Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need a solution The Adi S. Under the revenue recognition principle, when is revenue recorded 6. Under the matching principle, when are espenses recorded?

I need a solution

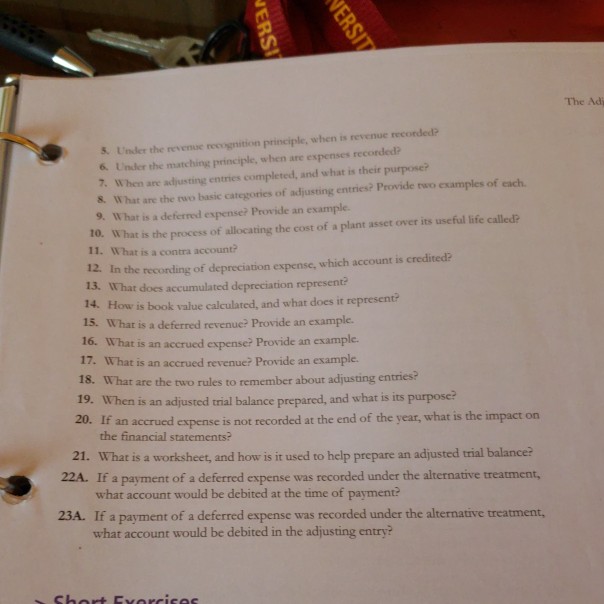

The Adi S. Under the revenue recognition principle, when is revenue recorded 6. Under the matching principle, when are espenses recorded? 7. When are adjusting entries completed, and what is their purpose? 8. What are the two basic categories of adjusting entries? Provide two examples of each 9. What is a deferred expense? Provide an example. 10. What is the process of allocating the cost of a plant asset over its useful life called 11. What is a contra account? 12. In the recording of depreciation expense, which account is credited? 13. What does accumulated depreciation represent? 14. How is book value calculated, and what does it represent? 15. What is a deferred revenue? Provide an example. IWhat is an accrued expense? Provide an example. 17. What is an accrued revenue? Provide an example 18. What are the two rules to remember about adjusting entries? 19. When is an adjusted trial balance prepared, and what is its purpose? 20. If an accrued expense is not recorded at the end of the year, what is the impact on the financial statements? 21. What is a worksheet, and how is it used to help prepare an adjusted trial balance? 22A. If of a deferred expense was recorded under the alternative treatment, a payment what account would be debited at the time of payment? If a paym what account would be debited in the adjusting entry? 23A. ent of a deferred expense was recorded under the alternative treatmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started