. Mr. Henry retains 10% ownership in CAF though his trust. Mr. Henry's sons, John and Joe, now run CAF. John Henry (45% owner) is responsible for the overall management and decision making of the operation including handling relationships with buyers and all collections and contracts. Joe Henry (45% owner) performs the daily farm supervision. John's wife, Kaylie, oversees all financial and administrative functions. Succession Planning is in place with 3rd generation Henry's joining the Company. John's son, JJ, joined the company in 2010 and Joe's daughters, Jessica and Ashlie, joined the company in 2013 after graduating from college. Industry Analysis: 2017 Fresh Vegetable Markets: Wet weather early in the year caused quality issues including mildew and some rusting/yellowing of product. Overall, prices were low during the first quarter, with the exception of broccoli and cauliflower as a result of scarce supplies. As the Salinas and Huron growing seasons came on, prices made a comeback. The markets saw record levels in April followed by near breakeven levels for some crops as a result of weather issues causing some product to be pushed back or pulled forward. The over-supply market that held prices down all summer suddenly experienced shortages which caused the markets to move sharply upward. Warm weather in September created a gap in the product supply. Growers with product and/or quality were able to capitalize on the high prices. CAF's product was slightly behind and they missed the top of the market. Labor: The agricultural market is actively seeking solutions for rising labor costs and demand needs. The supply of farm labor is a growing concern for California Ag operators in general. Increasing labor regulations also adds to the challenge, including the recent passage of AB 1066 (new overtime requirements). CAF has historically maintained its own crews, however, struggled to retain labor due to its inability to guarantee year-round work for most of its crew. Beginning in 2017 the Company began outsourcing crews from a local labor contracting company. While more expensive, outsourcing laborers allows CAF to find trained workers when needed. Circle A Farms Comparative Balance Sheets 12/31/2015 12/31/2016 12/31/2017 ASSETS Current Assets Cash Accounts receivable Crops in ground Prepaids Total Current Assets 787,160 2,938,100 5,285,565 203,554 9,214,379 1,302,390 3,722,480 4,999,767 212,664 10,237,301 113,230 4,043,168 5,536,000 247,493 9,939,891 Property and Equipment Land 283 acres (purchased 2008) Building Machinery & equipment Wells & pipes Furniture & fixtures Accumulated depreciation 5,660,000 569,362 6,467,058 2,706,946 69,672 (7,178,480) 5,660,000 569,362 7,013,115 2,811,415 69,672 (7,888,810) 5,660,000 569,362 7,901,085 3,118,790 69,672 (8,465,986) 620,411 7,043 (1,840) 19,418,428 Other assets Intangibles Accumulated amortization Total Assets 561,172 6,754 (181) 18,076,682 558,386 6,754 (222) 19,036,973 LIABILITIES Revolving line of credit Current portion of long-term debt Accounts payable Accrued expenses Total Current Liabilities 300,000 505,547 2,942,588 169,092 3,917,227 5,826,018 9,743,245 1,108,000 430,373 2,039,389 147,097 3,724,859 5,068,029 8,792,888 2,030,403 481,537 2,601,903 881.424 5,995,267 4,937,656 10,932,923 Long Term Debt Total Liabilities Total Equity Total Liabilities and Equity 8,333,437 18,076,682 10,244,085 19,036,973 8,485,505 19,418,428 Circle A Farms Comparative Income Statements 12/31/2015 12/31/2016 12/31/2017 Revenue Crop sales Other Total Revenue 29,210,174 49,800 29,259,974 31,017,955 60,949 31,078,904 29,094,412 17,290 29,111,702 Cost of Goods Sold Cost of Goods Sold Harvest Expense Total COGS Gross Profit 22,159,280 2,462,142 24,621,422 4,638,552 22,432,429 2,986,754 25,419,183 5,659,721 23,885,330 3,257,090 27,142,420 1,969,282 Operating Expenses General and