Answered step by step

Verified Expert Solution

Question

1 Approved Answer

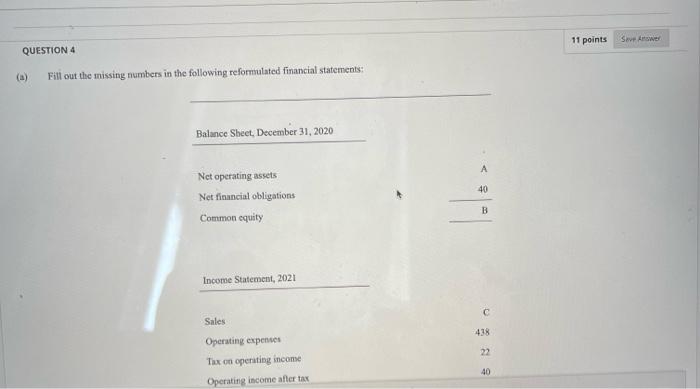

I need A,B,C answered as well as finding the net financial expenses after tax and comprehensive income. b) calculate ROCE For 2021 and the financial

I need A,B,C answered as well as finding the net financial expenses after tax and comprehensive income.

b) calculate ROCE For 2021 and the financial leverage at December 31, 2020

the data is given in the picture

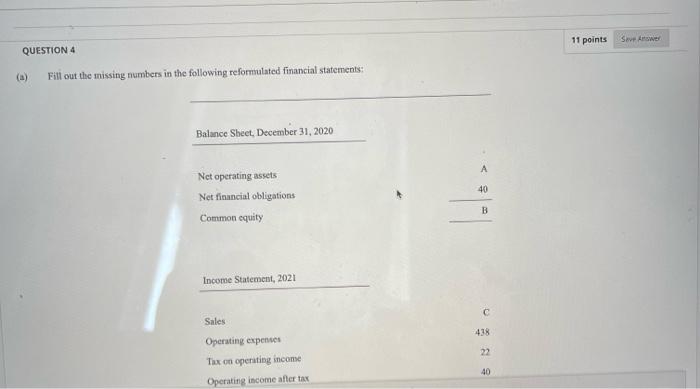

the previous picture is wrong. this is the bottom half to the first picture.

