I need a quick solution please

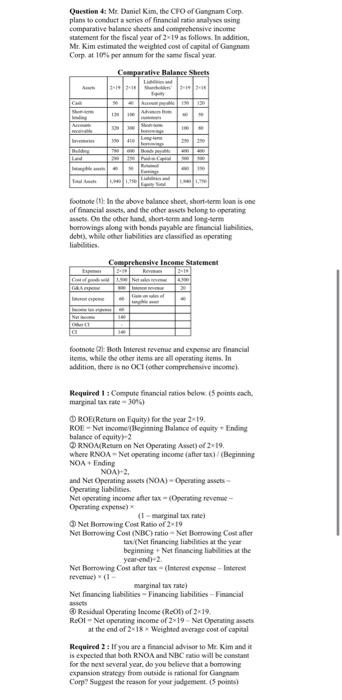

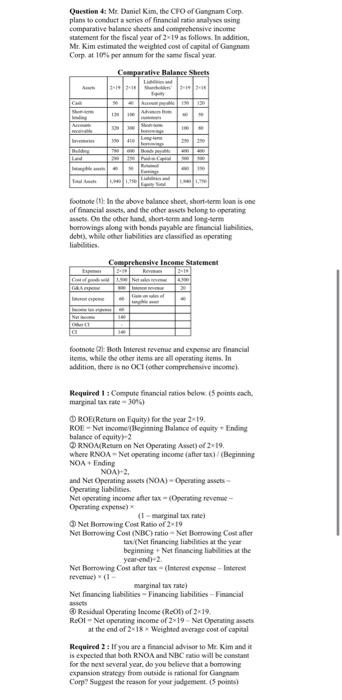

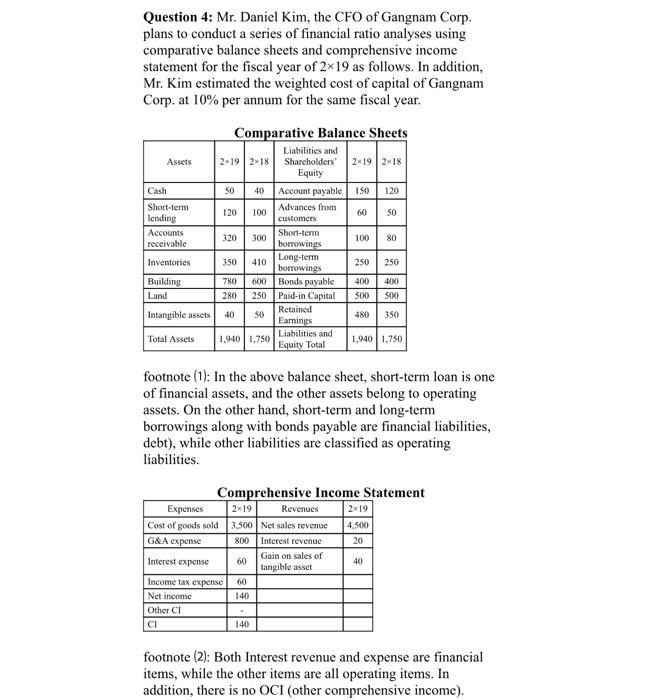

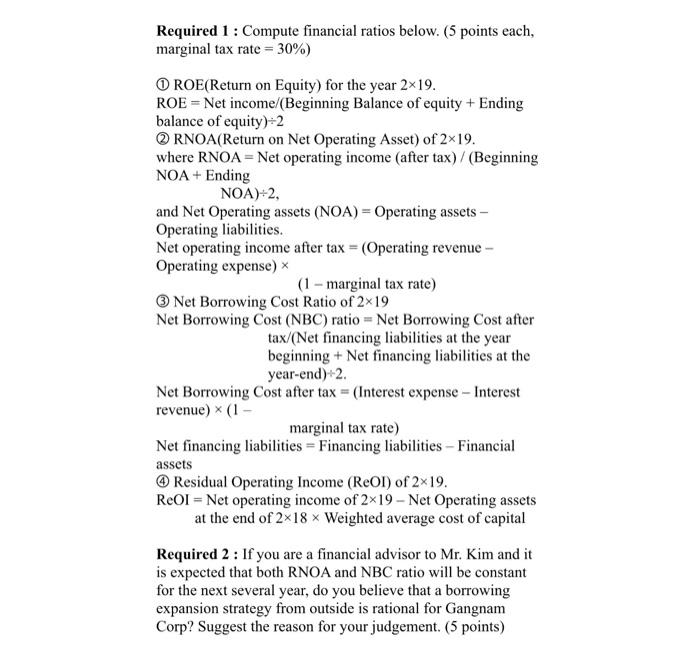

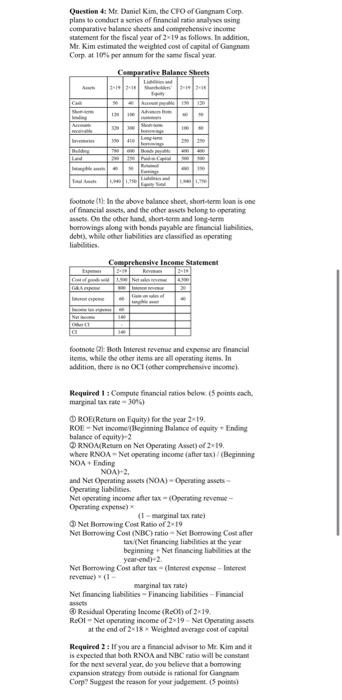

Questien 4t Mr. Daniel Kim, the CFO of Gavenam Corp. plans to ecesduct a series of firancial ratio aralyses asing compurative bulatice sheets and eotrgrehensive incume starement for the fiscall year of 219 as fotlowx: In addition, Mr. Kim estimated the weighted cost of crepital of Ganenam Corp, at 167 t per annum for the same fiscal year. footnose (t): In the above balance shect, short-1erm lown is one of financial aroets, and the other assets helong to operating assess. Os the other land, oboc-tern and long-term boerowings along with bonds payable are finascial liekilities, debth. while other tiabilitics are classefied as operating liabilltios. footnote (2) thoth Interest revenue and expense are financial it erais, while the ether itenve are all eperating inems. In addition, there is no OCI (ceher comprthetaive income). Required I a Compuie financial ratios below, ( 5 points wach, maryinal us rafe 304 ) (1) ROE(Retum on Equity) for the year 219. ROII - Nost income (lieggiening Ilalance of equity + Ending balasee of equity +2 Q2 RNOM(Reourn en Net Operating Aset) of 2*19. where RNOA = Net operating income (after tax) / (Beginning NO,A+ Euding (NO)+2 and Ner Operating assets (NO.A)= Operating assets - Operating liabilities. Net opcrating income after tax =( Operating revenwe - Operatien expense) = (I) - marginal tax nate) Net Bermoring Cost Ratio of 2=19 Net Barrowing Cost (NBC) ratio - Net Borrowing Cast affer tav/Net financing liabilities at the year beginning + Net flawcing liablinies at the ycar-endi- 2. Net Boerowing Cost affer tas - (Iaternet evpenae - Laternot feverroe )(1 Net financing liabilities - Financing liabilities - Financial asists 5 Residual Operating Income (ReO) of 219, ReOI - Net openiting income of 219 - Net Operating assets. at the end of 218 Weighted average cost of capital Required 2 \& If you are a financial advisor to Mr. Kim and it is expected than both RNON and NBC notio will be constant for the neve several year, do you believe that a borrowing expansicen stratery form outcide is ratictal for Cangant Corp? Saggest the reason for your jadgement (5 poines) Question 4: Mr. Daniel Kim, the CFO of Gangnam Corp, plans to conduct a series of financial ratio analyses using comparative balance sheets and comprehensive income statement for the fiscal year of 219 as follows. In addition, Mr. Kim estimated the weighted cost of capital of Gangnam Corp. at 10% per annum for the same fiscal year. footnote (1): In the above balance sheet, short-term loan is one of financial assets, and the other assets belong to operating assets. On the other hand, short-term and long-term borrowings along with bonds payable are financial