administrative Depreciation & Amortization Interest Total Operating Expenses Income from Operations 1,063,203 699,051 118,584 1,880,838 2,757,714 1,154,160 710,330 167,911 2,032,401 3,627,320 1,343,042 577,176 161,927 2,082,145 (112,863) Other Income/(Expense) Other income/(expense) State income tax Disposal of assets Total Other Income/(Expense) Net Income (55,943) (800) (46,180) (102,923) 2,654,791 (41,407) (800) (1,500) (43,707) 3,583,613 482 (800) 30,500 30,182 (82,681) Statement of Members' Equity Beginning Balance Net income Otis withdrawal John withdrawl Joe withdrawl Ending Balance 6,761,656 2,654,791 (108,301) (487,354.50) (487,354.50) 8,333,437 8,333,437 3,583,613 (167,296.50) (752,834.25) 10,244,085 (82,681) (176,590) (794,654.55) (794,654.55) 8,485,505 10,244,085 Cirde A Farms Key Financial Ratios Current Ratio Working Capital Net Worth Debt to Worth Net Profit Margin EBITDA Debt Service Coverage Operating Profit Margin Accounts Receivable Days Accounts Payable Days Accounts Receivable Turn Accounts Payable Turn Total Asset Growth Total Liabilities Growth Net Worth Growth Net Sales Growth Net Income Growth 2.35 5,297,152 8,333,437 1.17 9.07% 3,575,349 5.73 9.42% 36.65 48.47 9.96 7.53 2.75 6,512,442 10,244,085 0.86 11.53% 4,505,561 7.53 11.67% 43.72 33.18 8.35 11.00 5.31% -9.75% 22.93% 6.19% 34.99% 1.66 3,944,624 8,485,505 1.29 -0.28% 626,240 0.97 -0.39% 50.69 39.76 7.20 9.18 2.00% 24.34% -17.17% -6.20% -102.31% John and Kaylie Henry Personal Financial Statement 12/31/2017 Assets Cash Marketable Securities Retirement Plan Investment - CAF Residence Cabin Automobiles Cattle & Horses Personal Effects Total Assets 108,000 385,411 257,843 1,775,081 800,000 285,000 50,000 200,000 30,000 3,891,335 Liabilities Credit Cards Auto Loan Mortgage Total Liabilities 24,699 576,444 601,143 Net Worth 3,290,192 Joe and Addie Henry Personal Financial Statement 12/31/2017 89,000 987,346 190,678 Assets Cash Marketable Securities Retirement Plan Investment - CAF Investment - Salon Residence Automobiles Personal Effects 80,000 1,205,000 50,000 50,000 Total Assets 2,652,024 Liabilities Credit Cards Auto Loan Mortgage Total Liabilities 1,200 23,956 890,125 915,281 Net Worth 1,736,743 Rabobank, N.A. Case Study Spring 2018 Background: Circle A Farms, LLC (CAF) has approached Rabobank in Salinas for financing. Rabobank's Relationship Management Team has met with Company Management several times. CAF is well known in the Salinas Valley and is a highly sought after client. Founder, Otis Henry, is a very well respected farmer, and the entire Henry Family is highly regarded in the community. CAF has requested two loans from Rabobank: a $5,000,000 operating line of credit and a $3,200,000 real estate term loan to purchase farmland they currently lease. Per Management, the Company's existing line of credit with its current bank is $5,000,000 and has been adequate for them in the past. Historically, their overall usage is moderate. The Company also has some equipment debt and two real estate loans - one secured by 285 acres of farm land held in the Otis Henry Family Trust and one secured by 283 acres held by CAF). At this time, Management is not interested in refinancing existing term debt. To support its requests, CAF has provided the information listed below. Budget assumptions are based on the Company's historical (average) yields and market prices. Contracted prices are based on actual prices per crop contracts for the season. Background and Management Overview, including analysis of the industry Three years of Company Prepared financial statements for Circle A Farms, LLC Crop Budget for the upcoming year Personal Financial Statements for owners (John Henry, Joe Henry, and Otis Henry) Business Background: Circle A Farms, LLC (CAF) (S-corp), established in 1989 by Otis Henry, is one of the largest growers in South Monterey County. CAF