Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need a solution. Thanks. Consider the following information for the questions below: Statement of financial position for Puro Corporation and Sato Company on December

I need a solution. Thanks.

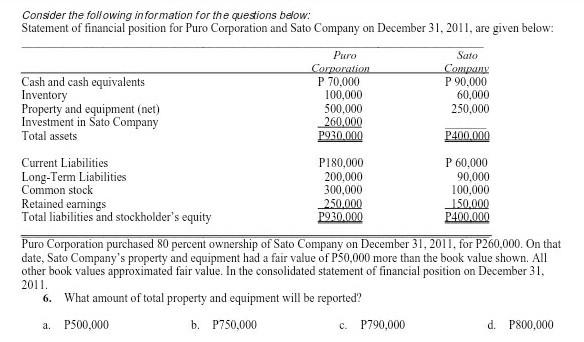

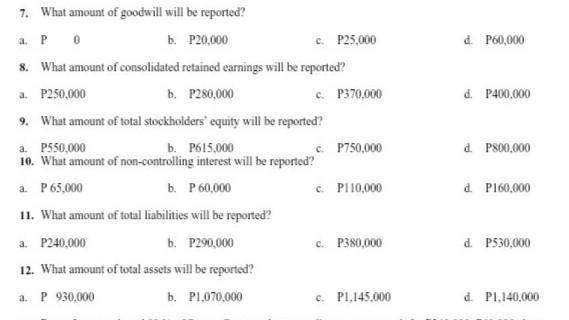

Consider the following information for the questions below: Statement of financial position for Puro Corporation and Sato Company on December 31, 2011, are given below: Puro Sato Corporation Cash and cash equivalents P 70,000 P 90.000 Inventory 100,000 60,000 Property and equipment (net) 500,000 250,000 Investment in Sato Company 260.000 Total assets P930.000 P400.000 Current Liabilities P180,000 P 60,000 Long-Term Liabilities 200,000 90,000 Common stock 300.000 100,000 Retained earings 250,000 150.000 Total liabilities and stockholder's equity P930.000 P400.000 Puro Corporation purchased 80 percent ownership of Sato Company on December 31, 2011. for P260,000. On that date, Sato Company's property and equipment had a fair value of P50,000 more than the book value shown. All other book values approximated fair value. In the consolidated statement of financial position on December 31, 2011. 6. What amount of total property and equipment will be reported? P500,000 b. P750,000 c. P790,000 d. P800,000 a. d. P60,000 d. P400,000 7. What amount of goodwill will be reported? a. Po b. P20,000 c. P25,000 8. What amount of consolidated retained earnings will be reported? a. P250,000 b. P280,000 6. P370,000 9. What amount of total stockholders' equity will be reported? a. P550,000 b. P615.000 c. P750,000 10. What amount of non-controlling interest will be reported? a. P 65,000 b. P 60,000 c. P110,000 11. What amount of total liabilities will be reported? a. P240,000 b. P290,000 c. P380,000 12. What amount of total assets will be reported? a. P 930,000 b. P1,070,000 c. P1,145,000 d P800,000 d. P160,000 d. P530,000 d P1.140,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started