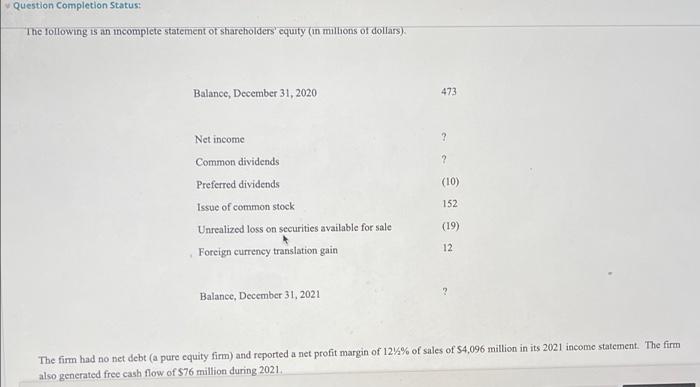

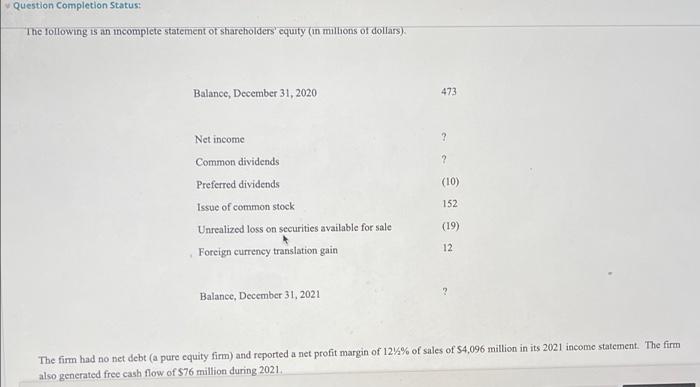

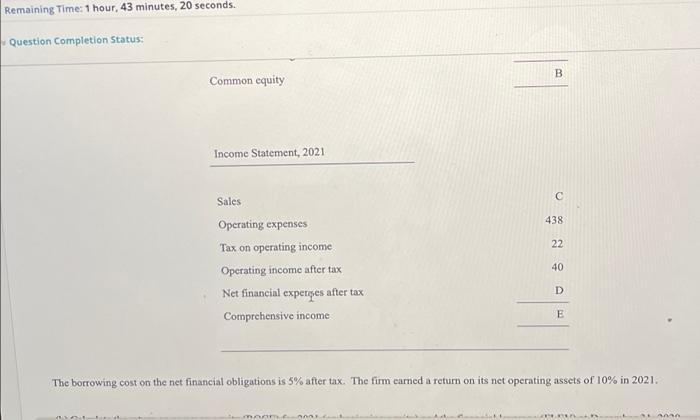

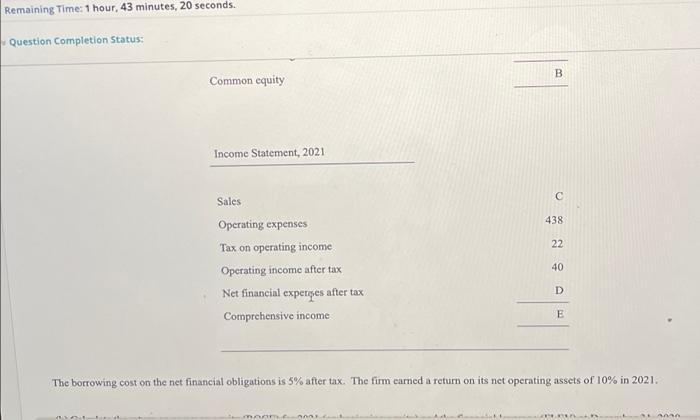

11 points Save Answer QUESTION 4 (a) Fill out the missing numbers in the following reformulated financial statements: Balance Sheet, December 31, 2020 Net operating assets Net financial obligations 40 B Common equity Income Statement, 2021 C Sales 418 22 Operating expenses Thx on operating income Operating income after tax 40 Question Completion Status: The following is an incomplete statement of shareholders' equity (in millions of dollars) Balance, December 31, 2020 473 Net income ? Common dividends ? Preferred dividends (10) Issue of common stock 152 (19) Unrealized loss on securities available for sale Foreign currency translation gain 12 3 Balance, December 31, 2021 The firm had no net debt (a pure equity firm) and reported a net profit margin of 12% of sales of $4,096 million in its 2021 income statement. The firm also generated free cash flow of 876 million during 2021 Remaining Time: 1 hour, 43 minutes, 20 seconds. Question Completion Status: B Common equity Income Statement, 2021 Sales 438 22 40 Operating expenses Tax on operating income Operating income after tax Net financini cxpcrpes after tax Comprehensive income D E The borrowing cost on the net financial obligations is 5% after tax. The firm carned a return on its net operating assets of 10% in 2021. AVA 11 points Save Answer QUESTION 4 (a) Fill out the missing numbers in the following reformulated financial statements: Balance Sheet, December 31, 2020 Net operating assets Net financial obligations 40 B Common equity Income Statement, 2021 C Sales 418 22 Operating expenses Thx on operating income Operating income after tax 40 Question Completion Status: The following is an incomplete statement of shareholders' equity (in millions of dollars) Balance, December 31, 2020 473 Net income ? Common dividends ? Preferred dividends (10) Issue of common stock 152 (19) Unrealized loss on securities available for sale Foreign currency translation gain 12 3 Balance, December 31, 2021 The firm had no net debt (a pure equity firm) and reported a net profit margin of 12% of sales of $4,096 million in its 2021 income statement. The firm also generated free cash flow of 876 million during 2021 Remaining Time: 1 hour, 43 minutes, 20 seconds. Question Completion Status: B Common equity Income Statement, 2021 Sales 438 22 40 Operating expenses Tax on operating income Operating income after tax Net financini cxpcrpes after tax Comprehensive income D E The borrowing cost on the net financial obligations is 5% after tax. The firm carned a return on its net operating assets of 10% in 2021. AVA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started