grows, markets, and ships a variety of vegetables including broccoli, lettuce, spring mix, romaine, spinach, and cabbage, in addition to other crops. CAF operates both on the open market and under various contracts with industry leaders who CAF has worked with for 10+ years. Roughly 42% of CAF's crops are under contract. Under all contracts, the buyer is responsible for harvesting and trucking. CAF harvests all product sold on the open market itself and utilizes a custom trucking company. Total crop acreage has historically ranged from 4,500 to 6,000 depending on the season and cropping cycle. In 2017 the Company farmed a total of 5,490 crop acres (compared to 5,402 in 2016). Total acreage for the upcoming season will be increased to 5,974. CAF and the Henry Family own a total of 568 acres of farm ground in King City, CA. Approximately 285 acres are held in a family trust. The remaining 283 acres are held by CAF. CAF is currently in contract to purchase an additional 113 acres adjacent to its existing acreage for $4,200,000. CAF is willing to purchase the ground above market value in order to secure it. The property will be held by the Company and consists of 113.15 level acres, 100% of which is farmable. There are no wells on the property. CAF has leased this property for nearly 20 years (current rental rate is $2,100/acre) and has historically sourced water from the adjacent property that it owns. Per management, the soil is primarily Class I and is well drained. Management Team: Otis Henry, founder of CAF, retired after successfully managing various operations for more than 40 years. Mr. Henry retains 10% ownership in CAF though his trust. Mr. Henry's sons, John and Joe, now run CAF. John Henry (45% owner) is responsible for the overall management and decision making of the operation including handling relationships with buyers and all collections and contracts. Joe Henry (45% owner) performs the daily farm supervision. John's wife, Kaylie, oversees all financial and administrative functions. Succession Planning is in place with 3rd generation Henry's joining the Company. John's son, JJ, joined the company in 2010 and Joe's daughters, Jessica and Ashlie, joined the company in 2013 after graduating from college. Industry Analysis: 2017 Fresh Vegetable Markets: Wet weather early in the year caused quality issues including mildew and some rusting/yellowing of product. Overall, prices were low during the first quarter, with the exception of broccoli and cauliflower as a result of scarce supplies. As the Salinas and Huron growing seasons came on, prices made a comeback. The markets saw record levels in April followed by near breakeven levels for some crops as a result of weather issues causing some product to be pushed back or pulled forward. The over-supply market that held prices down all summer suddenly experienced shortages which caused the markets to move sharply upward. Warm weather in September created a gap in the product supply. Growers with product and/or quality were able to capitalize on the high prices. CAF's product was slightly behind and they missed the top of the market. Labor: The agricultural market is actively seeking solutions for rising labor costs and demand needs. The supply of farm labor is a growing concern for California Ag operators in general. Increasing labor regulations also adds to the challenge, including the recent passage of AB 1066 (new overtime requirements). CAF has historically maintained its own crews, however, struggled to retain labor due to its inability to guarantee year-round work for most of its crew. Beginning in 2017 the Company began outsourcing crews from a local labor contracting company. While more expensive, outsourcing laborers allows CAF to find trained workers when needed. Circle A Farms Comparative Balance Sheets 12/31/2015 12/31/2016 12/31/2017 ASSETS