Answered step by step

Verified Expert Solution

Question

1 Approved Answer

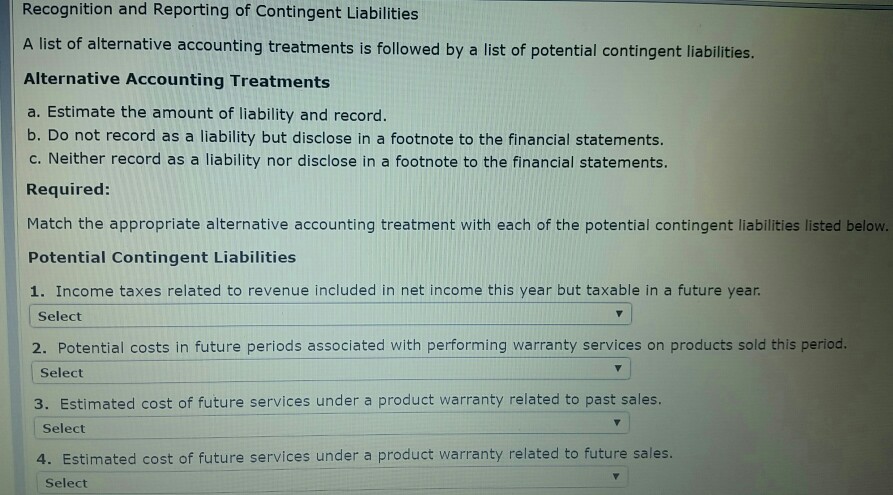

I need Accounting help please Recognition and Reporting of Contingent Liabilities A list of alternative accounting treatments is followed by a list of potential contingent

I need Accounting help please

Recognition and Reporting of Contingent Liabilities A list of alternative accounting treatments is followed by a list of potential contingent liabilities Alternative Accounting Treatments a. Estimate the amount of liability and record. b. Do not record as a liability but disclose in a footnote to the financial statements. c. Neither record as a liability nor disclose in a footnote to the financial statements. Required Match the appropriate alternative accounting treatment with each of the potential contingent liabilities listed below. Potential Contingent Liabilities 1. Income taxes related to revenue included in net income this year but taxable in a future year Select 2. Potential costs in future periods associated with performing warranty services on products sold this period. Select 3. Estimated cost of future services under a product warranty related to past sales. Select 4. Estimated cost of future services under a product warranty related to future sales. Select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started