liabilities, debt), while other liabilities are classified as operating liabilities. Comnrehensive Income Statement footnote (2): Both Interest revenue and expense are financial items, while the other items are all operating items. In addition, there is no OCI (other comprehensive income). Required 1 : Compute financial ratios below. (5 points each, marginal tax rate =30% ) (1) ROE(Return on Equity) for the year 219. ROE= Net income/(Beginning Balance of equity + Ending balance of equity )2 (2) RNOA(Return on Net Operating Asset) of 219. where RNOA = Net operating income (after tax) / (Beginning NOA+ Ending NOA)2, and Net Operating assets (NOA) = Operating assets Operating liabilities. Net operating income after tax=( Operating revenue Operating expense) ( 1 - marginal tax rate) (3) Net Borrowing Cost Ratio of 219 Net Borrowing Cost (NBC) ratio = Net Borrowing Cost after tax/(Net financing liabilities at the year beginning + Net financing liabilities at the year-end )2 Net Borrowing Cost after tax = (Interest expense Interest revenue )(1 marginal tax rate ) Net financing liabilities = Financing liabilities Financial assets (4) Residual Operating Income (ReOI) of 219. ReOI = Net operating income of 219 - Net Operating assets at the end of 218 Weighted average cost of capital Required 2 : If you are a financial advisor to Mr. Kim and it is expected that both RNOA and NBC ratio will be constant for the next several year, do you believe that a borrowing expansion strategy from outside is rational for Gangnam Corp? Suggest the reason for your judgement. (5 points) Questien 4t Mr. Daniel Kim, the CFO of Gavenam Corp. plans to ecesduct a series of firancial ratio aralyses asing compurative bulatice sheets and eotrgrehensive incume starement for the fiscall year of 219 as fotlowx: In addition, Mr. Kim estimated the weighted cost of crepital of Ganenam Corp, at 167 t per annum for the same fiscal year. footnose (t): In the above balance shect, short-1erm lown is one of financial aroets, and the other assets helong to operating assess. Os the other land, oboc-tern and long-term boerowings along with bonds payable are finascial liekilities, debth. while other tiabilitics are classefied as operating liabilltios. footnote (2) thoth Interest revenue and expense are financial it erais, while the ether itenve are all eperating inems. In addition, there is no OCI (ceher comprthetaive income). Required I a Compuie financial ratios below, ( 5 points wach, maryinal us rafe 304 ) (1) ROE(Retum on Equity) for the year 219. ROII - Nost income (lieggiening Ilalance of equity + Ending balasee of equity +2 Q2 RNOM(Reourn en Net Operating Aset) of 2*19. where RNOA = Net operating income (after tax) / (Beginning NO,A+ Euding (NO)+2 and Ner Operating assets (NO.A)= Operating assets - Operating liabilities. Net opcrating income after tax =( Operating revenwe - Operatien expense) = (I) - marginal tax