i need all of these if possible please.

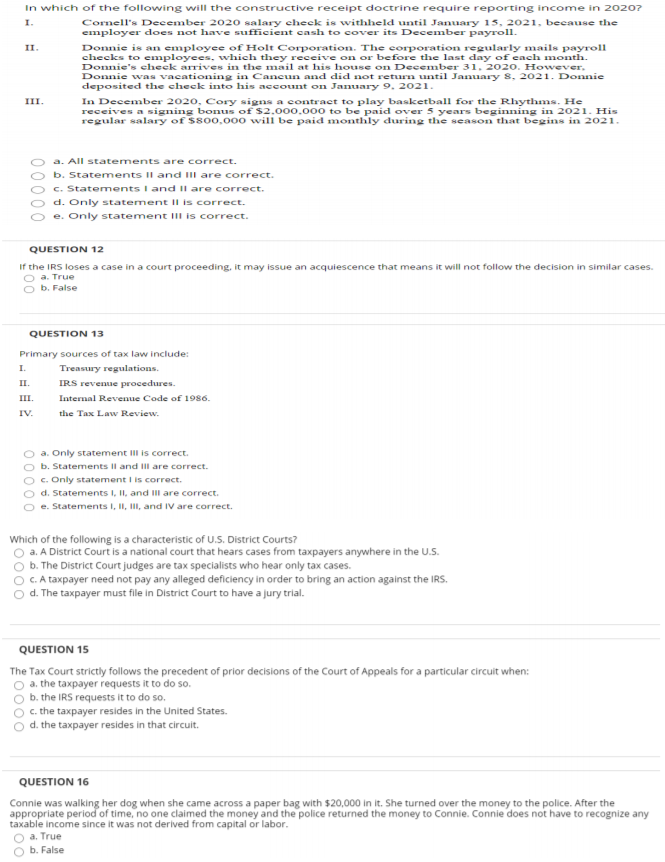

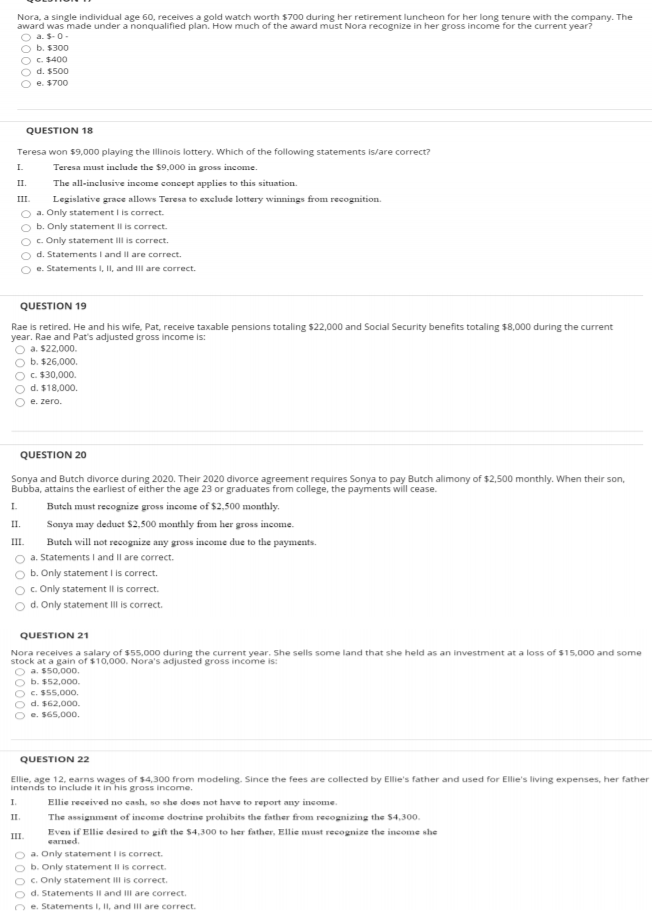

In which of the following will the constructive receipt doctrine require reporting income in 2020? I. Cornell's December 2020 salary cheek is withheld until January 13, 2021, because the employer does not have sufficient cash to cover its December payroll. II. Donnie is an employee of Holt Corporation. The corporation regularly mails payroll checks to employees, which they receive on or before the last day of each month. Donnie's cheek arrives in the mail at his house on December 31, 2020. However, Donnie was vacationing in Cancun and did not return until January 8, 2021. Donnie deposited the check into his account on January 9, 2021. III. In December 2020, Cory signs a contract to play basketball for the Rhythms. He receives a signing bonus of $2.000.000 to be paid over 5 years beginning in 2021. His regular salary of $800,000 will be paid monthly during the season that begins in 2021. 000 a. All statements are correct. b. Statements II and III are correct. c. Statements I and Il are correct. d. Only statement Il is correct. e. Only statement Ill is correct. QUESTION 12 If the IRS loses a case in a court proceeding, it may issue an acquiescence that means it will not follow the decision in similar cases. a. True b. False QUESTION 13 Primary sources of tax law include: I. Treasury regulations. II. IRS revenue procedures. III. Internal Revenue Code of 1986. IV. the Tax Law Review a. Only statement lll is correct. b. Statements ll and Ill are correct. C. Only statement is correct. d. Statements I, II and III are correct. e. Statements I, II, III, and IV are correct. Which of the following is a characteristic of U.S. District Courts? a. A District Court is a national court that hears cases from taxpayers anywhere in the U.S. b. The District Court judges are tax specialists who hear only tax cases. C. A taxpayer need not pay any alleged deficiency in order to bring an action against the IRS. d. The taxpayer must file in District Court to have a jury trial. QUESTION 15 The Tax Court strictly follows the precedent of prior decisions of the Court of Appeals for a particular circuit when: a. the taxpayer requests it to do so. b. the IRS requests it to do so. c. the taxpayer resides in the United States. d. the taxpayer resides in that circuit QUESTION 16 Connie was walking her dog when she came across a paper bag with $20,000 in it. She turned over the money to the police. After the appropriate period of time, no one claimed the money and the police returned the money to