Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need all the answers and explaination too. tq Pear Enterprise (PE) is a biscuits manufacturing company located at Long St. Singapore. The company is

i need all the answers and explaination too. tq

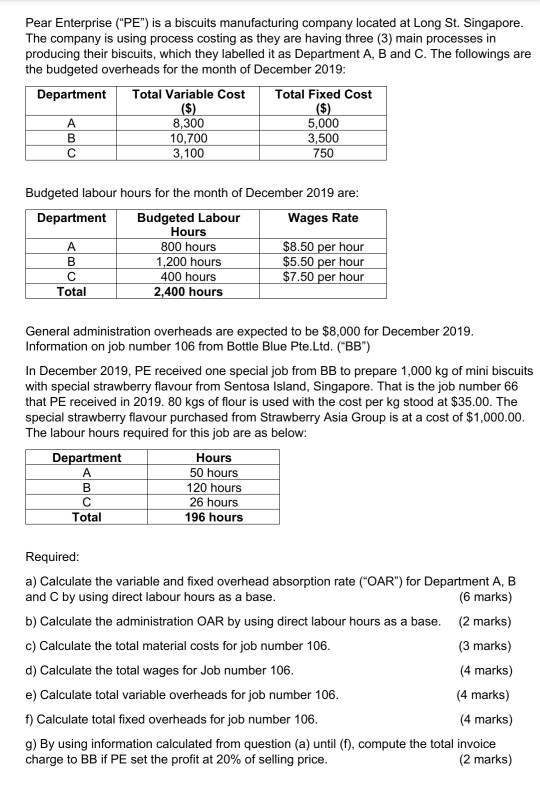

Pear Enterprise ("PE") is a biscuits manufacturing company located at Long St. Singapore. The company is using process costing as they are having three (3) main processes in producing their biscuits, which they labelled it as Department A, B and C. The followings are the budgeted overheads for the month of December 2019: Department Total Variable Cost Total Fixed Cost ($) ($) 8,300 5,000 10,700 3,500 3,100 750 A B Budgeted labour hours for the month of December 2019 are: Department Budgeted Labour Wages Rate Hours 800 hours $8.50 per hour B 1,200 hours $5.50 per hour C 400 hours $7.50 per hour Total 2,400 hours General administration overheads are expected to be $8,000 for December 2019. Information on job number 106 from Bottle Blue Pte.Ltd. ("BB") In December 2019, PE received one special job from BB to prepare 1,000 kg of mini biscuits with special strawberry flavour from Sentosa Island, Singapore. That is the job number 66 that PE received in 2019. 80 kgs of flour is used with the cost per kg stood at $35.00. The special strawberry flavour purchased from Strawberry Asia Group is at a cost of $1,000.00 The labour hours required for this job are as below: Department Hours 50 hours 120 hours 26 hours Total 196 hours B C Required: a) Calculate the variable and fixed overhead absorption rate ("OAR") for Department A, B and C by using direct labour hours as a base. (6 marks) b) Calculate the administration OAR by using direct labour hours as a base. (2 marks) c) Calculate the total material costs for job number 106. (3 marks) d) Calculate the total wages for Job number 106. (4 marks) e) Calculate total variable overheads for job number 106. (4 marks) f) Calculate total fixed overheads for job number 106. (4 marks) g) By using information calculated from question (a) until (1), compute the total invoice charge to BB if PE set the profit at 20% of selling price. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started