Current Assets Cash Accounts receivable Crops in ground Prepaids Total Current Assets 787,160 2,938,100 5,285,565 203,554 9,214,379 1,302,390 3,722,480 4,999,767 212,664 10,237,301 113,230 4,043,168 5,536,000 247,493 9,939,891 Property and Equipment Land 283 acres (purchased 2008) Building Machinery & equipment Wells & pipes Furniture & fixtures Accumulated depreciation 5,660,000 569,362 6,467,058 2,706,946 69,672 (7,178,480) 5,660,000 569,362 7,013,115 2,811,415 69,672 (7,888,810) 5,660,000 569,362 7,901,085 3,118,790 69,672 (8,465,986) 620,411 7,043 (1,840) 19,418,428 Other assets Intangibles Accumulated amortization Total Assets 561,172 6,754 (181) 18,076,682 558,386 6,754 (222) 19,036,973 LIABILITIES Revolving line of credit Current portion of long-term debt Accounts payable Accrued expenses Total Current Liabilities 300,000 505,547 2,942,588 169,092 3,917,227 5,826,018 9,743,245 1,108,000 430,373 2,039,389 147,097 3,724,859 5,068,029 8,792,888 2,030,403 481,537 2,601,903 881.424 5,995,267 4,937,656 10,932,923 Long Term Debt Total Liabilities Total Equity Total Liabilities and Equity 8,333,437 18,076,682 10,244,085 19,036,973 8,485,505 19,418,428 Circle A Farms Comparative Income Statements 12/31/2015 12/31/2016 12/31/2017 Revenue Crop sales Other Total Revenue 29,210,174 49,800 29,259,974 31,017,955 60,949 31,078,904 29,094,412 17,290 29,111,702 Cost of Goods Sold Cost of Goods Sold Harvest Expense Total COGS Gross Profit 22,159,280 2,462,142 24,621,422 4,638,552 22,432,429 2,986,754 25,419,183 5,659,721 23,885,330 3,257,090 27,142,420 1,969,282 Operating Expenses General and administrative Depreciation & Amortization Interest Total Operating Expenses Income from Operations 1,063,203 699,051 118,584 1,880,838 2,757,714 1,154,160 710,330 167,911 2,032,401 3,627,320 1,343,042 577,176 161,927 2,082,145 (112,863) Other Income/(Expense) Other income/(expense) State income tax Disposal of assets Total Other Income/(Expense) Net Income (55,943) (800) (46,180) (102,923) 2,654,791 (41,407) (800) (1,500) (43,707) 3,583,613 482 (800) 30,500 30,182 (82,681) Statement of Members' Equity Beginning Balance Net income Otis withdrawal John withdrawl Joe withdrawl Ending Balance 6,761,656 2,654,791 (108,301) (487,354.50) (487,354.50) 8,333,437 8,333,437 3,583,613 (167,296.50) (752,834.25) 10,244,085 (82,681) (176,590) (794,654.55) (794,654.55) 8,485,505 10,244,085 Cirde A Farms Key Financial Ratios Current Ratio Working Capital Net Worth Debt to Worth Net Profit Margin EBITDA Debt Service Coverage Operating Profit Margin Accounts Receivable Days Accounts Payable Days Accounts Receivable Turn Accounts Payable Turn Total Asset Growth Total Liabilities Growth Net Worth Growth Net Sales Growth Net Income Growth 2.35 5,297,152 8,333,437 1.17 9.07% 3,575,349 5.73 9.42% 36.65 48.47 9.96 7.53 2.75 6,512,442 10,244,085 0.86 11.53% 4,505,561 7.53 11.67% 43.72 33.18 8.35 11.00 5.31% -9.75% 22.93% 6.19% 34.99% 1.66 3,944,624 8,485,505 1.29 -0.28% 626,240 0.97 -0.39% 50.69 39.76 7.20 9.18 2.00% 24.34% -17.17% -6.20% -102.31% John and Kaylie Henry Personal Financial Statement 12/31/2017 Assets Cash Marketable Securities Retirement Plan Investment - CAF Residence Cabin Automobiles Cattle & Horses Personal Effects Total Assets 108,000 385,411 257,843 1,775,081 800,000 285,000 50,000 200,000 30,000 3,891,335 Liabilities Credit Cards Auto Loan Mortgage Total Liabilities 24,699 576,444 601,143 Net Worth 3,290,192 Joe and Addie Henry Personal Financial Statement 12/31/2017 89,000 987,346 190,678 Assets Cash Marketable Securities Retirement Plan Investment - CAF Investment - Salon Residence Automobiles Personal Effects 80,000 1,205,000 50,000 50,000 Total Assets 2,652,024 Liabilities Credit Cards Auto Loan Mortgage Total Liabilities 1,200 23,956 890,125 915,281 Net Worth 1,736,743Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started