Connie. Connie does not have to recognize any taxable income since it was not derived from capital or labor. a. True b. False Nora, a single individual age 60, receives a gold watch worth $700 during her retirement luncheon for her long tenure with the company. The award was made under a nonqualified plan. How much of the award must Nora recognize in her gross income for the current year a. $.0 - b. $300 C. $400 d. $500 e. $700 QUESTION 18 Teresa won 59,000 playing the Illinois lottery. Which of the following statements is/are correct? I. Teresa must include the $9.000 in gross income. II. The all-inclusive income concept applies to this situation. Legislative grace allows Teresa to exclude lottery winnings from recognition. a. Only statement is correct. b. Only statement il is correct. c. Only statement illis correct. d. Statements I and I are correct. e. Statements I, II, and Ill are correct. QUESTION 19 Rae is retired. He and his wife, Pat, receive taxable pensions totaling $22,000 and Social Security benefits totaling $8,000 during the current year. Rae and Pat's adjusted gross income is: a. $22.000 b. $26,000. c. $30,000 d. $18,000. e. zero. QUESTION 20 Sonya and Butch divorce during 2020. Their 2020 divorce agreement requires Sonya to pay Butch alimony of $2.500 monthly. When their son, Bubba, attains the earliest of either the age 23 or graduates from college, the payments will cease. 1. Butch must recognize gross income of $2,500 monthly II. Sonya may deduct $2,500 monthly from her gross income. III Butch will not recognize any gross income due to the payments. a. Statements I and II are correct. b. Only statement is correct. c. Only statement Il is correct. d. Only statement Ill is correct. QUESTION 21 Nora receives a salary of $55,000 during the current year. She sells some land that she held as an investment at a loss of $15,000 and some stock at a gain of $10,000. Nora's adjusted gross income is: O a. 550.000 b. 552,000 C. $55,000 d. $62,000. e. $65,000. QUESTION 22 Ellie, age 12, earns wages of $4,300 from modeling. Since the fees are collected by Ellie's father and used for Ellie's living expenses, her father Intends to include it in his gross income. 1 Ellie received no cash, so she does not have to report any income IL The assignment of income doctrine prohibits the father from recognizing the $4,300 III Even if Ellie desired to gift the 54,300 to her father, Ellie must recognize the income she earned a. Only statement is correct. b. Only statement il is correct. c. Only statement Ill is correct. d. Statements Il and lll are correct. e. Statements I, II, and Ill are correct