nate) Net Bermoring Cost Ratio of 2=19 Net Barrowing Cost (NBC) ratio - Net Borrowing Cast affer tav/Net financing liabilities at the year beginning + Net flawcing liablinies at the ycar-endi- 2. Net Boerowing Cost affer tas - (Iaternet evpenae - Laternot feverroe )(1 Net financing liabilities - Financing liabilities - Financial asists 5 Residual Operating Income (ReO) of 219, ReOI - Net openiting income of 219 - Net Operating assets. at the end of 218 Weighted average cost of capital Required 2 \& If you are a financial advisor to Mr. Kim and it is expected than both RNON and NBC notio will be constant for the neve several year, do you believe that a borrowing expansicen stratery form outcide is ratictal for Cangant Corp? Saggest the reason for your jadgement (5 poines) Question 4: Mr. Daniel Kim, the CFO of Gangnam Corp, plans to conduct a series of financial ratio analyses using comparative balance sheets and comprehensive income statement for the fiscal year of 219 as follows. In addition, Mr. Kim estimated the weighted cost of capital of Gangnam Corp. at 10% per annum for the same fiscal year. footnote (1): In the above balance sheet, short-term loan is one of financial assets, and the other assets belong to operating assets. On the other hand, short-term and long-term borrowings along with bonds payable are financial liabilities, debt), while other liabilities are classified as operating liabilities. Comnrehensive Income Statement footnote (2): Both Interest revenue and expense are financial items, while the other items are all operating items. In addition, there is no OCI (other comprehensive income). Required 1 : Compute financial ratios below. (5 points each, marginal tax rate =30% ) (1) ROE(Return on Equity) for the year 219. ROE= Net income/(Beginning Balance of equity + Ending balance of equity )2 (2) RNOA(Return on Net Operating Asset) of 219. where RNOA = Net operating income (after tax) / (Beginning NOA+ Ending NOA)2, and Net Operating assets (NOA) = Operating assets Operating liabilities. Net operating income after tax=( Operating revenue Operating expense) ( 1 - marginal tax rate) (3) Net Borrowing Cost Ratio of 219 Net Borrowing Cost (NBC) ratio = Net Borrowing Cost after tax/(Net financing liabilities at the year beginning + Net financing liabilities at the year-end )2 Net Borrowing Cost after tax = (Interest expense Interest revenue )(1 marginal tax rate ) Net financing liabilities = Financing liabilities Financial assets (4) Residual Operating Income (ReOI) of 219. ReOI = Net operating income of 219 - Net Operating assets at the end of 218 Weighted average cost of capital Required 2 : If you are a financial advisor to Mr. Kim and it is expected that both RNOA and NBC ratio will be constant for the next several year, do you believe that a borrowing expansion strategy from outside is rational for Gangnam Corp? Suggest the reason for your judgement. (5 points)